Our articles

Articles

Roofing materials market in Poland to reach €1bn by 2025

03 Feb 2021

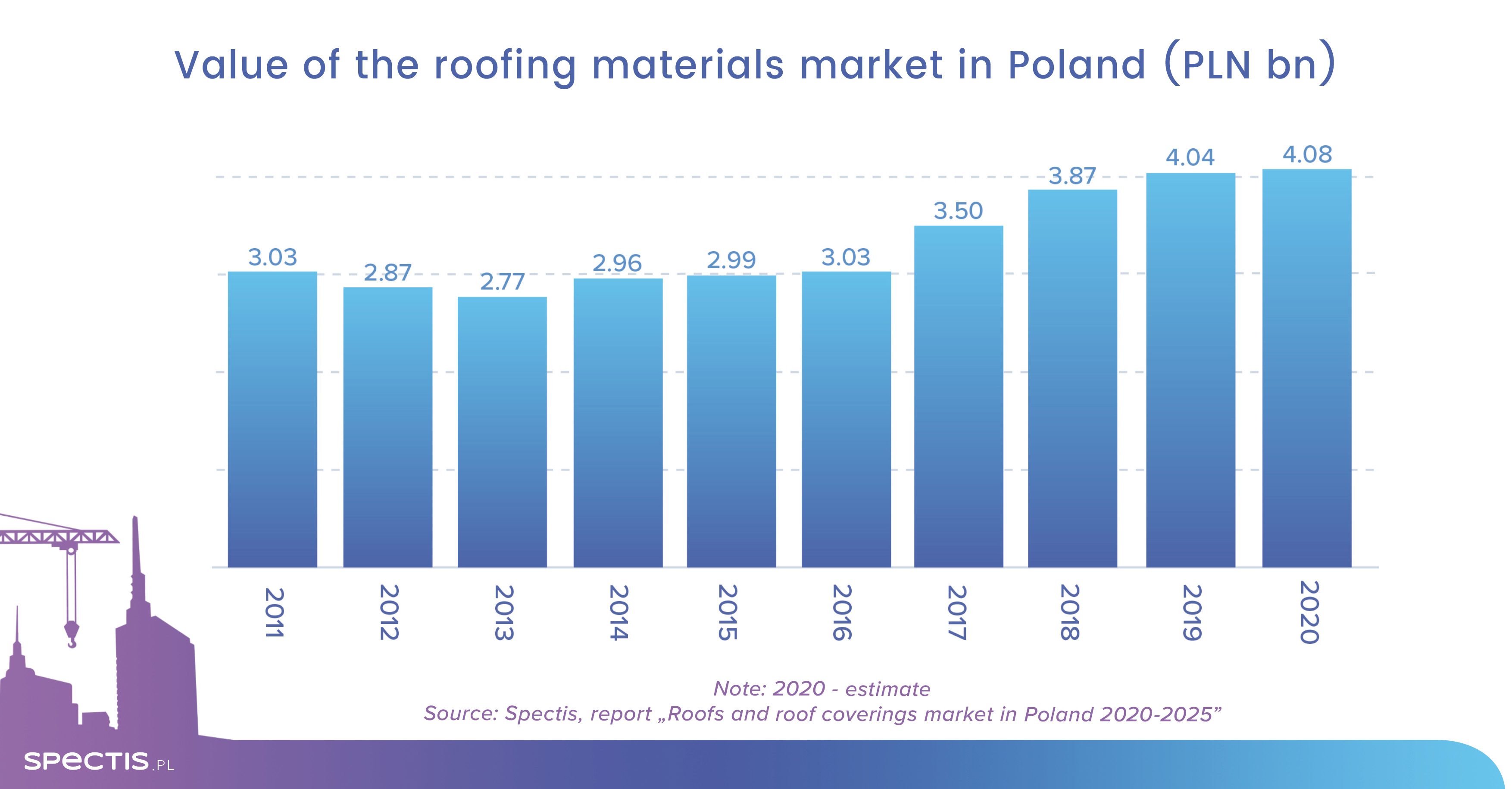

Manufacturers of roofing products were successful in generating a little over PLN 4bn (€900m) in revenue in 2020 in spite of slower activity in the building construction sector, according to the findings presented in the report released by Spectis entitled "Roofs and roof coverings in Poland 2020-2025".

Total revenue generated by 50 producers of roofing materials covered in the report increased by 2.3%, in nominal terms, to PLN 8.7bn (€1.96bn) in 2019, PLN 3.6bn of which was contributed by roofing products. Factoring in estimated revenue for all companies operating in the sector, the value of the roofing products market was PLN 4.04bn (€900m).

Based on preliminary data, Spectis expects the value of the roofing materials market to stay at a little over PLN 4bn in 2020 (roughly the same as 2019). In 2021, the market’s value is expected to decline slightly. Output generated by the roofing materials sector should again exceed PLN 4bn in 2022 and then steadily grow to PLN 4.4bn (€1bn) in 2025

As a result of overall increases in production costs (labour, raw materials, logistics, and transport), and the increased demand, in 2017-2019 the concrete products sector saw a substantial hike in value, from PLN 3bn in 2016 to over PLN 4bn in 2019. Within just three years, the market’s value rose by one-third, producing average annual nominal growth of over 10%. However, growth witnessed in the recent years has been less impressive in terms of production volume – an accumulated growth rate was 12%, i.e. 4% per year on average.

From the perspective of the competitive environment, the roofing materials market is moderately concentrated. The fact is that the 10 largest producers of represent a little over 50% of the roofing materials market’s value.

Metal roofing materials are the largest segment of the roofing sector in terms of value. In the past three years, the segment saw a clear upsurge in popularity. Out of 50 companies covered in the report, products from this segment are offered by almost half of the companies, though fewer than 10 of them generated significant sales of the products (over PLN 50m).

Bituminous roofing materials are the second-largest segment of the roofing sector in terms of value. Out of 50 companies covered in the report, products from this segment are offered by 15 companies, with 10 of them generating significant sales of the products.

Ceramic roofing materials are the third-largest segment of the roofing sector in terms of value. This segment is completely different from other metal or bituminous roofing in terms of production concentration. Out of 50 companies covered in the report, ceramic roofing is only offered by five companies. Cement roofing and fibre-cement roofing are the fourth-largest segment of the roofing sector in terms of value. This segment is similar to ceramic roofing in terms of production concentration.

Synthetic membranes, mainly EPDM, PVC, PCV, and TPO, are the fifth-largest segment in terms of value. These products are intended for flats roofs and are used generally in industrial buildings, but also on flat roofs of single-family houses. Synthetic membranes are an alternative solution to roofing felt, and despite a higher price, they have been gaining an increasing share of the flat roofing market.

In the coming years, the roofing materials market’s growth will be strongly driven by a growing share of renovations and upgrades. Efforts to curb smog and support thermal upgrading programmes in the segment of single-family buildings will translate into increased needs for additional attic thermal-insulation and more frequent roof replacement. On the other hand, substantial EU funds allocated to the extension and upgrading of farms will generate significant demand for pitched roofing products.

Ask for free sample of report

info@spectis.pl