Following a sharp correction, the value of the thermal insulation materials market in Poland has stabilised, and its outlook is increasingly optimistic. Since 2024, the insulation market has been gradually regaining value, driven primarily by a rebound in the residential construction sector. Over the longer term, the building renovation and improvement segment is expected to gain in importance.

Downturn in the thermal insulation market

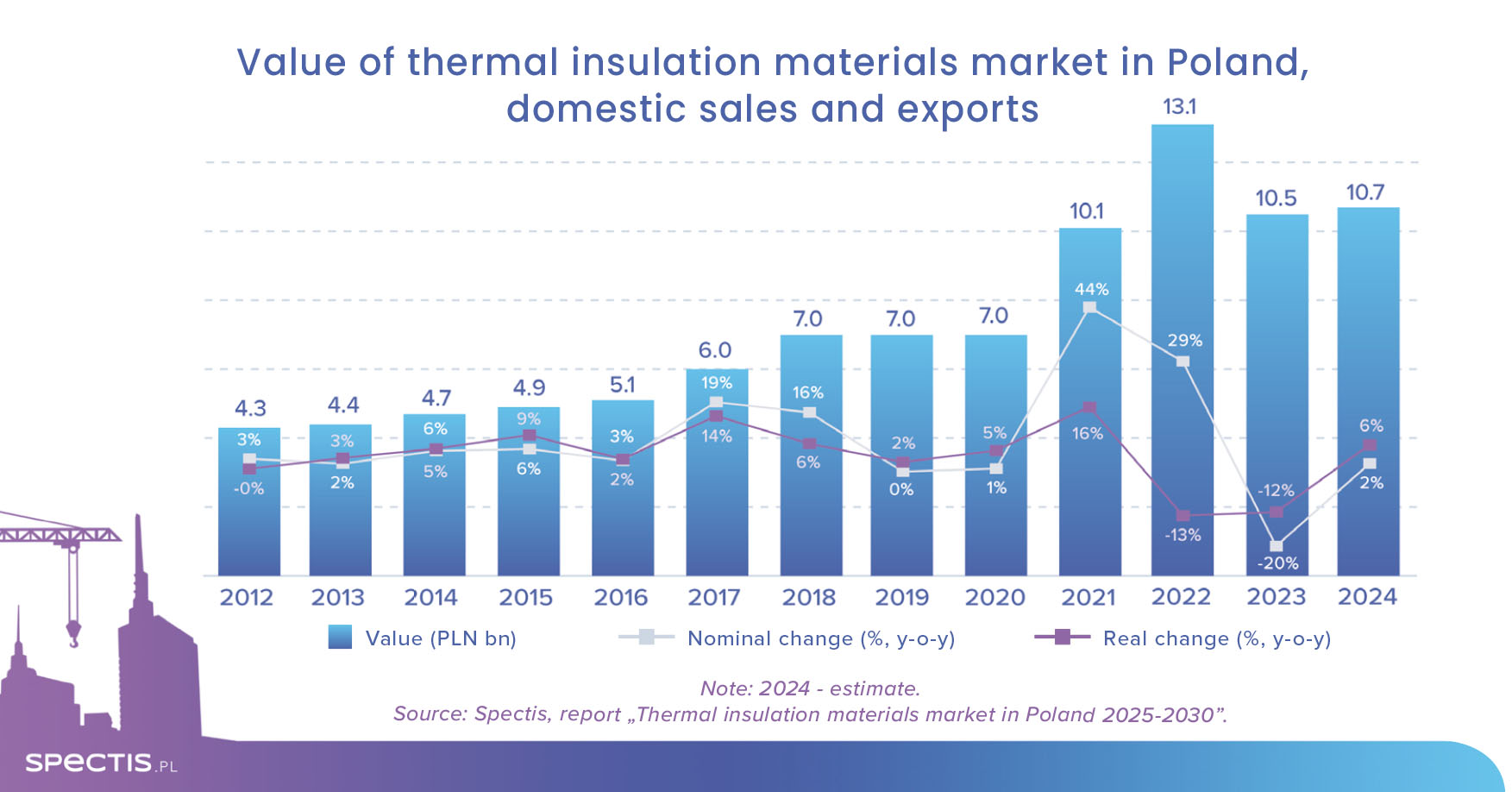

The year 2023 marked a period of sharp correction in the thermal insulation market. According to the report “Thermal insulation materials market in Poland 2025-2030”, the combined revenue of the 100 surveyed manufacturers reached nearly PLN 32bn in 2023, of which PLN 9.8bn came from thermal insulation products. After adjusting for the full population, the market value of thermal insulation materials stood at PLN 10.5bn, with approximately PLN 7bn generated from domestic sales and PLN 3.5bn from exports.

In 2023, the nominal value of the thermal insulation market fell by 20% - but after accounting for an estimated 8% price correction, the real market decline amounted to 12%.

Market enters stabilisation phase

Following the turbulent years of 2021-2023, the thermal insulation market saw signs of stabilisation in 2024.

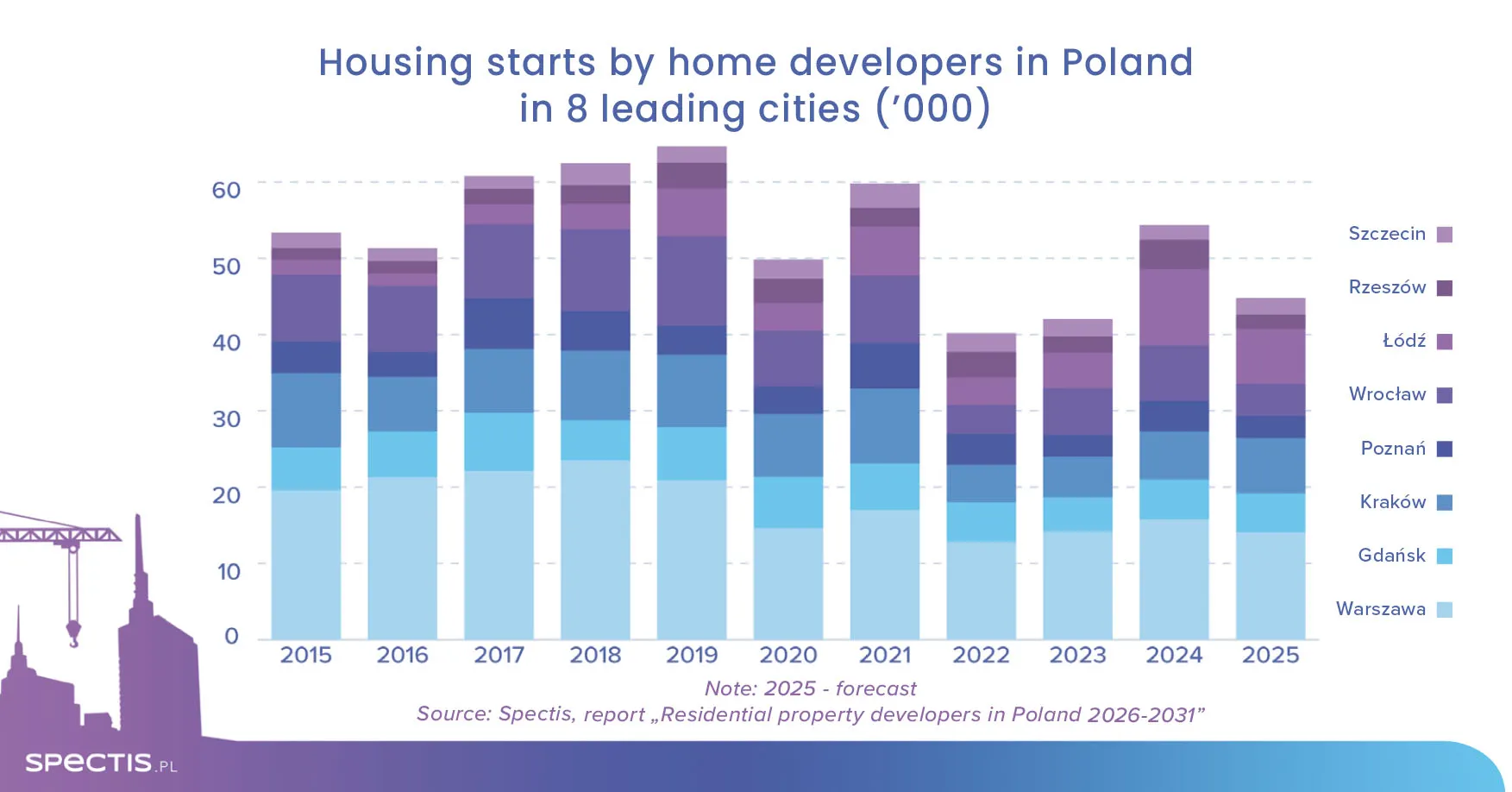

The market recorded single-digit growth both in volume and value terms. The main factor contributing to the more stable outlook was a notable recovery in residential construction. In terms of new housing starts, 2024 saw an increase of nearly 24%, reaching 234,000 housing units.

At the same time, the number of residential building permits grew by just over 20%. In 2024, the volume of permits for non-residential buildings also stabilised, following a 15% drop in 2023.

Forecasts and market expectations

Favourable trends in the residential construction sector only partially translated into volume growth in the thermal insulation market in the past year. Due to a time lag in market response, further increases are expected in 2025.

Spectis team forecast

As the recovery continues, the value of the thermal insulation materials market in Poland is expected to exceed PLN 11bn in 2025. Still, this will remain noticeably below the record-high level of over PLN 13bn achieved in 2022.

Growth drivers

In the coming years, the key drivers supporting the recovery of the thermal insulation materials market will include:

- solid long-term macroeconomic fundamentals of the Polish economy,

- persistent housing shortage in Poland compared to the EU average,

- the need to reduce the carbon footprint of the Polish economy in line with EU policy goals,

- efforts to combat smog and support for thermal retrofitting programmes in both residential and public buildings,

- the strong market position of the renovation and improvement segment,

- planned tightening of energy efficiency standards for buildings,

- gradually recovering demand in the residential sector,

- reduced inflow of competitive materials from eastern markets.

The key role of building construction

The thermal insulation materials market in Poland is almost entirely tied to building construction. The main exceptions are insulation used in the foundations and substructures of engineering structures, as well as insulation for bridge decks, tanks, pipelines, and other industrial installations.

