The combined revenue of the 300 largest construction companies in Poland has reached PLN 150bn. Despite the market slowdown, 2024 brought a period of stabilisation, with top-tier firms maintaining revenue levels close to those recorded in 2023—thanks in part to continued cost inflation in the construction sector. Civil engineering remains the key growth driver for large contractors, and the outlook for 2025-2026 is becoming increasingly optimistic.

PLN 150bn in revenue generated by the top 300 contractors

According to the Spectis report titled Construction companies in Poland 2025-2030, the combined revenue of the top 300 construction groups in 2023 reached PLN 152bn, accounting for over 60% of the total revenue generated by medium-sized and large construction companies. Despite the prevailing downturn in 2024, the leading players managed to maintain nearly the same revenue level, largely supported by the continued positive rate of construction inflation.

What revenue threshold grants entry to the group of the 300 largest construction companies in Poland?

- Based on revenue, inclusion on the broader Top 300 list in 2023 required a minimum of PLN 133m.

- To make it into the Top 100 required revenue in excess of PLN 360m.

- Joining the Top 50 required revenue of more than PLN 675m.

- The Top 30 featured in the report were those with revenue just above PLN 1bn.

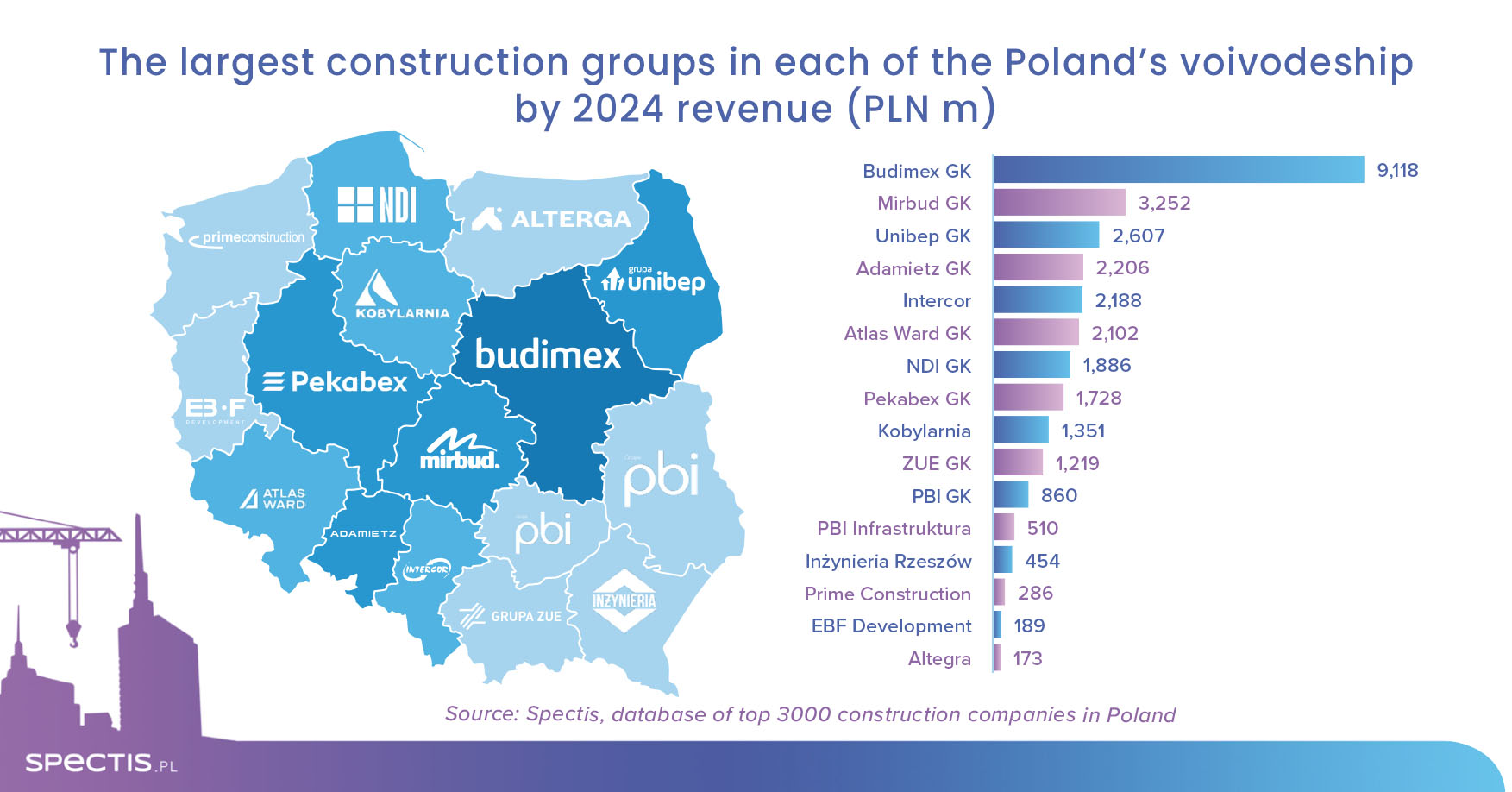

Fragmented market of leading contractors

The Polish construction sector remains fragmented, with consolidation progressing at a slow pace. The market leader (Budimex Group) accounted for 3.9% of total revenue generated by construction firms employing more than nine people in 2023. In turn, the top five construction groups—Budimex, Strabag, Porr, Mirbud, and Erbud—jointly accounted for 11.3% of total revenue in this segment.

Key business segments for top contractors

- According to Spectis’ analysis of ongoing contracts by the top 30 contractors, the largest-value projects are currently handled by Budimex, Polimex-Mostostal, Mirbud, Tecnicas Reunidas, Strabag, Porr, Intercor, and Gulermak, driven primarily by major road, railway, and industrial-energy contracts.

- Among non-residential construction specialists, the highest contract values are reported by Budimex, Adamietz, Warbud, as well as Porr, Strabag, Mirbud, Pekabex, and Atlas Ward.

- In residential construction, the leading contractors currently include Unibep, Erbud, Budimex, and Skanska.

A deep dive into several hundred active construction contracts shows that only a handful of the top construction groups maintain a consistently diversified order portfolio—an approach that has enabled them to remain in the Top 30 ranking throughout the past decade.

Profitability trends among construction companies

- The average net profitability among the Top 300 groups over the past three years stood at 3.8%.

- Among the 300 largest contractors, those with high exposure to commercial and industrial construction (especially warehouse projects) report the highest average profitability.

- Also highly profitable are construction companies delivering in-house development projects using their own execution capacities.

- Companies focused on civil engineering report the lowest profitability rates.

