Our articles

Articles

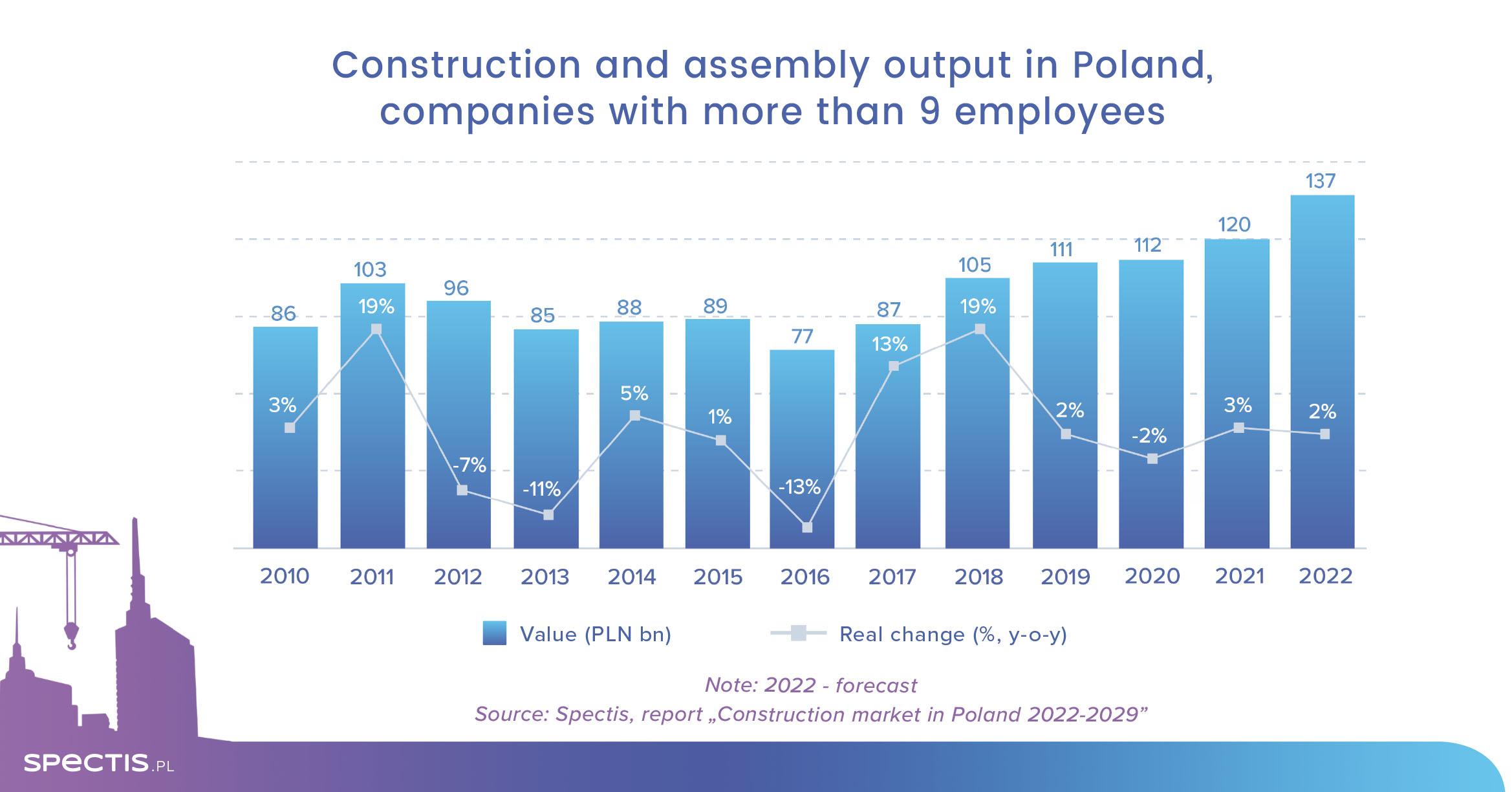

Construction market poised to grow 2% in 2022

03 Nov 2022

Despite hard market conditions, the 2022 outlook for the construction sector remains moderately favourable on the back of the results generated in the first half of the year, according to findings presented in the autumn edition of our report "Construction market in Poland 2022-2029". We expect that the real growth of the market’s value will stand at 1% for all construction companies, and 2% for the major construction enterprises with more than nine members of staff. Regarding 2023, the outlook for the construction industry is not that bright, though.

The construction sector made enough of a cushion in H1 2022, so it should see around 2% growth of the market’s value in real terms in 2022 as a whole. However, the already evident slowdown in construction activity will be reflected in the negative growth of the construction market in 2023, strongly impacted by the downturn in residential construction that will be offset, to a certain extent, by a stable situation in non-residential construction. As far as civil engineering construction is concerned, construction companies pin their hopes on the new EU financial envelope, but its influence on the investment volume will become apparent much later. Furthermore, the rapidly growing prices of construction services and materials will halt some projects due to the shortage of funds and having to secure additional funding.

Sharp downturn in residential construction

The residential construction segment will shrink in double digits in terms of both the area of construction permits and housing starts in 2022. The falling number of project starts will contribute to a major drop in construction output in 2023 and 2024. The main reasons behind the ongoing slowdown in investment activity include a high comparison base effect, record-high prices of construction materials and labour prices, and a series of interest rate increases resulting in the erosion of the home loan market.

Despite the fact that the influx of Ukrainian migrants generates additional demand for flats - as for now, mostly rental flats - interest rate hikes have greatly dampened interest in home purchases from private individuals. As a result, developers are increasingly encouraged to move to the PRS segment, either by selling packages of apartments to specialised institutional rental funds or trough investment in their own institutional rental platforms.

Temporary decline in civil engineering construction

The economic slowdown and rising construction costs will accelerate the economic downturn in the civil engineering construction sector. The plunge can come as early as 2023. The main reason behind the correction will be the transition period between the seven-year EU budgets that will result in fewer projects getting done. There is currently a shortage of public contracts for construction of large-scale infrastructure projects, in particular railway construction ones. On the other hand, there are many more public contracts for smaller civil engineering projects, mostly those run by the local authorities.

Following a short-lasting slowdown, public investment should be the major driver of economic growth in the coming years, financed through the Recovery and Resilience Facility, and the seven-year financial framework 2021-2027. We expect that despite difficulties and delays experienced so far, most of the funds will be disbursed during 2023.

Stable growth of non-residential construction

Of the three main construction segments, the outlook for 2023 is the strongest for the non-residential construction sector. As at the end of 2021, the volume of modern commercial space under construction grew by nearly 60%. The upward trend was continued throughout H1 2022 (up by 10% y-o-y). 2021 was also a successful year in terms of the area covered by permits for non-residential buildings - up by nearly 30% y-o-y. The high volume of construction permits continued also in H1 2022.

Industrial and warehouse construction will remain the largest non-residential construction segment in the coming years as its contribution to non-residential construction output will reach a record 45%. The segment emerges as one of the winners of the COVID-19 pandemic, mostly due to the rapid expansion of the e-commerce market. The war in Ukraine should not impact the segment, either. Over the long term, the continued growth of the industrial and warehouse segment might be supported by rising investor confidence in the Polish economy, sustainable economic growth, the development of the manufacturing sector, the improving condition of road infrastructure, and further growth of the e-commerce market.

Ask for free sample of the report

info@spectis.pl