The sector is nearly evenly driven by residential and non-residential construction. Each major construction segment influences a distinct portion of the insulation market. EPS and XPS boards, glass wool, wood wool, and spray foams are used predominantly in residential buildings (both new and renovated), while non-residential construction is the main recipient of stone wool, sandwich panels, and rigid PIR/PUR boards.

Thermal insulation in manufacturers’ portfolios

For the majority of companies surveyed (60 out of 100), thermal insulation is the core area of business. Among those for whom insulation is a secondary activity, the main business lines typically include:

- roof coverings,

- construction chemicals,

- steel sheets,

- wood-based products,

- packaging and broader industrial chemicals sector.

Report methodology

For the purpose of the report, the market of thermal insulation materials is defined as production (in Poland and abroad) and sales (in Poland and to overseas markets) of basic materials protecting premises, facilities, and equipment against heat loss.

Analysing the number of companies which were not covered in this report that discusses the top 100 manufacturers, and the value of their revenue (these firms were too small or had limited presence in the thermal insulation market), it is estimated that the 100 companies presented in the report account for around 94% of thermal insulation materials produced in Poland. The report also presents the market’s volume and value after factoring in estimated figures for all companies operating in the sector.

Products covered in the report can be divided into eleven main categories: EPS panels, XPS panels, stone wool, glass wool, wood wool, PIR/PUR core for sandwich panels, rigid PIR/PUR foam panels, PIR/PUR spray foam, PIR/PUR sheathing, rubber thermal insulation, and polyethylene thermal insulation.

To learn more or download a sample report, visit the store: