Nasze artykuły

Artykuły

Top 40 construction companies in Poland report nearly PLN 80bn in revenue in 2023

17 sty 2024

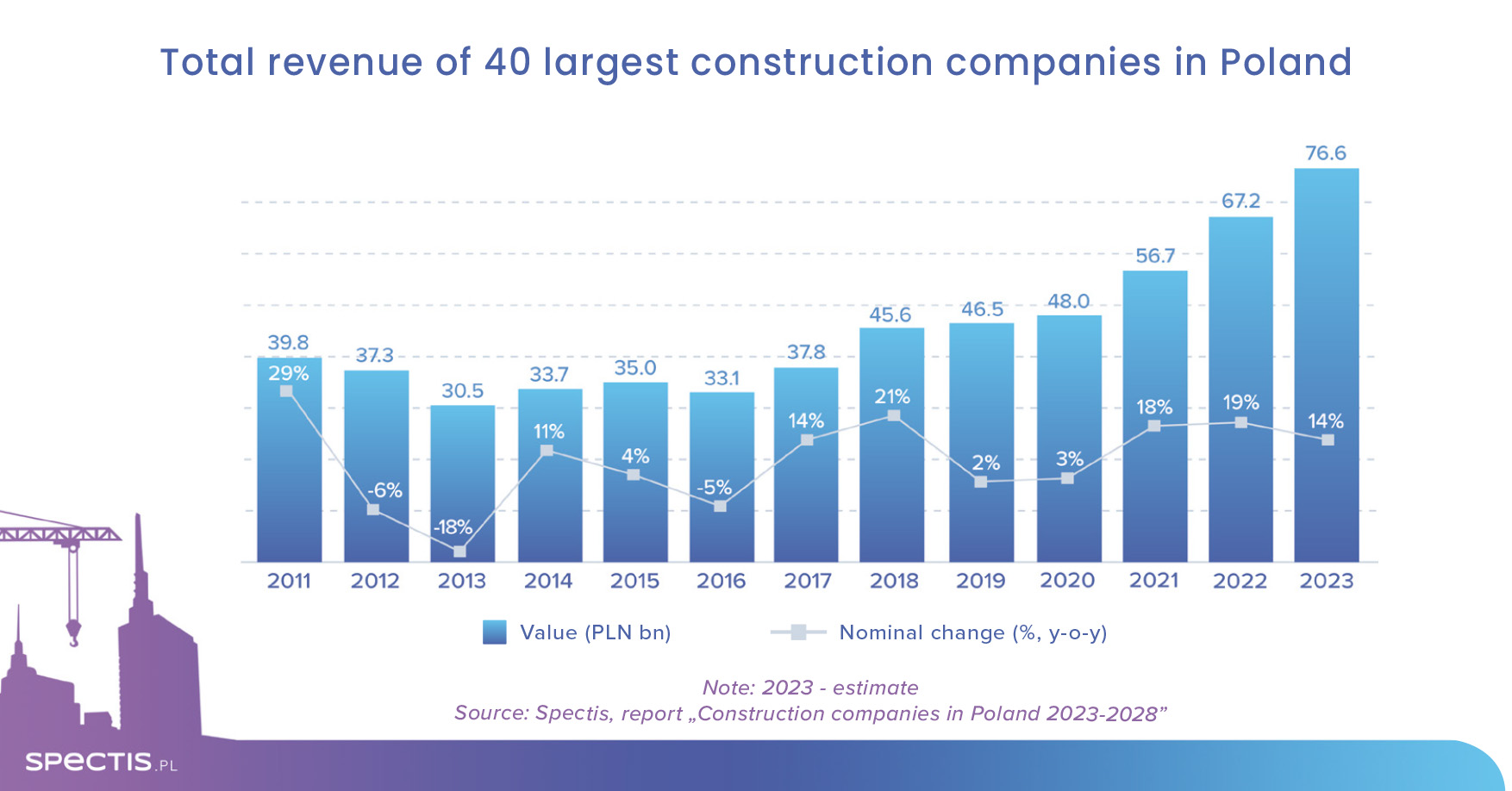

Revenue generated by the top 40 construction companies operating in Poland grew in double digits in 2023, in nominal terms, for the third straight year, and it was mostly the effect of the overall substantial growth of construction costs. For these companies to continue to thrive, it is necessary to disburse the EU funding for Poland promptly, including all the funds available under the National Recovery Scheme and the cohesion policy budget for 2021-2027.

Top 40 construction groups reported PLN 67bn in aggregate revenue in 2022, which was 30% of total revenue posted by medium-sized construction firms and large construction companies, according to our report entitled "Construction companies in Poland 2023-2028". As the condition of the civil engineering construction sectors was better than expected and a high inflation rate in the construction industry, construction companies reported nominal revenue growth of around 14% in 2023, reaching a record-high level of PLN 77bn.

The Polish construction sector is still a highly fragmented industry, with consolidation processes moving at a slow pace. The market leader (Budimex Group) had a 3.9% share in total revenue generated by companies which employ more than nine workers in 2022, compared with 4.7% two years earlier. The top five construction groups (Budimex, Strabag, Porr, Erbud, and Polimex-Mostostal) represent 11.4% of revenue reported by construction companies that employ more than nine members of staff.

Civil engineering boosts sales of top-tier companies

A review of active contracts handled by major companies that was conducted by Spectis shows that Budimex, Polimex-Mostostal, Intercor, Porr, Strabag, Mirbud, Gulermak, and Mostostal Warszawa are the groups currently engaged in the highest value projects, mostly due to participation in large-scale road, railway and power engineering contracts. Among companies specialised in non-residential construction, Porr, Adamietz, Budimex, Warbud, Skanska, Mirbud, Strabag, Dekpol, and Kajima report the highest value of contracts currently underway. Unibep, Skanska, and Erbud are at the helm of the residential construction sector.

The condition to qualify for the top 40 construction groups in 2021 was revenue exceeding PLN 500m. In 2022, the condition to qualify for the top 40 companies was raised to around PLN 650m. In a broader perspective, it was enough to post revenue of over PLN 120m to be qualified among the top 250 construction firms in 2022.

In anticipation of faster growth

Financial results construction companies have posted in recent years show that the sector remains largely unpredictable, and it is typified by a volatile number of large-scale orders from one year to another. A fact that should be noted here is that a vast majority of the major companies are specialised in a specific type of construction activity, e.g. industrial and warehouse, power railway, bridge or tunnel construction, which makes them highly vulnerable to changes in the market situation.

As it was the case in 2022, construction companies faced a lot of negative surprises in 2023 (e.g. a continued slowdown in the segment of large-scale public orders, mostly due to the shortage of funds from the National Recovery and Resilience Plan, a high level of inflation, and a downturn in residential construction). As a result, the aggregate backlog of orders of the largest construction companies grew at a rate hovering around 0%. However, starting from the final quarter of 2023, there has been more signs of improvement, which should have a positive effect on the contracting activity in 2024.

Request a free sample of the report:

info@spectis.pl