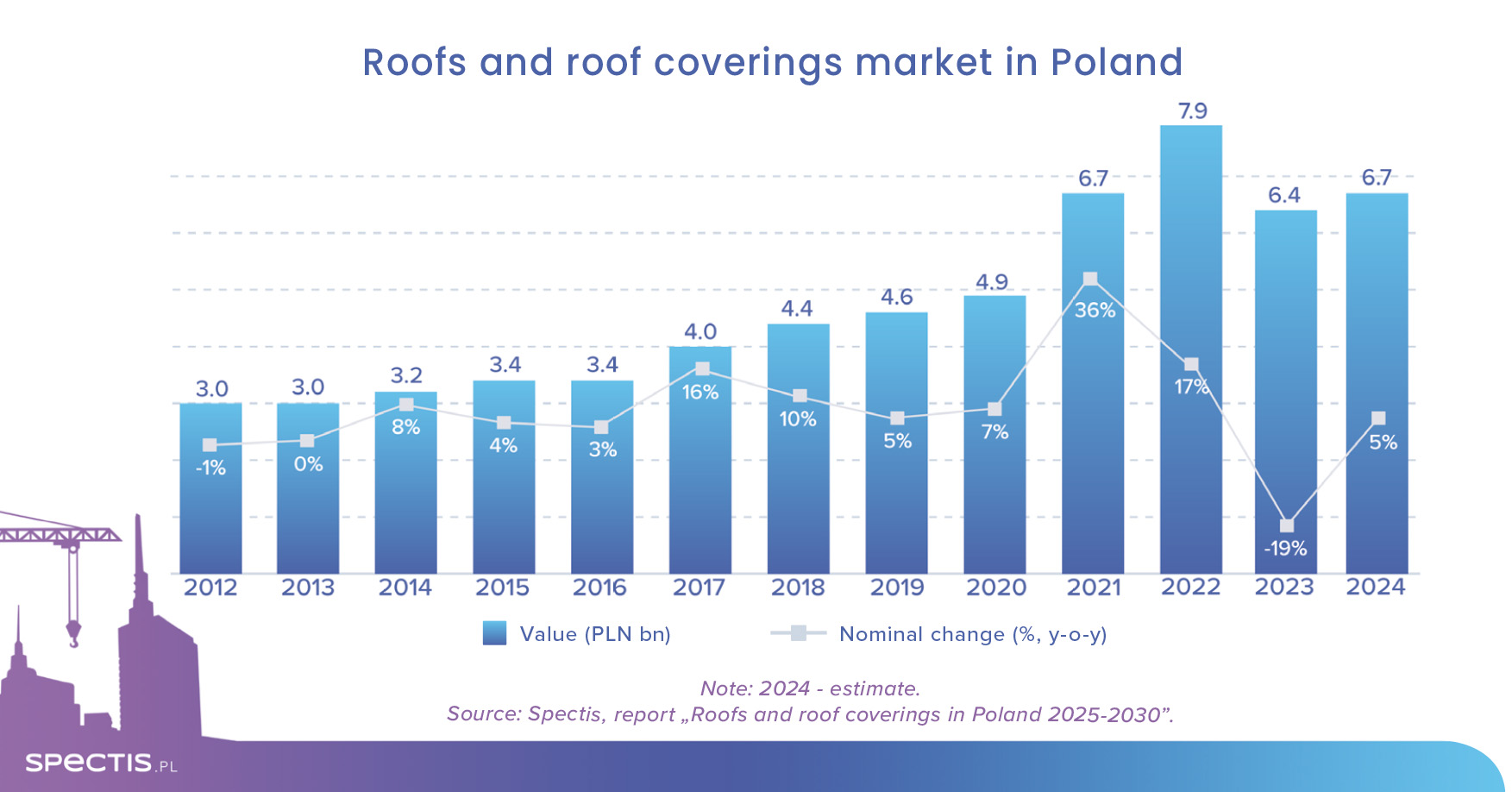

After several years of exceptional volatility, the Polish roofing market is entering a path of stabilization. Although the market value declined by nearly one-fifth in 2023, our estimates indicate its recovery as early as 2024. Metal and bituminous roofing materials continue to hold the largest market share in Poland, but the importance of modern solutions is growing year by year. In the coming years, the market will be supported by solid macroeconomic fundamentals, a cycle of monetary policy easing, as well as a structural housing shortage and the need to modernize existing buildings.

Value of the roofing market in Poland - recovery after declines

According to the Spectis report “Roofs and roof coverings in Poland 2025-2030”, the total revenue of 80 surveyed roofing manufacturers reached PLN 21bn in 2023, with 28% attributed to roofing products, translating into a value of nearly PLN 5.9bn.

After extrapolating to the full population of manufacturers and including other niche roofing types, the market value exceeded PLN 6.4bn, marking a 19% nominal decline.

During 2024, the market situation began to gradually improve, and the preliminary estimate for 2024 indicates a single-digit nominal market growth. After several years of significant fluctuations, the stabilization observed last year should be interpreted as a gradual return to normalcy.

Favorable long-term forecasts for the roofing market

In the coming years, the main factors supporting the development of the roofing market will be:

Positive trends

- solid long-term macroeconomic fundamentals and Poland's growing position in Europe,

- structural housing shortage in Poland compared to the EU average,

- ongoing cycle of interest rate cuts,

- recovering market demand in the residential sector,

- fight against smog and support for building thermal renovation programs for both single-family and multi-family buildings,

- growing importance of the building repair and improvement segment,

- increasing number of multifunctional mixed-use buildings,

- strong position of Polish building materials on the European market,

- limited inflow of competitive materials from Eastern markets.

Challenges for the market:

- unfavourable demographic forecasts for the Polish economy,

- decline in non-residential building permit area recorded in 2023-2024,

- noticeable slowdown in the industrial and warehouse construction sector,

- frequent underestimation by investors of the real cost of roof construction,

- high material and labor costs forcing some investors to scale back projects.

Types of roofing materials - segment analysis

Metal roofing - the market leader in Poland

The largest segment of the Polish roofing market remains metal coverings, which include not only metal roof tiles but also sandwich panels intended for roofing use. Of the 80 companies analyzed in the report, 42 entities offer metal roofing products, and in the case of 9 companies, sales exceed PLN 100m.

Metal roof tiles have become a common choice due to their durability, aesthetics, and ease of installation. Some versions imitate traditional ceramic or wooden tiles while offering the resilience of metal.

.webp)

Bitumen roofing - used on flat and pitched roofs

The second-largest segment is bitumen coverings. Out of 80 surveyed companies, 22 offer these products, with 11 companies reporting sales above PLN 50m.

Bitumen sheets, also known as asphalt membranes, are widely used on flat roofs and also serve as underlay materials on pitched roofs with rigid decking.

Bitumen roofing is popular on flat roofs thanks to its high durability and weather resistance. The segment also includes bitumen shingles.

Ceramic and concrete tiles - traditional heavy roofing

The third-largest segment in terms of value is ceramic roofing. Among the 80 companies analyzed, fewer than 10 offer ceramic products, and only 3 of them record significant sales above PLN 100m.

The fourth segment includes concrete (cement) and fiber-cement roofing. Pitched roofs using tiles are commonly chosen for their durability, aesthetics, and wide range of colors and patterns.

.jpg)

Synthetic membranes - modern solutions for flat roofs

The fifth market segment includes synthetic membranes (mainly EPDM, PVC, PCV, TPO), which are an alternative to bitumen-based roofing and are steadily growing in popularity despite higher prices. Out of the 80 analyzed firms, 10 entities offer products in this category.

EPDM membranes (synthetic rubber) are increasingly used due to their flexibility, durability, resistance to weather and microorganisms. EPDM is chemically and biologically inert, making it environmentally safe.

Liquid membranes - innovative roofing

The smallest analyzed segment includes liquid membranes, mainly used in the renovation of flat roofs. Out of 80 companies, 7 entities offer these solutions.

The market size estimates also include niche roofing types such as wooden shingles, natural slate, thatch, and solar roofs.

.jpg)

Roofing innovations - trends and technologies

Sustainable and smart roofing solutions

With growing interest in sustainability, a notable trend is the rise of roof coverings with integrated photovoltaic modules. Both metal and heavy roofing manufacturers are exploring such solutions. A full alternative to conventional roofing is also emerging in the form of complete solar roofs for pitched structures.

Green roofs – rooftops covered with vegetation – are also gaining traction as a way to improve building insulation, absorb rainwater, and reduce the urban heat island effect.

%20w%20Warszawie.jpg)

Smart roof technologies are also growing in popularity, including insulation monitoring systems, rainwater drainage systems, and temperature or ventilation control systems.

Technological innovations in production and installation

Key players in the Polish roofing industry are continuously investing in R&D for new materials and improvements to existing solutions. The primary goals are to reduce the carbon footprint, increase product longevity, and boost resistance to environmental conditions.

Innovations also aim to automate roof installation processes, potentially lowering future installation costs. Development of repair systems will help extend roof life and reduce the need for full replacements.

To learn more or download a sample report, visit our store: