Nasze artykuły

Artykuły

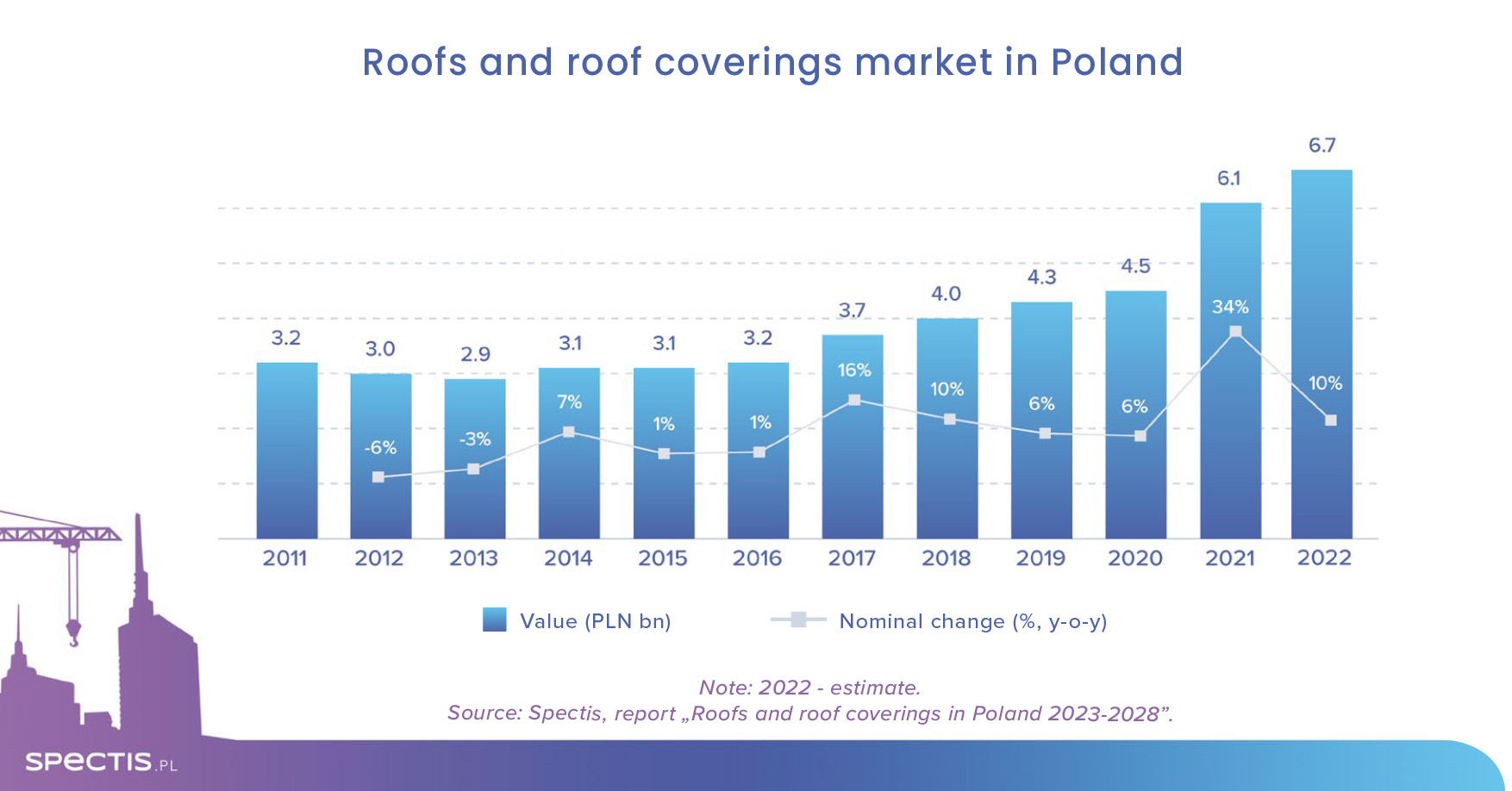

Value of the roof coverings market in Poland exceeds PLN 6bn

04 wrz 2023

Revenue generated by 54 manufacturers of roofing products amounted to PLN 12.9bn in 2021, with 42% of the figure contributed by roof coverings, according to the findings presented in the report "Roofs and roof coverings in Poland 2023-2028" released by research company Spectis. Factoring in estimated revenue for all companies operating in the sector and taking into consideration other niche types of roof coverings, the value of the roofing products market was PLN 6.1bn, reporting impressive growth of over 30%.

In real terms, i.e. taking account of price increases, the hike recorded in 2021 was much lower, though. We estimate that the segment’s value grew by around 10% in nominal terms in 2022, and it was due to continued price increases. It is because 2022 was marked by decreases in terms of volume. The volume of the market is expected to further shrink also in 2023, mostly due to the continued, sharp downturn in the residential construction segment and a temporary slowdown in the industrial and warehouse construction sector, which represents a major share in the segment of flat roofs. Even sharper decreases can be expected in terms of value. Average prices of roof coverings have been falling significantly as of Q2 2023, and there are no signals that the downward trend should slow in H2.

Key factors supporting the recovery of the roofing market’s potential will include: strong long-term macroeconomic foundations of Poland, the structural shortage of flats in Poland when compared to the EU average, efforts aimed at reducing smog and support thermal upgrading programmes in the segment of single-family houses (including roof replacement), the fact that repairs and upgrades account for a substantial portion of the market, as well as the growing popularity of Polish roofing materials in European countries, recovery of demand partly driven by the Safe 2% Loan scheme, fast-paced growth of the e-commerce segment fuelling the growth of logistics and warehouse projects, and restrictions on imports of competitive roof covering products from eastern markets to Poland.

Metal roofing materials remain the largest segment of the roofing sector in Poland. 24 companies (out of 54 businesses presented in the report) carry products from this segment, and seven of them generated significant sales (over PLN 100m). Bituminous roofing products are the second-largest segment. Out of 54 companies presented in the study, 17 companies offer products from this segment, with eight of them generating sales exceeding PLN 50m.

Request a free sample of the report:

info@spectis.pl