Our articles

Articles

Polish construction companies upping bid prices to rescue profit margins

03 Apr 2019

Construction companies successfully confronted looming insolvency issues in 2018. However, this does not mean that the risks have been entirely mitigated. Loss-making contracts whose prices were set at the time of increased competition will still be pursued and billed in 2019 and 2020. Nevertheless, there will be fewer of them active, and the backlogs will start to comprise mostly contracts valued conservatively.

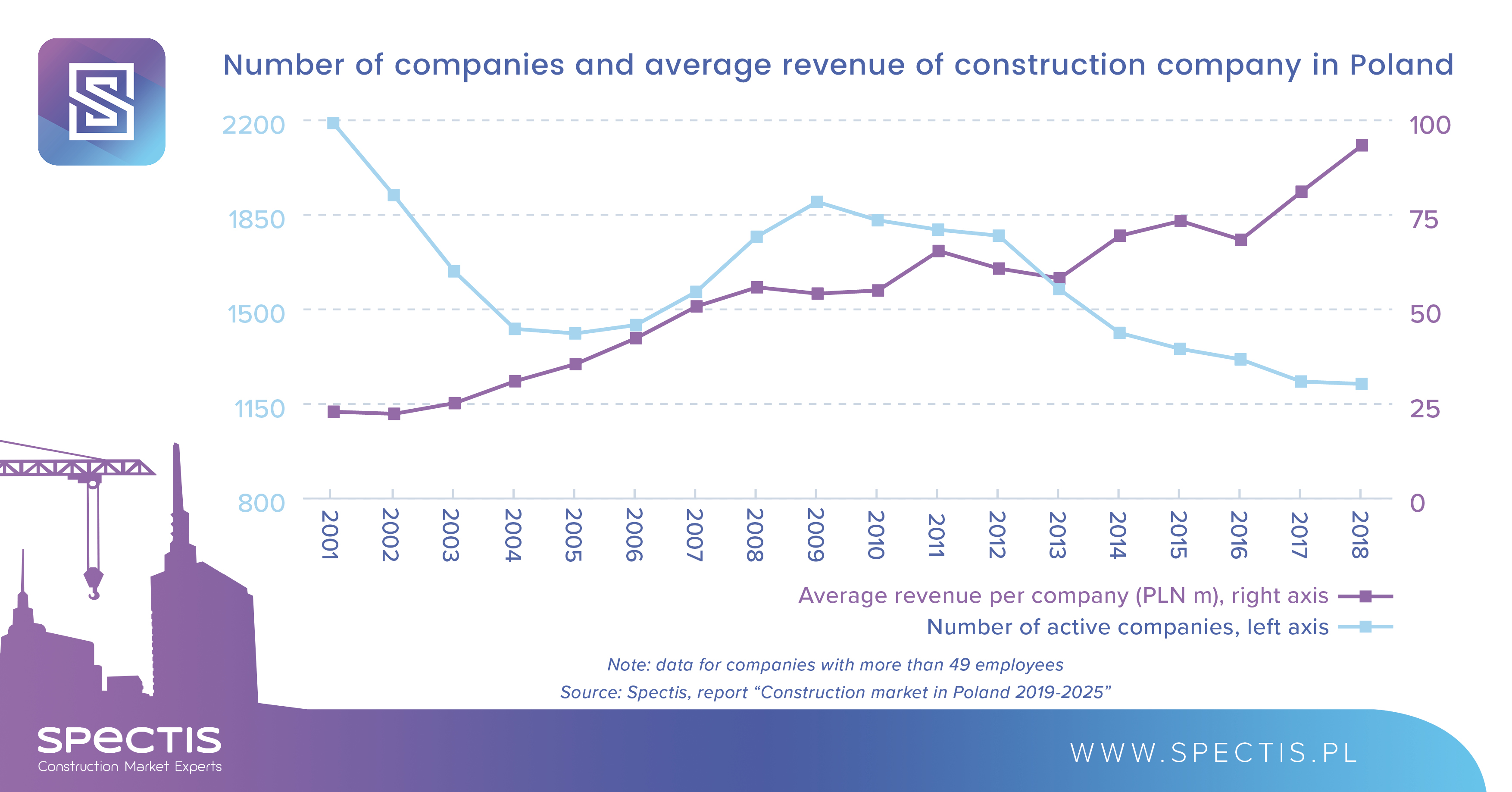

Medium-sized construction firms and large construction companies generated a total net profit of PLN 4.3bn (€1bn) in 2018, compared to PLN 2.9bn (€0.7bn) in the preceding year, according to our latest report entitled "Construction market in Poland 2019-2025".

Nearly half (PLN 2.03bn) of the profit was contributed by companies specialised in building construction projects, which are among the chief beneficiaries of the upturn in the residential construction segment that has lasted for the past few years. Importantly, civil engineering companies also showed robust performance profit-wise last year as they reported aggregate net profits of PLN 1.44bn. Specialist construction enterprises (involved mostly in installation and finishing projects) added PLN 0.83bn in net profit.

While the general contracting sector was severely impacted by soaring prices of building materials and increased labour costs in 2018, it benefitted from the fact that these rising costs were accompanied by a substantial revenue hike, coming on the back of a significant number of orders. As a result, the companies were to some extent able to reduce the cost-to-revenue ratio to just under 96%, which resulted in improvement of net sales margin to 3.7%.

In most cases, general contractors have learnt the lesson from the investment boom on the eve of Euro 2012. A vast majority of contractors take into account current market realities in their bidding policies, which has resulted in a major hike in bid prices in tenders. It is also increasingly the case that companies adopt a selective approach to contract bidding and, quite often, they decide not to sign a contract despite winning the tender. Moreover, delayed tender procedures often cause bidders to withdraw their bids. As a result, it is more and more often the case that contracts are awarded to lower-ranking contractors with higher-priced bids.

Pushing bid prices, on the back of declining competition within the sector, creates an opportunity for construction companies to avoid the scenario of 2012-2013 and restore contract margins. The growth of bid prices recently observed is capable of offsetting increased costs of construction companies. Moreover, in some cases high-priced contracts of today can generate above-average margins in two or three years’ time, provided that building material prices finally decrease after upward price movements, just as was the case in 2015.

More information will avalible in upcoming report "Construction market in Poland 2019-2025".

Ask for free report samples

info@spectis.pl