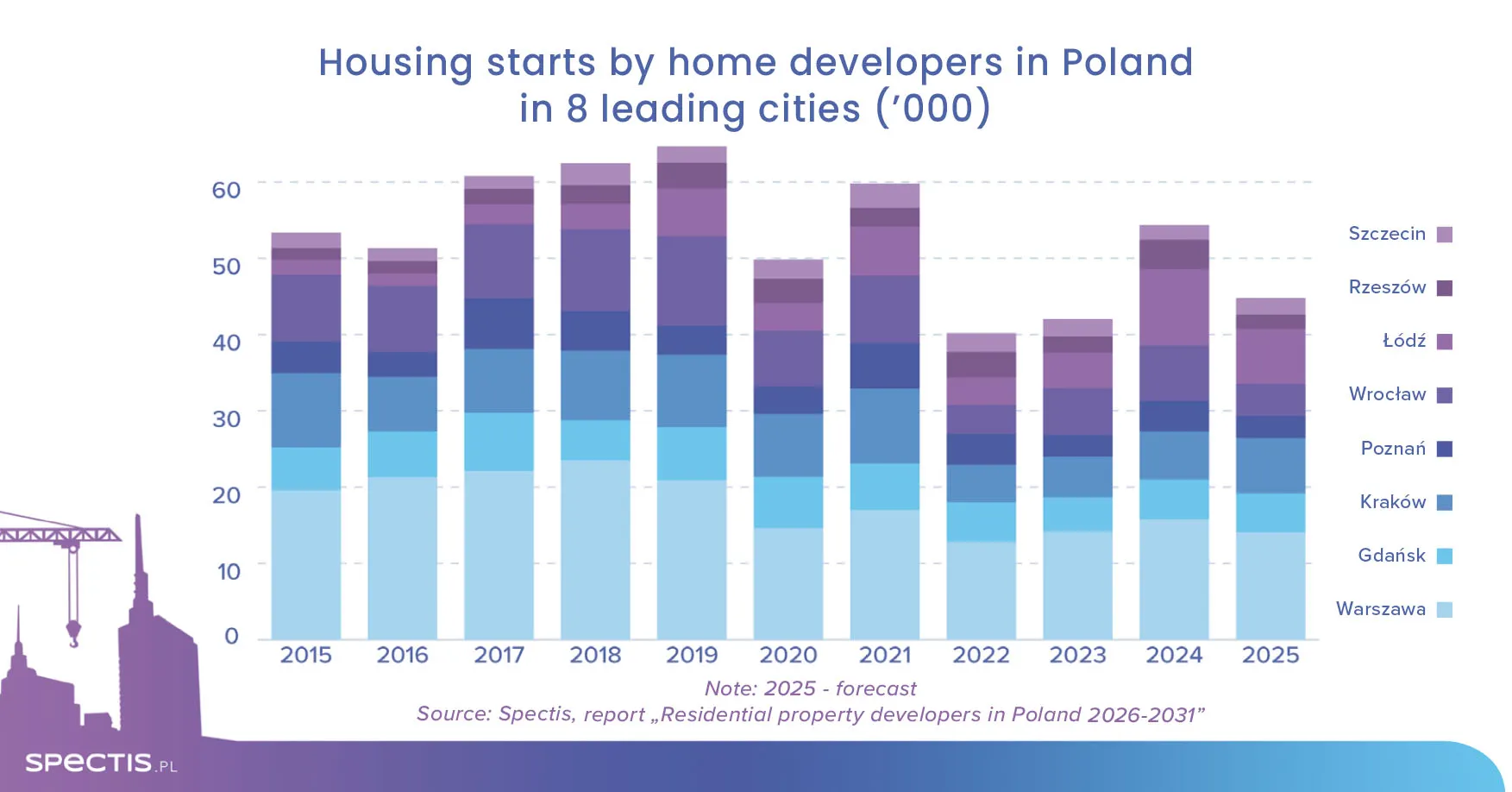

- An important factor supporting profitability for multi-segment construction groups is activity in the residential development market.

As recent financial results show, the construction sector remains unpredictable, marked by volatile inflow of large contracts each year. Most of the largest contractors specialise in a specific area—be it industrial and warehouse, energy, rail, bridge or tunnel construction—making them highly sensitive to cyclical market shifts.

Limited foreign activity of Polish contractors

- In recent years, most companies have seen a decline in the share of export revenue in total revenue.

- Medium and large construction firms still show limited exposure to foreign markets: export revenue among the Top 300 accounts for less than 10% of their total sales.

- Fewer than 40 companies in the Top 300 regularly report export revenue of at least 20%.

- This low figure stems from the presence of numerous local branches of international groups among the Top 300, which already operate abroad through separate, centrally managed entities.

- Despite growing interest in international expansion, efforts by Polish contractors abroad have so far delivered modest results and often ended in failure, negatively affecting domestic financial performance. Nevertheless, many companies continue to pursue or initiate foreign ventures.

Optimistic outlook and rebound in order backlogs

Following a weak 2024, the outlook for top contractors in 2025–2026 is becoming increasingly optimistic.

By the end of 2024, the order backlogs of leading contractors were already growing at a double-digit pace, driven primarily by:

- unblocking of EU funds (including the National Recovery Plan)

- government decisions to continue strategic megaprojects (e.g., CPK, KDP Y, offshore wind farms, nuclear projects)

- steady resolution of large-scale road, rail, and energy tenders.

Additionally, expected interest rate cuts starting mid-2025 are likely to spark renewed activity in the private investment market—both in multi-family residential and commercial construction.

To find out more or download a sample report, go to the store: