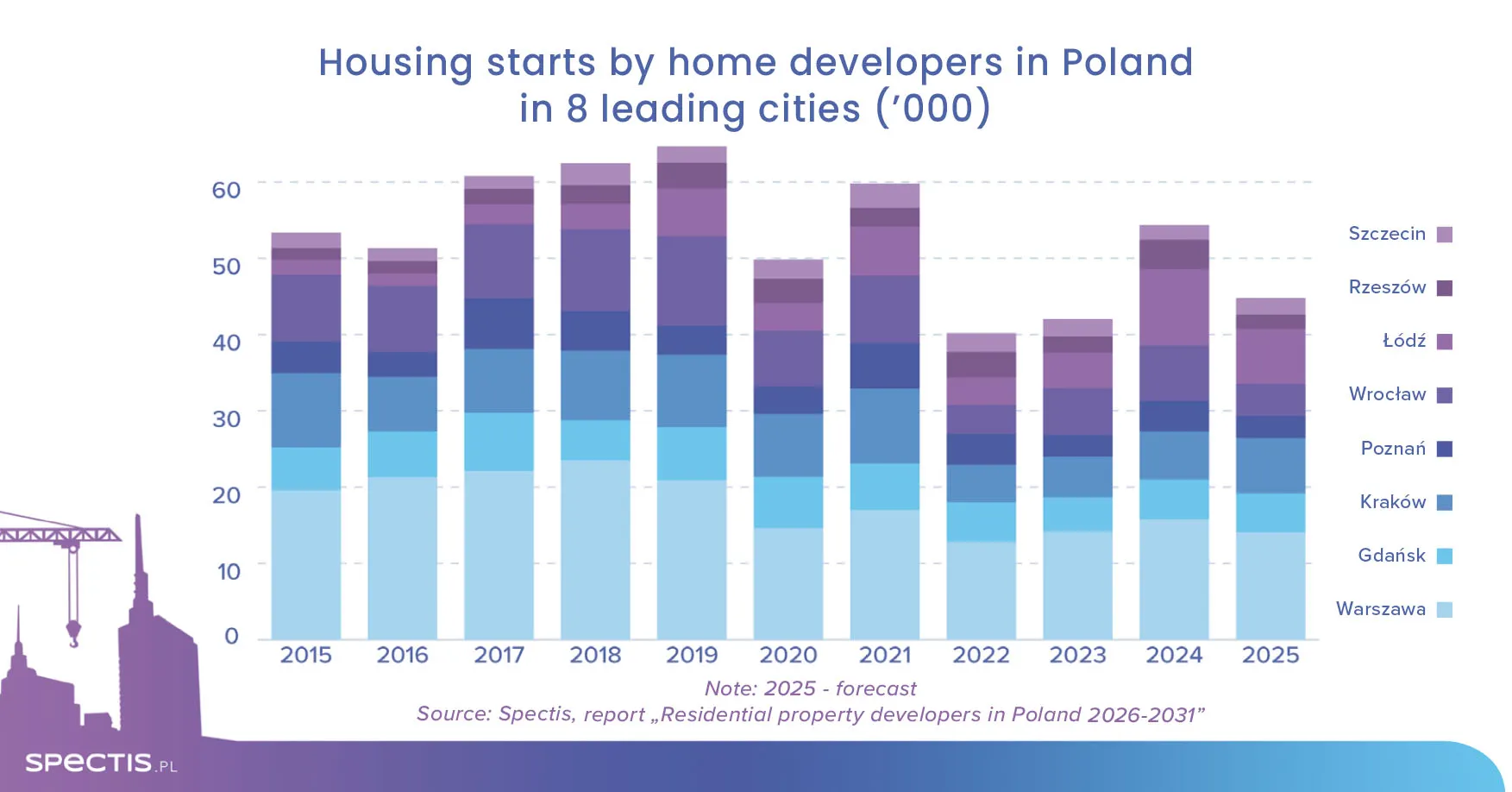

Although 2025 was not an easy year for residential developers, many of them continued their involvement in developing the PRS segment in Poland. According to the Spectis report Residential property developers in Poland 2026–2031, development companies still recognise the potential of the institutional rental market and are moving forward with new investments in buildings offering rental apartments.

A young market with strong momentum

The Polish PRS market is still at an early stage of development compared to Western European countries. However, over the past decade it has demonstrated strong momentum. At the end of 2025, total housing stock in this segment in Poland amounted to nearly 30,000 units, held by 33 institutional investors.

Despite this dynamic growth, even in the largest urban agglomerations the share of institutional PRS units in the overall housing stock rarely exceeds 1%. The cities with the largest PRS housing stock are currently Warsaw, Wrocław and Kraków.

The specifics of PRS project implementation

In Poland, developers implement PRS projects based on two types of zoning plans: residential and commercial. In the case of commercial zoning, a prerequisite is the allowance of collective temporary accommodation functions, such as hotels, student housing or hostels. Due to difficulties in acquiring attractive residential land, most PRS projects are currently being developed on commercial plots.

Factors supporting the development of the PRS market

The outlook for the PRS market remains promising. Key factors supporting further growth of the segment include:

- High apartment prices in metropolitan areas

- Limited availability of mortgage financing

- Growing social mobility

- Changing lifestyles of younger generations

According to announcements from developers active in the PRS segment, they plan to deliver a combined total of several tens of thousands of rental units over the next five years.

PRS market leader remains unchallenged

Echo Investment remains the undisputed leader of the Polish rental housing market. As of the end of September 2025, the group was implementing projects comprising approximately 2,000 units under the Resi4Rent platform, with a further 945 units at the preparation stage.

Resi4Rent platform – key data

The Resi4Rent platform, a joint venture between Echo Investment (30% stake) and Griffin Real Estate / PIMCO (70% stake), was established in 2018 and by mid-2025 had delivered more than 6,100 rental units. By 2027, the group plans to develop over 10,000 rental apartments in total. The platform currently offers apartments in six of Poland’s largest cities: Warsaw, Kraków, Łódź, Wrocław, Gdańsk and Poznań.

Planned transaction with Vantage Development

In August 2025, Resi4Rent signed a preliminary agreement with Vantage Development, a company owned by the TAG Immobilien Group, for the sale of a package of 5,322 rental units to the Vantage Rent platform (the second-largest PRS player in Poland) for approximately PLN 2.4bn. The agreement covers the sale of 100% of shares in 18 subsidiaries holding legal title to properties developed for residential or accommodation purposes.

In December 2025, Resi4Rent and Vantage Development signed an annex to the preliminary agreement, extending the deadline for signing the final agreement from 15 December 2025 to 15 May 2026. According to Echo Investment, both Echo and Griffin Capital Partners intend to remain involved in the development of the remaining Resi4Rent portfolio and further expansion in the rental housing market.

Competition is heating up

Other investors with significant rental housing portfolios include:

- TAG Immobilien – more than 3,200 units in Wrocław, Poznań and Łódź as of the end of 2024 under the Vantage Rent platform

- PFRN – approximately 2,400 units within the Rental Housing Fund

Vantage Development – German capital on the Polish market

In 2020, 100% of Vantage Development shares were acquired by TAG Beteiligungs- und Immobilienverwaltungs GmbH, based in Hamburg and part of the TAG Immobilien AG group. TAG is one of the largest rental housing operators in Germany.

Following the change in majority shareholder, Vantage Group’s core activity now focuses on developing rental housing projects under the Vantage Rent brand and managing the leasing of completed units. The general contractor for Vantage projects is Robyg, which is also part of the TAG Immobilien Group.

Vantage Development’s strategic objectives include:

- Gradual expansion of its rental housing portfolio to more than 10,000 units by the end of 2029

- Expansion into additional Polish cities (Tri-City, Kraków, Warsaw)

If the preliminary agreement with Echo is finalised in 2026, these objectives may be achieved earlier than originally planned.

LifeSpot – a platform backed by Ares Management and Griffin Capital

LifeSpot also holds a significant share of the PRS segment. The platform was established by Ares Management Corporation and Griffin Capital Partners in Q3 2021. A substantial portion of projects for the platform are delivered by the Murapol development group, over 98% of whose shares were acquired by Ares Management Corporation and Griffin Capital Partners in 2020.

In addition to cooperation with Murapol, LifeSpot also sources projects from other investors, including partnerships with Eiffage Immobilier Polska and Cavare.

Ronson and the LivinGo brand

Ronson also plans to expand in the PRS segment. In the first half of 2022, the company launched the LivinGo brand dedicated to institutional rental housing. This new business line is intended to provide stable rental income from assets located in attractive areas of Poland’s largest cities.

PRS as an alternative for commercial developers

AFI Home is also among the leading rental housing operators in Poland. Its residential portfolio, located in Kraków, Warsaw and Wrocław, is expected to exceed 2,200 units by the end of 2025. The strategy of AFI Poland – a developer also active in the office market – assumes further expansion in the PRS segment.

Cavatina – from offices to rental housing

In May 2023, the Cavatina development group, previously focused mainly on the office market, announced the establishment of a company dedicated to managing rental housing. According to its plans, the newly created entity Cavare aims to build a portfolio of 10,000 rental apartments in Poland’s largest cities within five years.

Trei Real Estate and Kingstone Real Estate partnership

In September 2023, Trei Real Estate and Kingstone Real Estate entered into a partnership to develop rental housing in Poland’s major cities. Trei Real Estate acts as co-investor and developer responsible for land acquisition and construction, while Kingstone Real Estate is responsible for investor relations and asset management. The joint venture has already secured land for PRS projects in Poznań and Warsaw.

Polski Holding Nieruchomości and other players

In 2024, Polski Holding Nieruchomości announced that, alongside commercial and residential properties, it plans to develop a third pillar of activity: rental apartments and private student housing. Other developers building proprietary rental platforms include Aurec Capital and Apricot Capital Group.

Own rental platform or asset sale

Not all developers recognising the potential of the PRS segment choose to build their own rental platforms. Some opt to cooperate with investment funds, selling selected projects.

This strategy has been adopted by, among others:

- YIT – the Finnish developer that delivered and sold more than 500 rental apartments in Warsaw to the NREP fund within two years

- Spravia – a company owned by the Czech Crestyl Real Estate Group, which in May 2021 signed an agreement with Heimstaden Bostad to sell 2,500 apartments over five years

- White Stone Development – which in October 2024 signed an agreement with NREP for a PRS project in Warsaw to be operated under the Lett platform

Similar approaches are also followed by Matexi and Eiffage Immobilier Polska.

A comprehensive overview of completed and planned PRS investments, as well as future development market trends, is presented in the report “Residential property developers in Poland 2026–2031”.

To learn more or download a sample of the report, visit the store:

Definitions:

PRS (Private Rented Sector) – the institutional rental sector, where residential units are owned and operated by professional entities engaged in commercial rental activity (e.g. investment funds or developers). In this model, investors either construct new or acquire completed residential buildings for long-term rental. Such properties typically offer a consistent standard and are often managed by specialised operators, with additional amenities such as laundry rooms, gyms or co-working spaces.