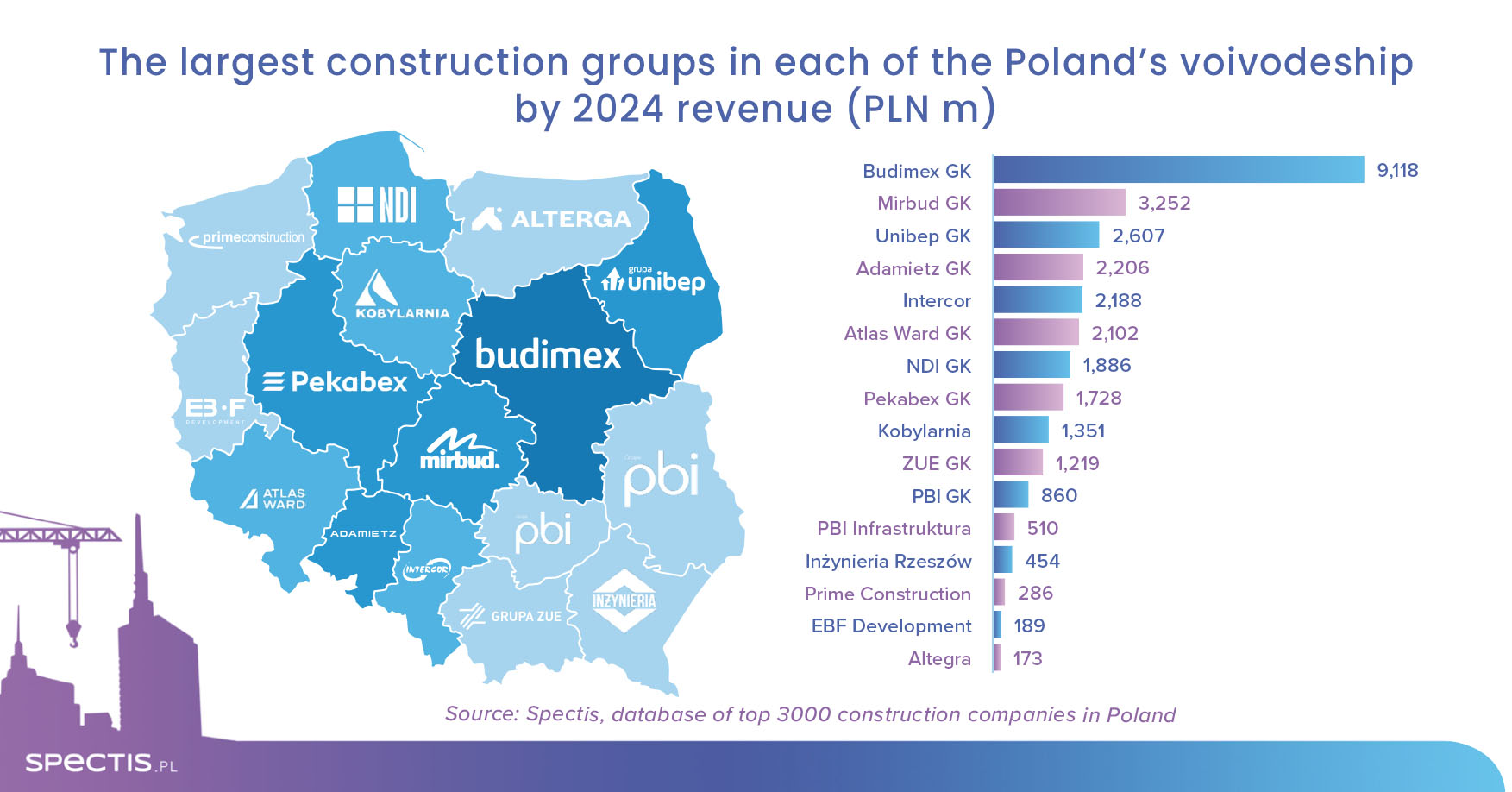

A sustained period of relatively strong market conditions in the construction sector, combined with continued increases in the prices of building materials and labour, pushed the combined revenue of companies listed in the database of the 3,000 largest construction firms in Poland up by more than 60% over a five-year period, reaching PLN 320bn.

Market segmentation – ranking of the 3,000 largest construction companies in Poland

As every year, we have updated our database of the 3,000 largest contractors operating in Poland. The Excel-based database is a valuable tool for analysing the competitive landscape in the construction sector. It is also helpful when looking for new contractors or subcontractors. The database is particularly useful when selecting or verifying companies in terms of revenue size, profitability, area of specialisation or geographical location.

Stabilisation of companies reporting revenue of over PLN 1bn

Based on 2024 revenue figures, there were 39 construction and development groups in Poland generating more than PLN 1bn in revenue, one less than the year before. Combined revenue for these 39 companies reached PLN 78bn in 2024. Their share of the full group of 3,000 firms also declined slightly – from 25 to 24%.

64 companies generating between PLN 500m and PLN 1bn

The market share of entities with revenues in the range of PLN 500m-PLN 1bn is clearly growing. We currently classify 64 such companies, compared to 51 a year earlier. Their combined revenue amounted to PLN 43bn, up by PLN 8bn year on year. As a result, their contribution to total revenue in the database rose from 11.7% to 13.6%.

Subcontractors in the mid-sized segment gaining importance

The past year saw noticeable growth in the number of companies generating revenue of PLN 200-300m (from 97 to 119), and PLN 100-200m (from 342 to 365). These segments also increased their revenue share in the overall database. As of the end of 2024, companies in these two brackets accounted for 25% of the total number of firms in the database, up from 23% the year before.

A significant portion of this group comprises subcontractors focused on niche areas of construction, such as earthworks, reinforced concrete structures, utility installations, gas connections, water and sewage systems, industrial flooring, road surfacing, rail infrastructure, steel structure assembly, roofing works, lighting installations, or refurbishment and renovation.

More than 660 companies with revenue above PLN 100m

In total, the database includes 662 companies with revenue exceeding PLN 100m, which represents over 22% of the total number of firms (up from 20% a year earlier), and accounts for 72% of the combined revenue of all companies in the database (up from 71% the year before).

Firms with revenue between PLN 10m and PLN 100m remain the largest group

The most numerous segment in this year’s database of 3,000 construction and development firms continues to be companies with revenue below PLN 100m – 2,338 firms, compared to 2,384 a year earlier. Their total revenue reached PLN 90bn (versus PLN 87bn the previous year). These smaller entities faced significant barriers to growth in 2024, often losing out to larger firms with greater resources in terms of skilled workforce, equipment, experience, or track record.

We continuously work on expanding and refining our database. In recent years, we have introduced a classification system based on core specialisations, which allows users to filter companies by the following criteria:

- Residential construction (more than 1,400 companies)

- Non-residential construction (over 1,600 companies)

- Road construction (over 550 contractors)

- Railway construction (170 companies)

- Energy construction (over 600)

- Other civil engineering (over 600)

- Residential developers (over 500)

- Non-residential developers (over 100)

On average, each company in the database has close to two core specialisations. However, there are many cases of companies assigned up to five specialisations – typically the largest contractors or developers with their own in-house construction teams.

To find out more or download a sample report, go to the store: