Our articles

Articles

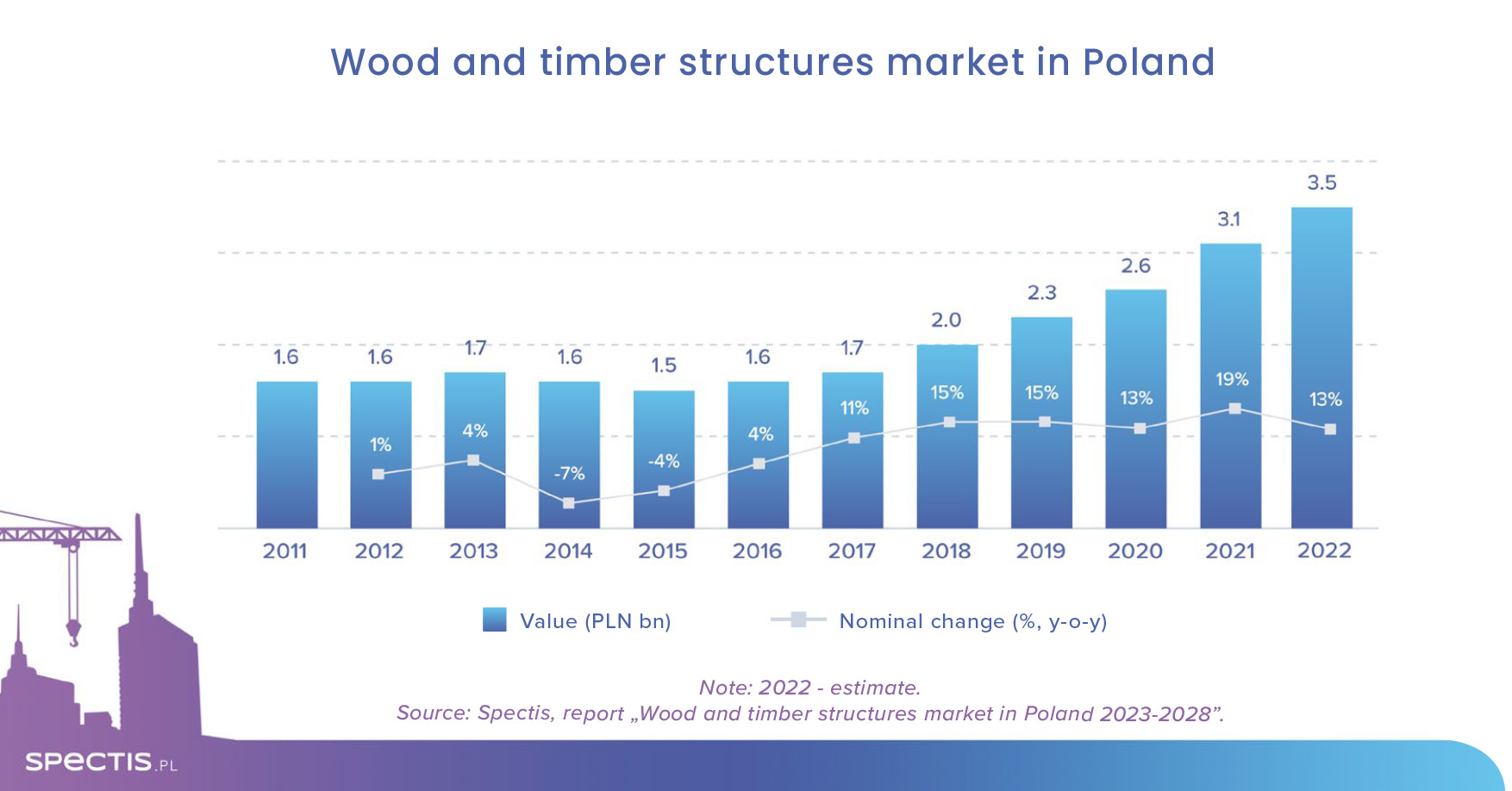

The value of the Polish wood and timber structures market is already over PLN 3bn

06 Sep 2023

Growing popularity of wood construction combined with rising prices of wood have doubled the value of the wood and timber structures market in Poland in just five years. The change has been boosted by exports, which accounted for nearly 60% of revenue generated by Polish manufacturers in recent years. The wood construction sector has promising prospects until 2028 although a short-lasting downturn is likely.

Top 50 manufacturers generated revenue of PLN 5.5bn in 2021, with 57% of the figure contributed by sales of wood and timber structures, according to our report "Wood and timber structures market in Poland 2023-2028". As a result, the value of the market amounts to over PLN 3.1bn. Based on preliminary data, we estimate that the market’s value grew by 13%, in nominal terms, reaching a record value of PLN 3.5bn in 2022.

The market’s growth is expected to slow in 2023 and 2024. The main reasons behind the economic downturn include a general economic slowdown in both Poland and the export markets and a slump in the single-family houses sector. These factors temporarily weigh down on demand for wood and timber structures. However, we anticipate the market to return to the growth path as of 2025.

In the coming years, key factors supporting the continued recovery of the wood and timber structures market’s potential will include strong long-term macroeconomic foundations of Poland, structural shortage of housing in Poland when compared to the EU average, well-developed production facilities comprising experienced, specialised manufacturers, increased interest in modular timber construction in Poland, growing popularity of modular houses built in Poland across Europe, and prospects for the implementation of the Fit for 55 EU package, which promotes wood and timber construction.

Factors that will have a negative effect on the wood and timber structures market will include unfavourable demographic forecasts for Polish economy, high interest rates, high prices of wood products and specialist construction services that require investors to limit or discontinue their investment plans, and numerous concerns on the part of investors regarding technology aspects of wood construction, including fire resistance, durability, maintenance concerns, issues related to humidity, wood drying and shrinking.

Despite the expected short-term slowdown, the long-term outlook for the wood and timber structures market is highly promising. Interest in wood construction has risen not only among individual investors but also in the sector of companies, partly due to the requirements of the Fit for 55 EU package. Examples of companies whose actions confirm that trend include the Erbud Group (recently expanded in the sector of wood and timber structures through MOD21) of the Austrian-based Strabag (plans to gain a stronger foothold in the wood construction segment, first in Poland, subsequently in the other countries of the region).

Methodology note: for the purposes of this report, the market of wood and timber structures is defined as the manufacturing of, or trading in (understood as imports of structures from overseas markets to Poland) complete prefabricated wood buildings and structural timber elements that are mainly used in the construction of buildings, including tool sheds, carports, garden houses and containers.

Request a free sample of the report:

info@spectis.pl