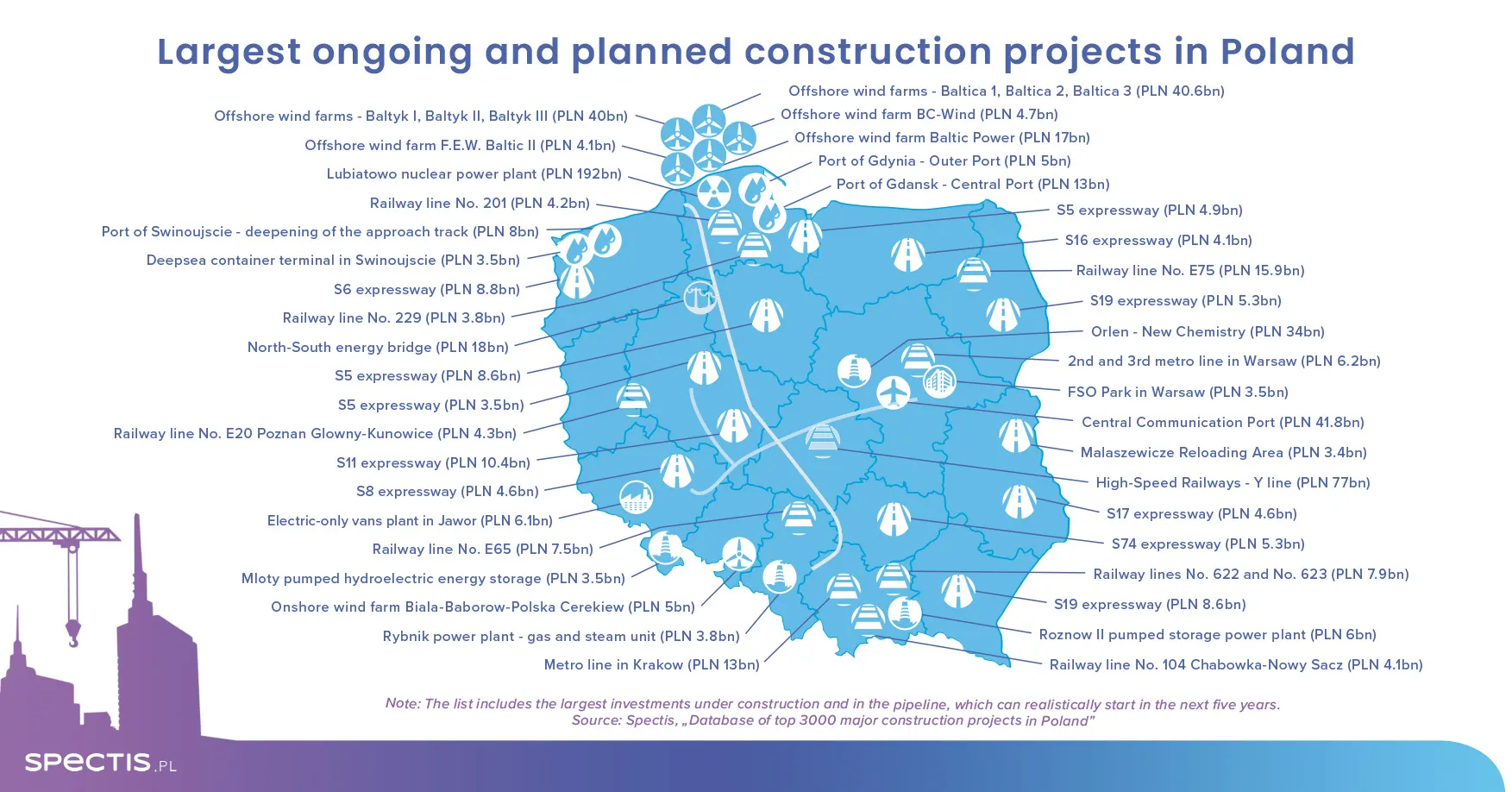

The combined value of Poland’s 3,000 largest construction projects has reached an impressive PLN 1.64 trillion. Of this total, PLN 322 billion is attributed to projects currently underway, while PLN 1.32 trillion refers to developments at the tendering, planning, or early concept stage.

While most megaprojects remain in early-phase development, Poland is now entering a period when many of these long-planned undertakings will begin to materialise. Although some delays or plan revisions are to be expected—typical for investments of this scale—their overall impact on the construction market will grow steadily over the coming years.

To better understand the scale and significance of these schemes, we take a closer look at key infrastructure investments already shaping the future of Poland.

Below we present selected projects from the report prepared by our team. The full study is available in our store.

Major infrastructure developments in Poland

Central Transportation Hub (CPK)

The Central Transportation Hub (CPK) in Baranów is the project with the greatest impact on the Polish economy over the next decade. The estimated cost of the entire project is over PLN 131 billion, of which:

- Airport development – PLN 42.7bn

- Rail infrastructure (Y-line) – approx. PLN 80bn, designed to revolutionise connectivity between Poland’s top metropolitan areas

The new hub will eventually replace Warsaw’s Chopin Airport as the main aviation gateway and emerge as a central transport node for Central and Eastern Europe. Construction is scheduled for 2026-2032.

CPK has intensified its design and procurement work, securing partnerships with subcontractors. In 2024, designs for the terminal, railway station, and intermodal hub were approved. That same year, some 60 tenders were announced, with a total value exceeding PLN 8.3bn.

High-speed rail – the Y-line

Poland’s high-speed rail (HSR) initiative envisions a modern network enabling travel speeds of up to 350 km/h. The concept, known as “Poland in 100 Minutes”, aims to dramatically reduce travel times between the country’s key urban centres.

At the heart of this network is the Y-line, linking Warsaw, CPK, Łódź, Wrocław, and Poznań. The project involves major engineering components, such as:

- A 4.6 km tunnel under central Łódź (construction 2026–2028)

- A 9 km tunnel under Warsaw’s Odolany district (completion by 2032)

The Y-line will be delivered in stages:

- Warsaw–Łódź: scheduled completion by 2032

- Connections to Wrocław and Poznań: operational by 2035, completing the western segment of the HSR network

Estimated cost of the 480-km Y-line: PLN 80bn. Preparatory work is already well advanced, with contracts signed for construction of the Łódź tunnel (phases I & II), and environmental approval granted for the Warsaw Zachodnia-CPK section. Applications have been submitted for environmental clearance on the Pleszew-Poznań and Sieradz-Kalisz-Pleszew corridors.

For a comprehensive overview, see the report Railway Construction in Poland

Nuclear power plants

Poland’s first nuclear power plant

Poland’s inaugural nuclear power facility is to be built in Lubiatowo on the Baltic coast, marking a milestone in the country's energy transition. The strategic partner is the experienced consortium of Westinghouse Electric Company and Bechtel.

Key investment parameters:

- Technology: advanced American AP1000 reactors meeting the highest global safety standards

- Timeline: construction start in 2028, first nuclear-generated electricity by 2036

- Target capacity: approximately 3.75 GW (three units launched in stages)

- Estimated investment value: PLN 192 billion

In January 2025, the government approved legislation allocating PLN 60.2bn to Polskie Elektrownie Jądrowe (PEJ) between 2025 and 2030 for project delivery.

Second nuclear plant

Parallel analyses are being conducted to determine the location for a second nuclear power station, to be built in a former coal region. Four sites are under consideration:

- Primary options: Bełchatów and Konin

- Additional sites: Kozienice and Połaniec

The location decision is expected in 2026. Once both strategic investments are completed, Poland’s nuclear capacity could reach 6.5-7 GWe. The combined estimated cost is PLN 300bn.

Plans also include the development of small modular reactors (SMRs), with Orlen Synthos Green Energy among the key players.

See the report Power and Industrial Construction in Poland for full project insights.

Offshore wind energy

Poland is pushing ahead with a comprehensive offshore wind energy programme in the Baltic Sea to support its energy transition and improve national energy security. The strategy includes:

- Phase I (by 2030) - targeting around 6 GW of installed capacity. Investors involved include PGE, Ørsted, Polenergia, Equinor, Orlen, Northland Power, Ocean Winds, and RWE Renewables. The total value of projects in this phase is estimated at around PLN 95 billion.

- Phase II (by 2040) - aiming for an additional 11 GW of capacity. Commitments have been made by Polenergia, Equinor, Orlen, PGE, Tauron, Enea, and Ørsted. The estimated value of projects is around PLN 150 billion.

Construction is already underway on MFW Baltic Power, a joint venture between Orlen and Northland Power. At the same time, PGE and Ørsted are building the onshore grid connection infrastructure for MFW Baltica 2, with both developments set for completion between 2026 and 2027.

North–south power corridor

Between 2025 and 2034, grid operator PSE plans to build a high-voltage direct current (HVDC) transmission line connecting Słupsk in the north with Upper Silesia.

- Line length: approximately 720 km

- Estimated investment cost: around PLN 18 billion

The goal is to boost transmission capacity between northern renewable power zones and industrial hubs in the south. The line will help transfer offshore wind surpluses to high-demand regions.

Timelines may be adjusted depending on the pace of nuclear (SMR) roll-out and updated offshore capacity forecasts. Public consultations are also planned in areas affected by the route.

Orlen Nowa Chemia – the future of petrochemicals

Orlen Nowa Chemia is a strategic project replacing the previously planned Olefins III scheme at Orlen’s Płock site.

Key goals:

- Constructing an advanced production complex for high-margin chemical products

- Diversifying Orlen’s product mix and reducing its reliance on fossil fuels

- Phasing out the existing Olefin II installation from 2030

- Leveraging infrastructure for long-term site development

Under Olefins III, Orlen invested approx. PLN 13bn, with another PLN 22bn worth of contracted works. The new initiative is now valued at approx. PLN 34bn.

Game-changing rail projects

Podłęże-Piekiełko line

Delivered by PKP PLK, this project involves upgrading and electrifying the Chabówka–Nowy Sącz line (75 km) and building a new 58-km section from Podłęże to Tymbark and Mszana Dolna.

Completion is scheduled for 2029, creating a new rail connection between Kraków, Podhale, and the Nowy Sącz region. It is the largest rail investment in southern Poland. Estimated cost: over PLN 11bn.

Rail Baltica – E75 line upgrade

Rail Baltica is a new double-track, electrified line with EU-gauge rails, linking Warsaw to the Baltic States (Lithuania, Latvia, Estonia).

In January 2025, a PLN 6bn tender was launched for the Białystok-Ełk section (100 km), covering 8 stations and 10 stops. Construction will run 2025-2029.

Next: modernisation of the Ełk-Trakiszki section (94 km), scheduled for 2027-2031, estimated at PLN 8bn.

Strategic road and urban development

S6 western bypass of Szczecin

The planned project involves constructing a 49 km section of the S6 expressway to bypass Szczecin from the west and north. A key element is a 5 km tunnel under the Oder River near Police.

- Estimated investment cost: PLN 8 billion

- Expected completion: 2032

In December 2024, tenders were announced for design and construction works.

Warsaw metro expansion

The city of Warsaw continues expanding its metro system as part of a long-term investment program.

- Construction of Metro Line 2 (M2) has been underway since 2010, with completion expected in Q4 2026.

- The planned Metro Line 3 (M3) will connect Praga-Południe with the city center, ultimately covering 15 stations.

- Construction of the first M3 section (6 stations) is scheduled for 2028–2032.

- Estimated cost: around PLN 6 billion

M3 is part of a broader vision to develop a five-line metro network by 2050.

Expansion of seaports

Port of Świnoujście

Two strategic investments are planned. First, construction of the eastern approach channel (2027-2029), 70 km long, 250-530 m wide, 17 m deep. Estimated cost: PLN 10bn.

Second, a deepwater container terminal to serve as a regional hub. Scheduled commissioning: by 2029. Land portion: PLN 1.2bn; pier construction: PLN 2.5bn.

Port of Gdańsk

Currently building the T3 Baltic Hub container terminal, due to launch in 2025

Meanwhile, the ambitious Central Port project—planned as a multi-terminal complex—has been suspended due to limited market interest.

Port of Gdynia

Gdynia is advancing its External Port scheme.

In October 2024, a contract was signed for the construction of new protective breakwaters—an essential step for further development.

The project is being delivered as a Public-Private Partnership (PPP). The tender process to select a private partner is ongoing, with submissions extended to the end of June 2025.

The future of Polish construction – outlook and conclusions

The megaprojects outlined above are more than just figures and forecasts—they form the foundation for Poland’s transformation. Their execution will deliver:

- Balanced infrastructure growth – bridging the development gap with Western Europe

- Energy transition – diversified sources and improved energy security

- Transport revolution – faster, greener, more efficient connections

- Major growth opportunities for construction – job security and skills development

Despite the challenges ahead—securing funding, managing complex stakeholder dynamics, and mitigating project risks—successful delivery of these projects could prove a defining moment for Poland’s economic future and quality of life.

For further details on government investment programmes and major projects, see Spectis reports: Construction Market in Poland and Construction Market in Poland – Analysis of 16 Regions.

To find out more or download a sample report, go to the store: