Our articles

Articles

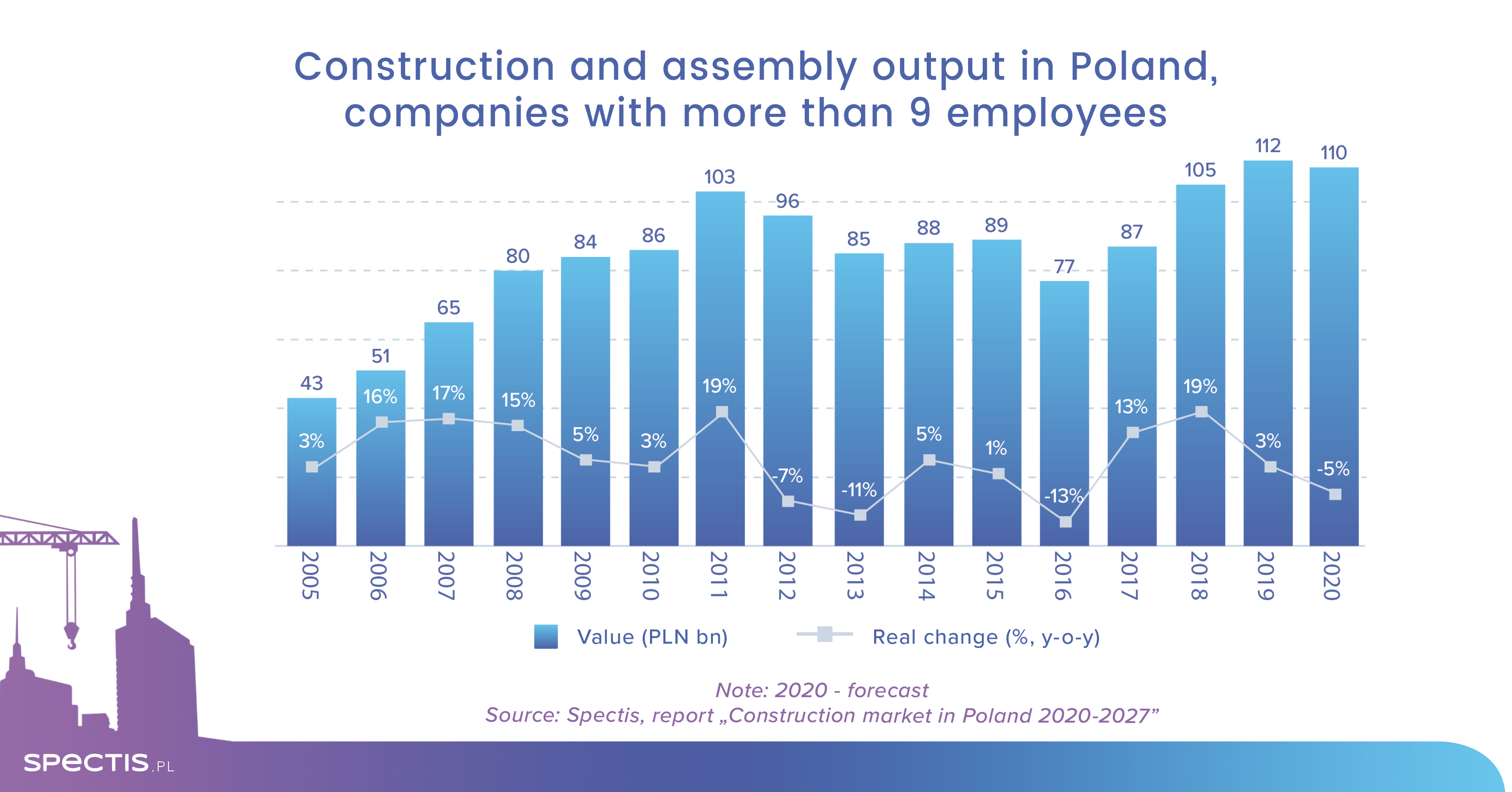

Construction market in Poland to shrink 3-5% in 2020

28 Sep 2020

The Polish economy is already past the low point of the short-term economic activity downturn. However, the construction industry is not at this point yet as it responds to economic shocks after a certain time period. This is why the first half of 2021 will be marked by challenges. The market pins its hopes on the new EU financial envelope, but a tangible effect on the investment volume will not become apparent before H2 2021.

According to the autumn edition of our report "Construction market in Poland 2020-2027", owing to relatively good performance the construction industry delivered in the first half of the year, analysts revised 2020 forecasts upwards. We expect that the market value real change will reach around 3% for the total market and 5% for companies with more than nine workers, versus falls of around 5% and 6%, respectively, projected last spring.

Unlike 2017-2019, the sector’s change will not be driven by all the three construction segments in 2020 and 2021. The slowdown will exert the strongest impact on private construction. Construction companies with sizeable exposure to building construction can find it very hard with securing enough orders to utilise their capacity in 2021 and 2022.

Sharp downturn in non-residential construction

Out of the three segments of the construction industry, the non-residential sector will be hurt the most due to the coronavirus pandemic. However, the pandemic only propelled and aggravated the declines that had already been suggested in the data on building permits issued in 2019 (a 19% fall). In terms of supply, most non-residential projects, which are already underway, progress smoothly, without undue problems or delays. However, in the coming quarters some of the projects planned will be put on hold.

Beginning of stabilisation in residential construction

On the back of anti-crisis measures (financial shields, interest rate cut, job protection, re-opening of the economy in June), the coronavirus pandemic will exerts a less severe impact on the growth of residential construction. Sharper declines in residential construction will also be prevented thanks to the substantial contribution of the single-family housing segment, which has reported a less severe downturn compared to home builders. Following a record 2019 (207,000 flats), in 2020 the number of flats delivered for use will again climb to the high of around 220,000 in post-1989 Poland.

Hopes pinned on civil engineering construction and EU funds

Projects conducted by GDDKiA and PKP PLK can be a major stabilising factor in the civil engineering construction sector in the next few years. Regarding the sector of projects run by the local authorities, there is a major risk of investment slowdown. The local authorities’ sector will be the weakest link in the course of civil engineering projects in the coming years. However, the decline in local government projects in 2021 will be partly offset by the government-led Local Government Fund, whose budget for 2020-2021 has been set at PLN 12bn.

Therefore, public investment will be a major component in stimulating economic growth in 2021-2023, financed through the Recovery and Resilience Facility for 2021-2023 (€57bn in grants and loans available to Poland) and a seven-year EU budget for 2021-2027 under which Poland can receive €67bn in EU grants. At the same time, projects funded from the EU’s 2014-2020 budget will be implemented until the end of 2023. A combination of several major funding sources means that the civil engineering sector should keep the construction industry’s growth solid in 2022 and 2023.

ASK FOR FREE REPORT SAMPLES

info@spectis.pl