After a temporary correction, the concrete products market is growing again - both in terms of value and volume. During the slowdown, the largest players fared the best. Today, 15 companies account for nearly 52% of production among the 150 producers analysed.

Gradual increase in the value of the concrete products market

According to the Spectis report “Sector of concrete products in Poland 2025–2030” , total sales revenue from the 150 leading concrete product manufacturers reached PLN 15.25 bn in 2023, representing a nominal decline of 12%. Of this amount, two-thirds derived from concrete products, translating to over PLN 10 bn in sales. Preliminary estimates for 2024 indicate a single-digit growth in market value.

Half of the concrete products market held by 15 producers

The concrete products market remains highly fragmented, where even leading producers hold only 6–8% market shares. However, despite widespread distribution of production, top players are gradually increasing their presence in the market.

Based on our calculations, the 15 largest players account for nearly 52% of the total production among the 150 producers analyzed in the report, up from less than 50% a few years ago. Analysis of financial reports suggests an ongoing market consolidation.

From a segment perspective, the most concentrated remains the aerated concrete sector. Conversely, the most dispersed segments include those with low entry barriers, inexpensive production technology, and economically unviable transport over long distances - primarily paving blocks and concrete blocks.

Stable segment structure of the market

In quantitative terms, the paving-block segment is the dominant segment of the concrete product market. However, it’s worth noting that the significance of this segment has decreased in recent years, mainly benefiting more technologically advanced concrete solutions.

In terms of value, the largest market segment is heavy precast concrete products , largely due to the high steel content in the total product cost. Following paving blocks, the third largest value segment is aerated concrete. Together, these three specializations account for about 80% of the market value.

The rest of the market includes product groups such as:

- pipes, wells, culverts, and other sewer system elements;

- concrete blocks and cavities;

- roof coverings and concrete façade materials;

- fencing;

- small architectural and decorative concrete products.

