Poland's modular construction market continues its expansion, setting new benchmarks within the industry. With growing interest in modern technologies and increasing pressure for efficiency in construction processes, prefabrication is gaining recognition among both individual and institutional investors. While the sector faces challenges such as high material costs and investment financing, its foundations for growth remain robust. Temporary slowdowns are giving way to optimistic forecasts, highlighting the pivotal role of modular technology in shaping the future of Poland’s construction sector.

Modular construction market has slowed down

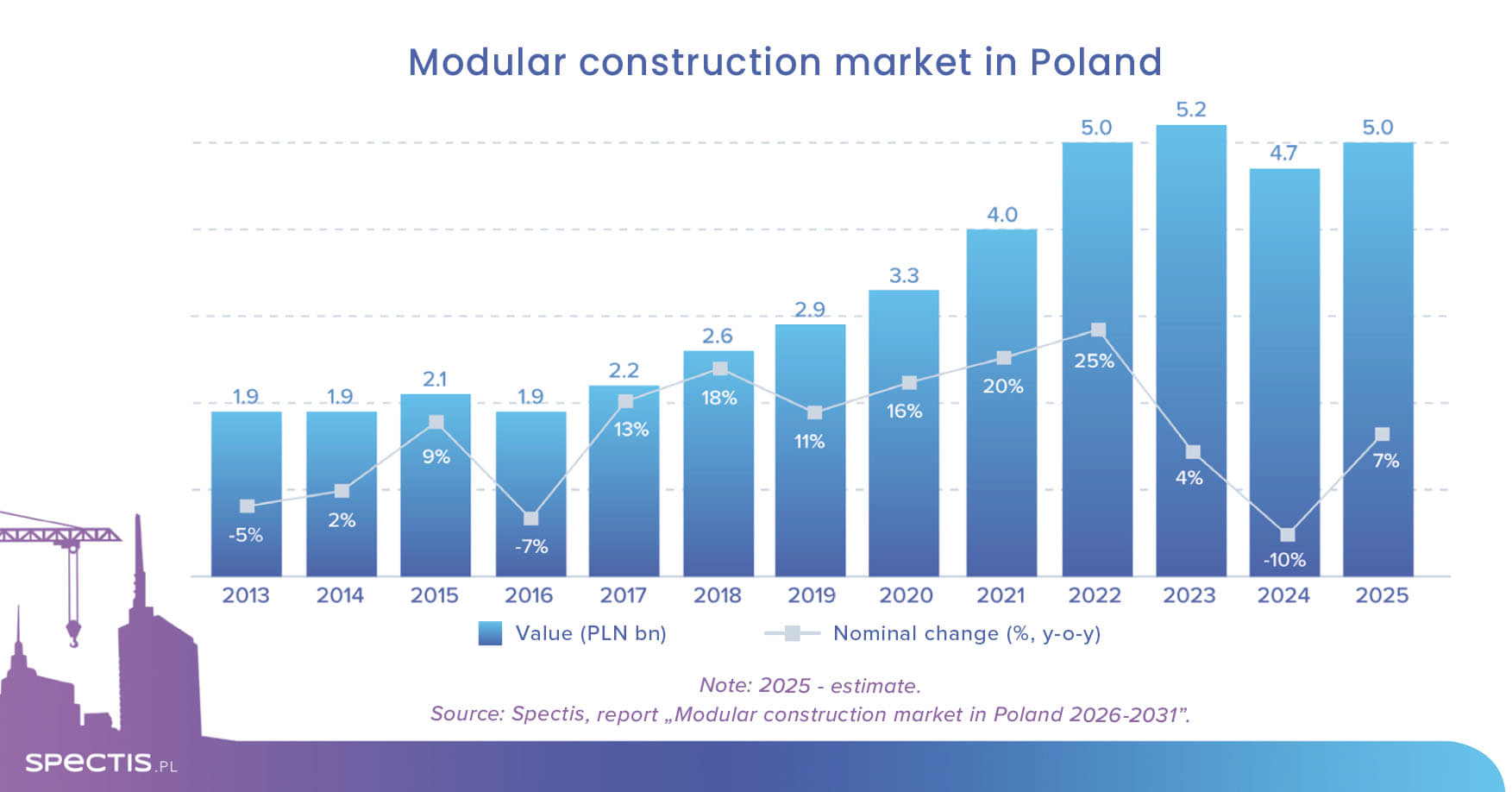

Top 150 manufacturers of prefabricated buildings made of wood, steel, concrete, or LECA generated revenue of PLN 12.5bn in 2024, with more than 37% of the figure contributed by sales in the modular building segment, indicating a slowdown in the market after years of dynamic growth, according to Spectis report "Modular construction market in Poland 2026-2031".

