Our articles

Articles

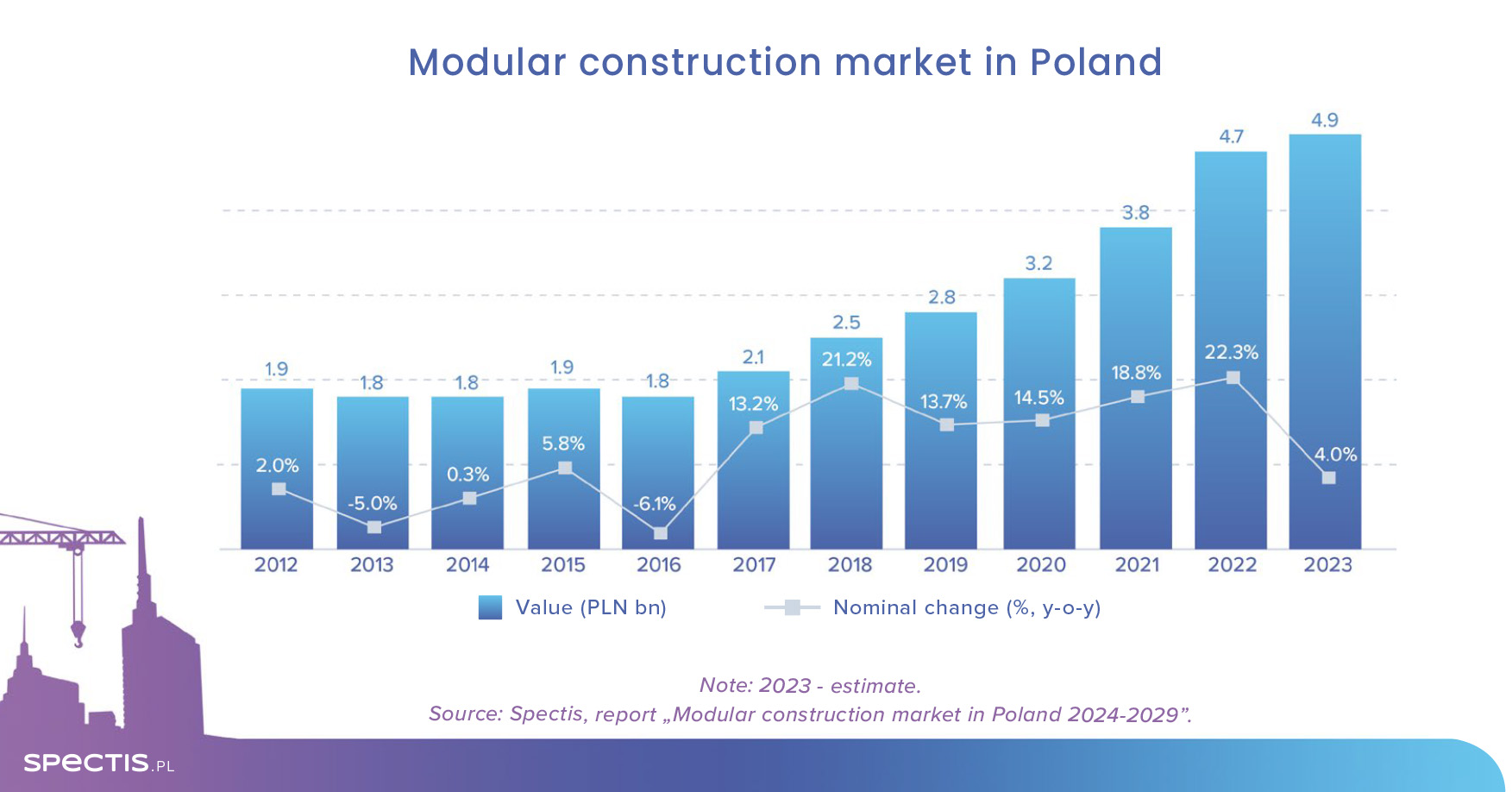

The value of the Polish modular construction market at nearly PLN 5bn

08 Jan 2024

As prefabrication technologies are increasingly applied in building construction, the value of the modular construction sector in Poland has increased nearly by half over the past two years. The process has been helped by a great selection of available materials as well as growing prices of materials and labour costs. Exports make a substantial contribution to the sector’s growth as sales to foreign markets represent over one-third of the manufacturers’ revenue. In spite of the brief slowdown, the outlook for modular construction through 2029 remains highly promising.

Record-high value of modular construction market

Top 100 manufacturers of prefabricated buildings made of wood, steel, concrete, or LECA generated revenue of nearly PLN 10bn in 2022, with 47% of the figure contributed by sales in the modular building segment, according to our report "Modular construction market in Poland 2024-2029". As a result, the value of that segment amounted PLN 4.7bn. Based on preliminary data, Spectis researchers estimate that its value grew by 4% in nominal terms in 2023, and it reached a record value of PLN 4.9bn.

Bright outlook despite short-lasting slowdown

The market is poised for continued, albeit slow, growth in 2024. The main reason behind the sluggish growth will be the general economic slowdown reported in both Poland and the export markets throughout 2023. Last year, the investors were much less willing to make decisions about launching new projects in the future, so the manufacturers’ order books for 2024 are less sizeable. These factors will temporarily curb modular construction’s growth, but the sector should be back on the fast-growth track in 2025.

In the coming years, key factors supporting the continued growth of the modular construction market will include strong long-term macroeconomic fundamentals of the Polish economy, the continued shortage of housing in Poland compared to the EU average, the increased interest in modular construction in Poland, well-developed production facilities comprising experienced, specialised manufacturers, a large selection of available prefabrication technologies, a growing pressure on shortening the construction process, big popularity of modular houses built in Poland across Europe, and the government’s growing involvement in the development of modular construction in Poland.

Major factors that will have a negative effect on the modular construction market will include unfavourable demographic forecasts for Polish economy, a continued high level of interest rates, high prices of key raw materials and semi-finished products, such as cement, steel and timber, growing prices of specialist construction services, and numerous concerns on the part of investors regarding technology aspects of modular construction, including durability, acoustics, as well as transport and assembly issues.

Despite a short-lasting downturn in building construction, the modular construction sector is poised for very good times in the long term. Modular construction has garnered increased interest from individuals, who generated demand through single-family houses, but also from institutional investors, such as hotel chains, home developers, and local government institutions, which generate demand for larger capacity buildings.

Methodology note: for the purposes of the report, the modular construction sector is defined as the manufacturing of large-sized building components conducted by specialist prefabrication plants. Products covered in the report can be divided into two main categories: 2D modular construction (precast walls or complete precast buildings consisting of walls, ceilings, staircases, and balconies, which are assembled on-site). 3D modular construction (modular buildings, modular bathrooms, container homes, sanitary containers, and office containers delivered to construction site in 3D form). These categories are further divided into sub-categories that vary according to the dominant structural material. The sub-categories are as follows: wood and wood-based products, concrete products, steel products, expanded clay products.

Request a free sample of the report:

info@spectis.pl