Our articles

Articles

Exponential growth of investment potential in Polish railway construction

09 Oct 2024

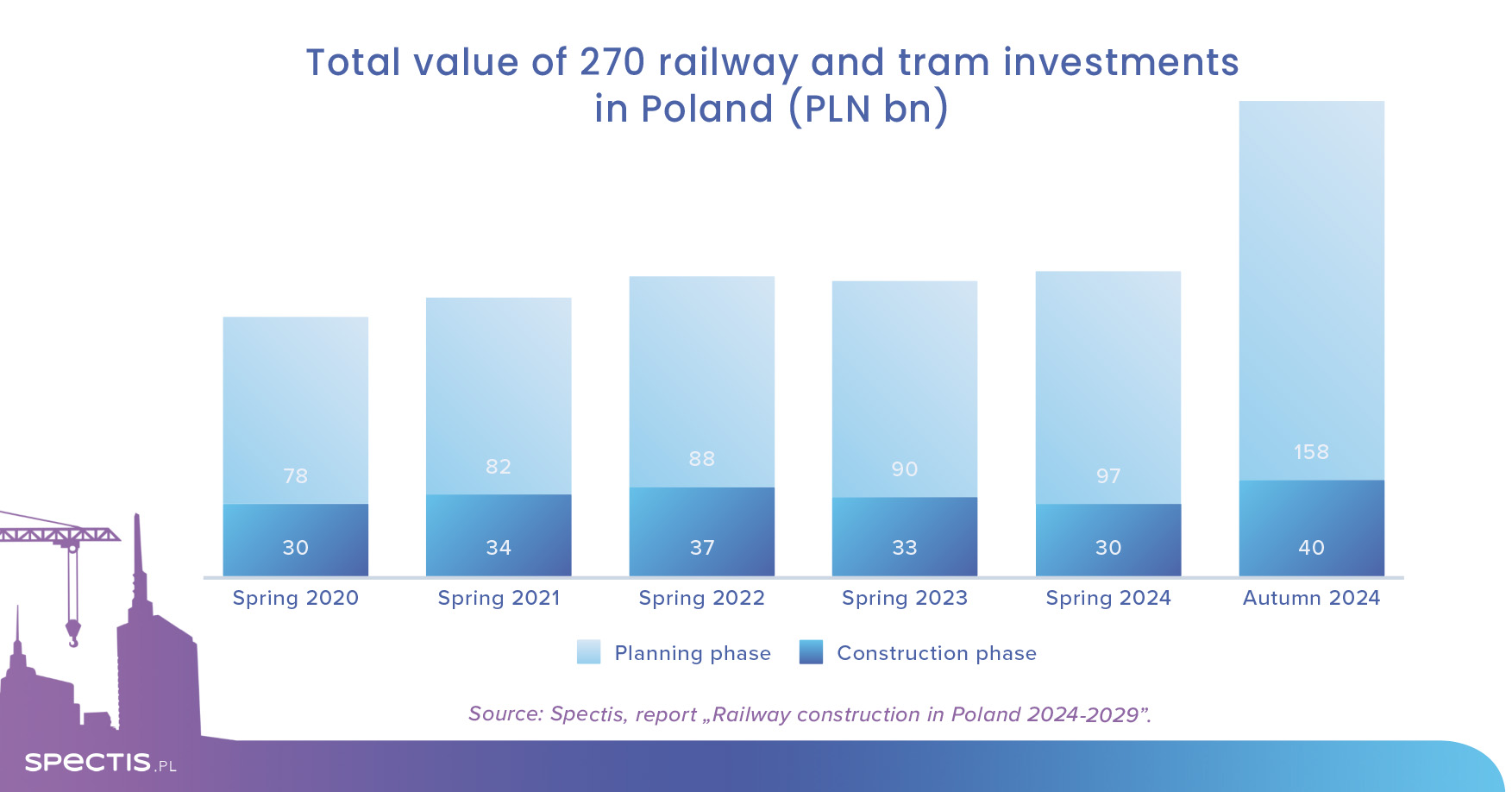

The government’s decision to move the High-Speed Rail project to the construction phase had a tremendous effect in boosting the railway construction segment’s long-term potential in Poland. The total value of the top 270 railway and tramway projects underway or planned in Poland rose to nearly PLN 200bn, according to findings presented in the September edition of the report entitled "Railway construction in Poland 2024-2029".

In its latest report, we reviewed the top 120 railway construction companies (defined as companies specialised in construction of railways, tramways, electrical traction systems, rail traffic control, signalling systems, and railway civil engineering structures). While their combined revenue totalled PLN 44.5bn in 2023, the amount of just PLN 16bn (36% of total revenue) was generated through railway projects.

High-Speed Rail to boost investment potential

The decision of June 2024 to start construction of High-Speed Rail contributed to changes in the list of the biggest railway and tramway projects in Poland. As a result, the aggregate value of the 270 projects grew to nearly PLN 200bn, compared to PLN 130bn in the preceding years. The value of projects underway is only PLN 40bn (20% of the total), while projects in the tender, planning or initial concept stages are valued at PLN 158bn. The sizeable gap between the value of ongoing projects and projects in the planning stage reveals a huge long-term growth potential for that branch of the construction industry.

Inclusion of the High-Speed Rail component in the list resulted in significant changes in terms of the railway sector’s regional potential. The top-ranking regions in terms of the value of railway projects currently include Lodzkie, Wielkopolskie, Mazowieckie, Malopolskie, Slaskie, and Dolnoslaskie. These six voivodships combined account for almost 80% of all projects underway or planned.

Improvement in order books for leading contractors

What construction companies need to secure sustainable growth of production capacity is a steady stream of new contracts, which was not quite the case in the past years. A slowdown in PKP PLK’s tendering activity observed in the recent years has been reflected in the aggregate backlog of orders held by the top four railway construction companies (Torpol, Budimex, ZUE, and Trakcja) in the past two years or so, as calculated by Spectis researchers - it was a little over PLN 6bn during 2023, compared to PLN 10bn at the end of 2019.

Despite a short-lasting drop in tendering activity, the long-term outlook for the railway construction sector remains promising, as can be already seen in the backlogs of the leading companies reported in H1 2024 - as at the end of Q2 2024, the total value of railway projects secured by the companies under review was back at PLN 10bn, thus indicating an upturn in the railway sector.

Massive reshuffling among contractors

The Budimex group remains the leader of the railway construction market, and it is also the only company with a double-digit market share. However, an analysis of the companies’ 2023 financial results reveals numerous changes to the rest of the ranking list. ZUE and Trakcja both made significant advances in the top 10. On the other hand, Torpol, Przedsiebiorstwo Napraw i Utrzymania Infrastruktury Kolejowej w Krakowie, and Zaklad Robot Komunikacyjnych - DOM w Poznaniu (which are three of the top six construction contractors with an indirect interest held by the State Treasury) dropped in the ranking list. Importantly, the combined share of the top six companies held by both PKP PLK and CPK declined by around 2 percentage points in terms of the railway construction market share.

Request a free sample of the report:

info@spectis.pl