Paving-block market chasing record volumes

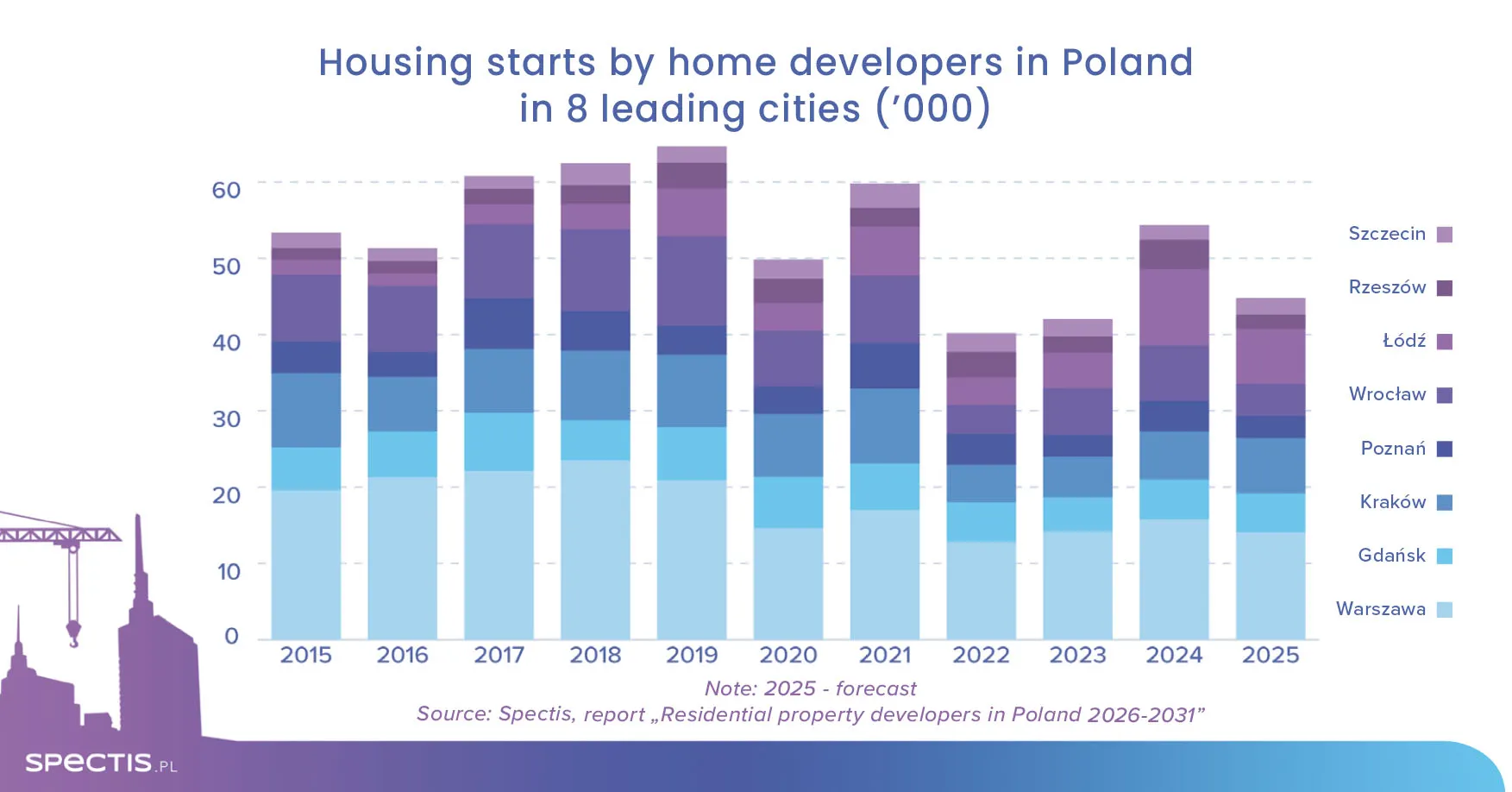

In the coming years, Poland will remain one of the European leaders in vibropressed products, including paving blocks. Yet, the record volume achieved in 2021 is expected to be challenging to repeat.

A significant supporting factor will be the continued investment plans by the General Directorate for National Roads and Motorways (GDDKiA) under the National Road Construction Program. The cost of accompanying concrete infrastructure usually exceeds 10%, sometimes reaching 15% of the contract value.

The municipal segment will also be a key driver of demand for paving blocks. Long-term trends point to a rising share of premium products, primarily purchased by individual investors.

Aerated concrete market

Looking ahead to 2030, Poland will remain the largest producer of aerated concrete products in Europe, with total production around 15-16 million m³. Aerated concrete will remain one of the most popular materials for wall construction in Poland, with over 40% share in the total wall material market - and up to 50% in the single-family home segment.

Rising share of concrete products in the construction market

Over the past decade, the concrete products sector - defined as manufacturing activity involving reinforced, prestressed, spun, and vibropressed concrete elements - has gradually increased its share in overall construction.

As late as 2013, this market accounted for just 3% of total construction production, while in 2021–2022 its share clearly exceeded 4%.

What’s next for the concrete products market – Spectis forecast

In the coming years, we expect gradual but clear consolidation of the concrete products industry. Producers with economies of scale, strong brand presence, and modern technological solutions will gain increasing market advantage.

Demand will be supported by both large infrastructure investments - such as road projects by GDDKiA - and municipal activity. Consequently, the market will steadily strengthen its position in the construction sector.

For more information or to download a sample report, visit the store:

Methodological note:

For the purposes of the report, the “concrete products market” refers to manufacturing activity related to reinforced, prestressed, spun, and vibropressed concrete elements.

The products analyzed in the report can be divided into the following seven main categories:

- heavy structural and engineering prefabricates: foundations, columns, beams, floors, walls, stair elements, sanitary modules, docks, bridge girders, foundation piles, road panels, tram panels, railway sleepers, retaining walls, acoustic screens, tunnel segments, and lighting/energy masts

- paving blocks, sidewalk slabs, curbs, and edges

- aerated concrete

- pipes, wells, tanks, septic systems, drainage, and other sewer elements

- concrete blocks and cavities - foundation, wall, ceiling, and chimney types

- roof coverings and concrete façade materials

- fencing, small architectural elements, and decorative concrete products.

The report does not include ready-mix concrete, which is covered in a separate specialized report.