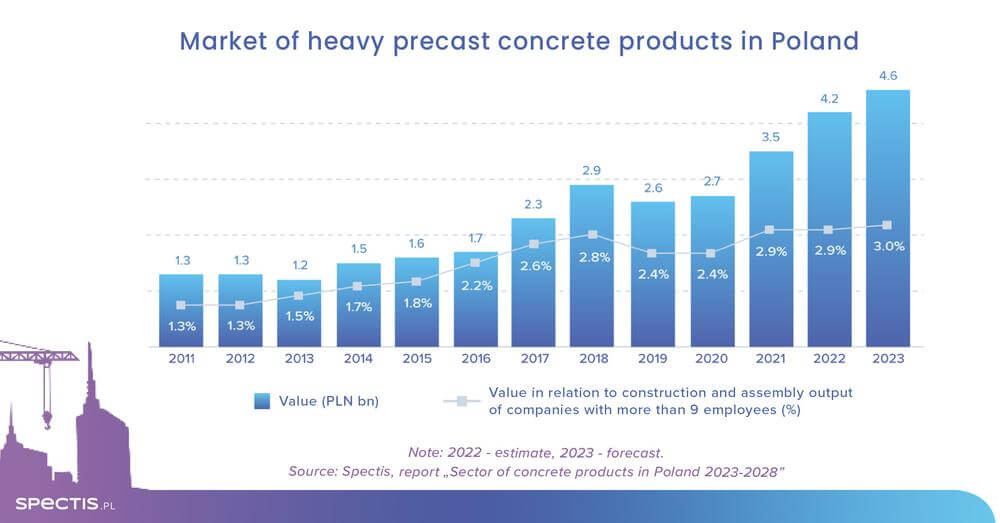

Top 50 manufacturers of precast concrete products generated a record revenue of PLN 5.5bn in 2021, with 65% of the figure added by precast concrete products, according to our latest report "Sector of heavy precast concrete products in Poland 2023-2028". Accordingly, the value of the heavy precast concrete products sector totalled a record PLN 3.5bn by 2021.

We estimate that the pace of the precast concrete market’s growth slightly slowed in 2022, adding that its value stood at PLN 4.2bn, which represents a growth rate of nearly 20% in nominal terms. According to our forecast, nominal growth of the market will slow to just under 10% in 2023, mostly due to continued increases in production costs. For the same reason, further increases of the market’s value are expected in the coming years, which will bring the segment’s output to PLN 5bn by 2025.

Importantly, the prefabrication sector has steadily boosted its contribution to the economy industry for almost a decade (except for the weaker years 2019 and 2020), in terms of both GDP value and the value of the construction market. Compared to Scandinavian countries or Germany, its share is still limited, which indicates a considerable growth potential for the future.

Structural products used in building construction, which include sill plates, pad footing, columns, beams, girders, and stairs, continue to be the largest segment of the heavy prefabrication sector. As many as 37 out of 50 companies covered in the report manufacture these products.

The segment of floor slabs and balconies, which are used in both residential and non-residential construction segments, is in the second position in terms of size. This product segment is the most represented – as many as 41 out of the 50 companies covered in the report offer these products.

The segment of building walls is the third-largest in terms of value (a move up from the fourth spot). Over a half of the 50 companies covered in the report produce building walls, but rarely are they the main product category.

Pretensioned prestressed concrete sleepers are the fourth-largest market segment, but just a few years ago it was the second largest segment. Such a substantial decline was caused by a sharp fall in investment activity on the part of PKP PLK.

Besides the main market segments, there are also several minor product specialisations represented by just one or two companies. Examples include bathroom modules, foundation piles, columns, lighting and electricity posts and towers, and products for agriculture. The rest of the market is divided among handling docks, bridge beams, platform slabs and platform walls, road and tram slabs, retaining walls, and sound barriers.

In the longer term, the market’s growth will be largely conditional on the consistent fulfilment of the government’s investment promises, in particular those regarding large-scale power projects, a timely start of railway projects co-funded from the EU’s budget for 2021-2027, and the completion of the Central Communication Port, which creates numerous opportunities to use a wide range of precast concrete products. Multi-dwelling buildings and industrial and warehouse buildings will remain the key drivers of the sector’s results.

Request a free sample of the report:

info@spectis.pl