Nasze artykuły

Artykuły

Value of the construction market in Poland set to exceed PLN 400bn in 2026

13 wrz 2024

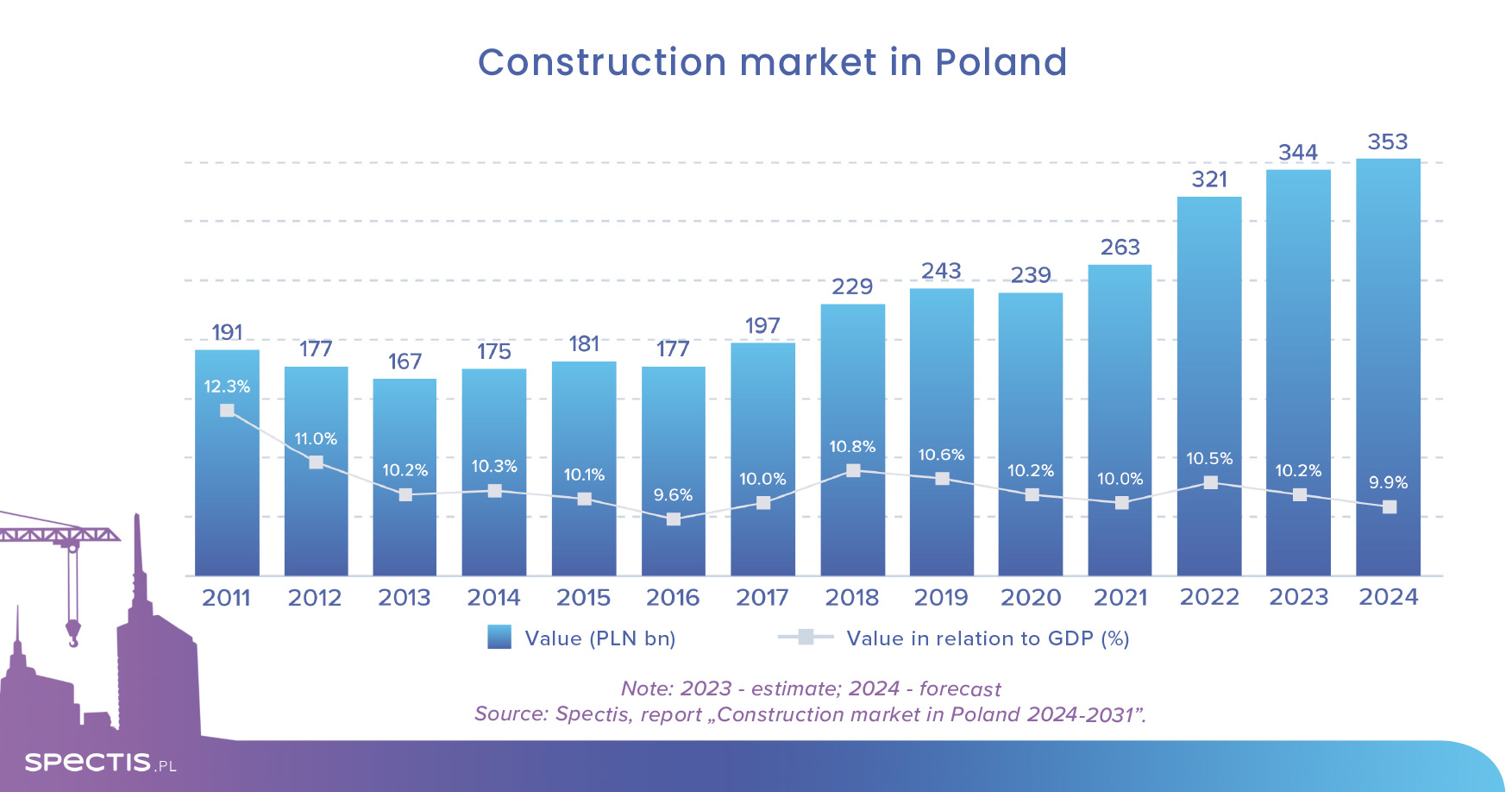

The value of the Polish construction market has doubled in the past eight years, and its growth is expected to continue. After a weaker 2024, the outlook forecasts a moderate pace of the market value recovery in the forthcoming years. As a result, the value of the construction market will top PLN 400bn (€90bn) in 2026. However, the impressive growth in terms of the market’s value has not been accompanied by a commensurate increase in volume, which has remained mired in stagnation for over a decade.

The latest edition of the "Construction market in Poland 2024-2031" report indicates that construction output generated by companies operating in Poland rose from PLN 177bn in 2016 to PLN 350bn in 2024. It should be noted, however, that increases recorded in the said period were nominal and were driven by growing prices of materials and higher labour costs. In real terms measured by consumption of the basic construction materials (e.g. cement, concrete, steel), the construction market is in a prolonged stabilisation stage, as indicated also by the comparison of its value to Poland’s gross domestic product. After hitting a record share of over 12% in 2011 (a period of wide-ranging preparation for Euro 2012), the value of construction market output has been at around 10% of GDP since 2013.

Real growth on the horizon

The latest forecasts presented by Spectis indicate that after a weak 2024 in the industry both 2025 and 2026 should be a much better period for construction companies, and the rate of the market’s growth will greatly exceed the inflation rate in the construction sector. As a result, the value of the construction market is expected to exceed the PLN 400bn (€90bn) mark already in 2026, while construction output should again account for over 10% of Poland’s GDP.

Strategic civil engineering projects to serve as the driving engine

The main drivers of the Polish construction market’s growth in the coming years will include strong long-term macroeconomic foundations of Poland, €72bn in EU grants for cohesion policy 2021-2027, €58bn in grants and loans for the implementation of project under the national recovery and resilience plan, the continued implementation of the National Road Construction Programme and the National Railway Programme, the energy transition of the Polish economy, the structural shortage of housing in Poland compared to the EU average, an upturn in military construction projects, and a more likely launch of the planned mega-projects (a nuclear power plant, offshore wind farms, the Central Communication Port, High-Speed Rail).

Potential major factors that will have an adverse effect on the construction market include adverse demographic projections, Poland being subject to the excessive debt procedure, a continued high level of interest rates, high prices of raw materials, semi-finished products, materials, and labour costs, an uncertain geopolitical situation dampening investor interest in Central and Eastern Europe, and the shortage of construction labour.

Ambitious plans subject to numerous risks and limitations

In our opinion, an exaggerated role of mega-projects in shaping the outlook for the construction market can be a significant risk to the construction market. For smaller companies, the effect of an upturn that is mostly dependent on mega-projects might be limited or there might not be any impact at all. Conversely, large companies must be prepared to handle more risks than in the case of typical projects. As shown by the example of other countries, ambitious strategic projects in the construction sector nearly always face delays, concept issues, design changes, and cost overruns. On the other hand, even if the public investor is exceptionally determined and closely follows schedules, it seems impossible that all of the planned mega-projects would stay on schedule as there would not be enough capacity on the part of the construction industry to carry out the projects, while construction prices would soar to record levels. In brief, Poland’s theoretical needs and investment plans are both big and urgent for the forthcoming decade, but, effectively, the actual pace of the projects will be determined by competences and financial capacity of the public sector and human resources and production capacity of large construction companies.

Request a free sample of the report:

info@spectis.pl