Our articles

Articles

Value of the heavy precast concrete products sector to reach PLN 4bn in 2024

09 May 2024

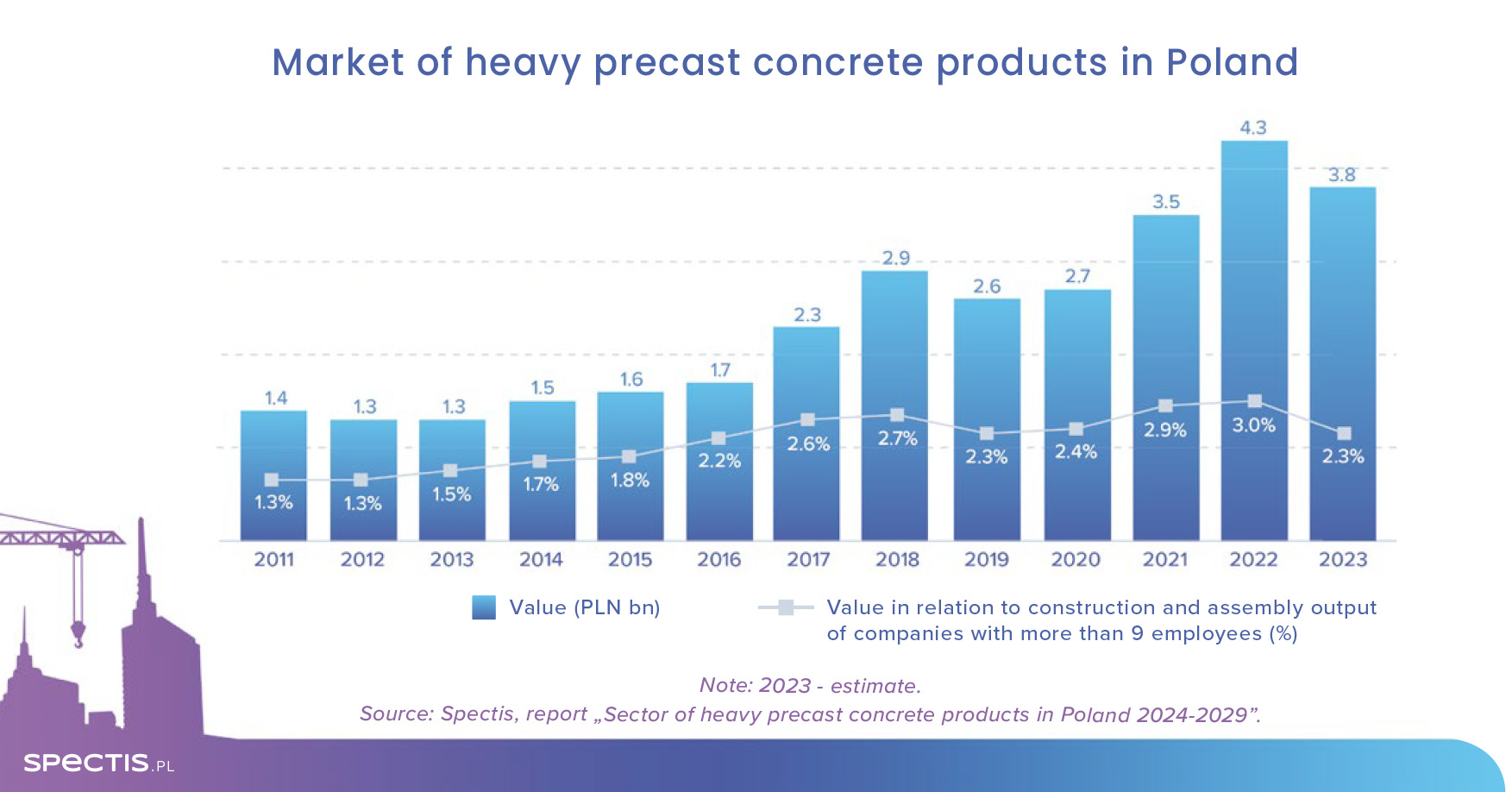

Top 50 manufacturers of precast concrete products generated a record revenue of PLN 6.7bn in 2022, with 64% of the figure contributed by precast concrete products, according to the report "Sector of heavy precast concrete products in Poland 2024-2029" released by research firm Spectis. Accordingly, the value of the heavy precast concrete products sector totalled a record PLN 4.3bn in 2022.

We estimate, based on preliminary data, that the pace of the precast concrete market’s growth markedly slowed in 2023 and that its value dropped to around PLN 3.8bn, which translated into a growth rate of around - 12% in nominal terms. In relation to construction and assembly output generated by construction companies with more than nine workers, that growth rate translated into a decline in the share from the record 3% to 2.3%.

The downturn in the value of the sector of heavy precast concrete products was caused by a combination of two factors: a limited volume of orders and the decrease in the average price of precast concrete products. The latter was due to a sharp drop in steel prices in 2023, with steel being the main cost driver for precast reinforced concrete and prestressed concrete products.

According to the Spectis forecast, the nominal growth of the market will be in the positive terrain again in 2024, at around 10%, so the market’s value will return to over PLN 4bn. The growth will be mostly attributable to a gradual upturn in the housing market. Stronger signals of recovery should be expected already in the second half of 2024. However, the market’s value should see more marked growth in 2025 and 2026 when a glut of construction projects is expected to come online again.

Structural products used in building construction, which include sill plates, pad footing, columns, beams, girders, and stairs, continue to be the largest segment of the heavy prefabrication sector. As many as 37 out of 50 companies covered in the report manufacture these products.

The segment of floor slabs and balconies, which are used in both residential and non-residential construction segments, is in the second position in terms of size. This product segment is the most represented – as many as 41 out of the 50 companies covered in the report offer these products.

The segment of building walls is the third-largest in terms of value (a move up from the fourth spot). Over a half of the 50 companies covered in the report produce building walls, but rarely are they the main product category.

Pretensioned prestressed concrete sleepers are the fourth-largest market segment, but just a few years ago it was the second largest segment.

Besides the main market segments, there are also several minor product specialisations represented by just one or two companies. Examples include bathroom modules, foundation piles, columns, lighting and electricity posts and towers, and products for agriculture. The rest of the market is divided among handling docks, bridge beams, platform slabs and platform walls, road and tram slabs, retaining walls, and sound barriers.

Request a free sample of the report:

info@spectis.pl