Positive outlook despite temporary slowdown

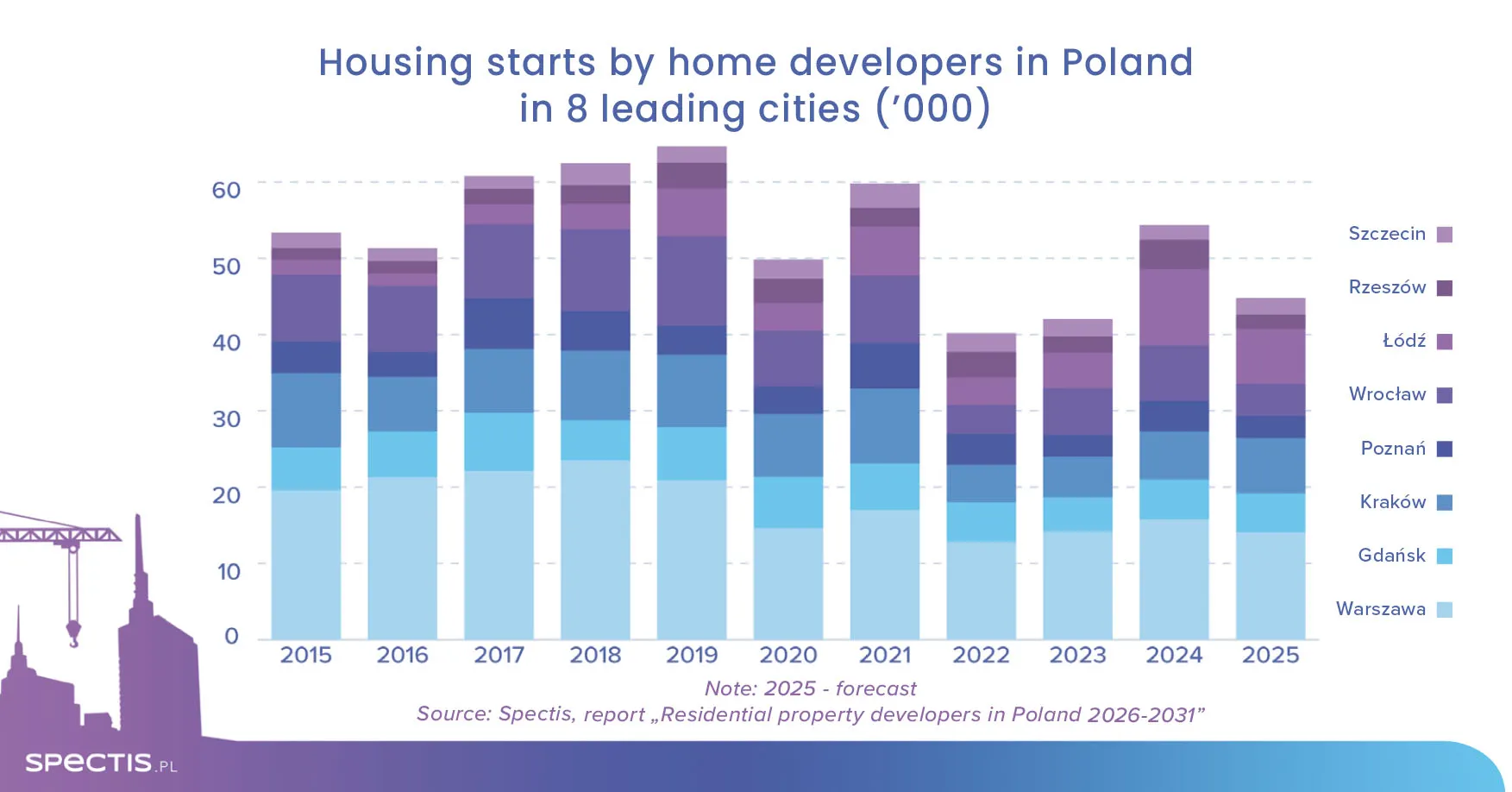

In 2025, single-digit growth in market value is expected. The primary drivers of this improvement will be the recovery in the residential construction market, as well as the implementation of investments from the National Recovery and Resilience Plan by 2026. This plan includes support for the construction sector, particularly investments in eco-friendly, modern, and energy-efficient solutions.

Factors supporting the growth of modular construction

In the coming years, key factors supporting the continued growth of the modular construction market will include strong long-term macroeconomic fundamentals of the Polish economy, the continued shortage of housing in Poland compared to the EU average, the increased interest in modular construction in Poland, well-developed production facilities comprising experienced, specialised manufacturers, a large selection of available prefabrication technologies, a growing pressure on shortening the construction process, and big popularity of modular houses built in Poland across Europe.

Factors hindering the development of the prefabricated buildings market

Major factors that will have a negative effect on the modular construction market will include unfavourable demographic forecasts for Polish economy, a continued high level of interest rates, high prices of key raw materials and semi-finished products, such as cement, aggregates, steel and timber, growing prices of specialist construction services, as well as high initial investment costs, which pose a significant barrier to market entry.

Institutional investors drive the growth of the modular construction market

Following a period of temporary market cooling, the long-term outlook for the Polish modular construction market appears highly promising. Interest in modular technologies is increasing not only among individual investors but especially within the institutional investor group, including hotel chains, residential developers, and government or municipal institutions, which are driving demand for larger-scale buildings.

The future of modular construction in Poland

All indications suggest that in the coming years, modular technologies will gain prominence in both commercial and public construction. The market outlook remains moderately optimistic, and the combination of the factors mentioned above means that by 2031, the value of the modular construction market in Poland could increase by more than half compared to 2024 levels. This is a clear signal that the future of Polish modular construction is shaping up to be exceptionally bright.

Report methodology

For the purposes of the report, the modular construction sector is defined as the manufacturing of large-sized building components conducted by specialist prefabrication plants. Products covered in the report can be divided into two main categories: 2D modular construction (precast walls or complete precast buildings consisting of walls, ceilings, staircases, and balconies, which are assembled on-site). 3D modular construction (modular buildings, modular bathrooms, container homes, sanitary containers, and office containers delivered to construction site in 3D form). These categories are further divided into sub-categories that vary according to the dominant structural material. The sub-categories are as follows: wood and wood-based products, concrete products, steel products, expanded clay products.

To learn more or download a report sample, visit our shop: