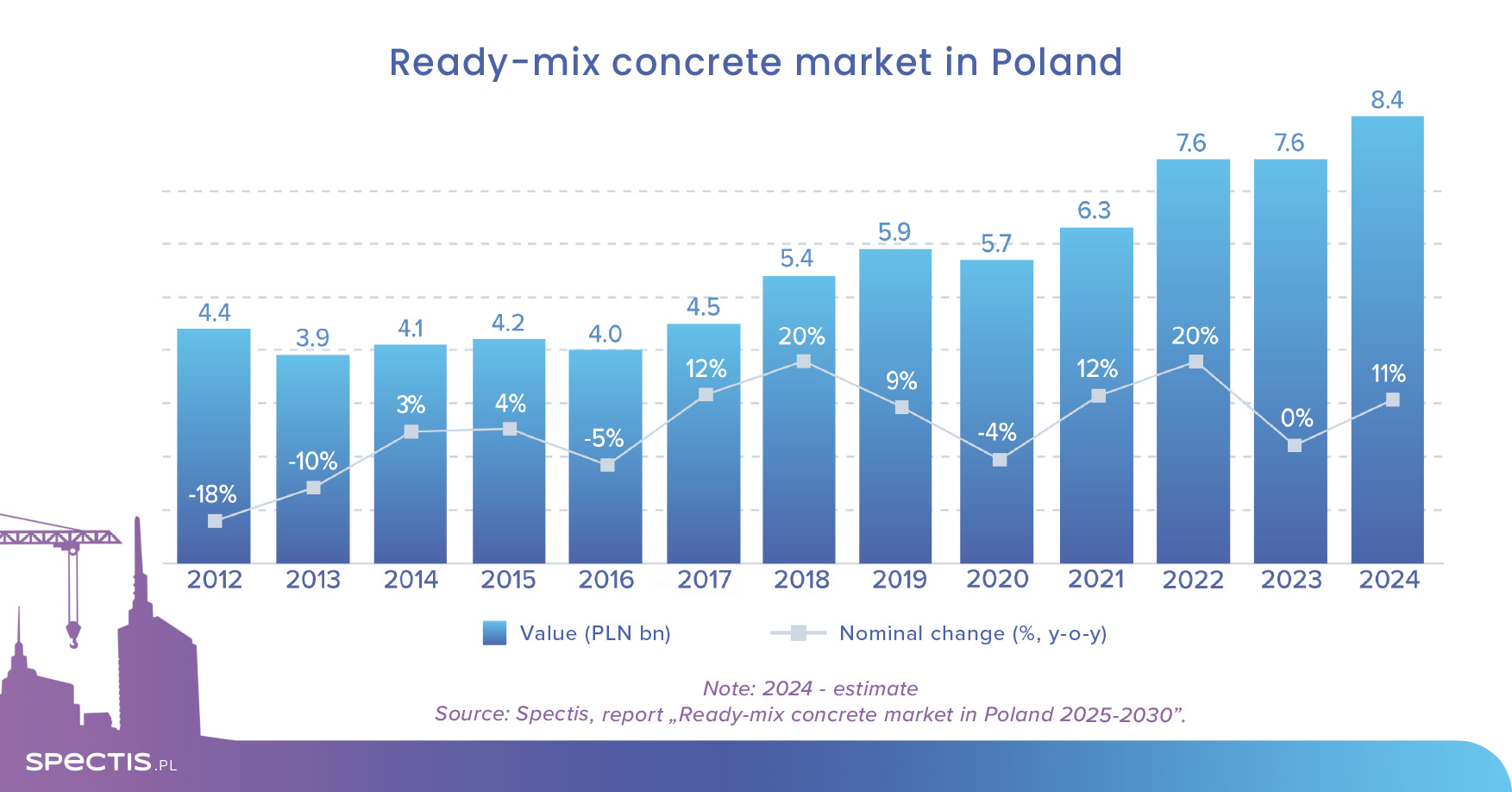

The ready-mixed concrete market in Poland reached a record value of PLN 8.4bn in 2024 – an increase of over 10% year on year, driven primarily by rising production volumes and a slight uptick in prices. The sector is now entering a period of moderate growth, supported by the inflow of EU funds, stabilisation in the housing market, and the rollout of major infrastructure projects.

According to the report “Ready-mixed concrete market in Poland 2025-2030” published by Spectis, the combined revenue of the top 200 concrete producers reached nearly PLN 16bn in 2023, with the ready-mixed concrete segment accounting for 41% of this figure. This means that sales of ready-mixed concrete amounted to almost PLN 6.5bn. When extrapolated to cover the entire market, the total value of the ready-mixed concrete market in 2023 is estimated at around PLN 7.6bn, roughly matching the level recorded in the previous year.

In 2024, the situation on the ready-mixed concrete market turned out better than expected. Preliminary data suggests that concrete production grew by as much as 9% year on year. Combined with a slight increase in concrete prices, we estimate that the market value rose by over 10%, reaching a record high of PLN 8.4bn.

Stable output on the concrete market

In volume terms, the Polish ready-mixed concrete market has remained stable in recent years, with only minor fluctuations driven by the economic cycle. However, a pipeline of large-scale infrastructure projects and a more stable outlook for the non-residential building sector could push production volumes to new highs as early as 2026, surpassing the record levels seen in 2018-2019.

Key growth drivers

Over the next few years, Poland’s ready-mixed concrete market is expected to expand dynamically, supported by a range of important factors:

- the solid macroeconomic fundamentals of the Polish economy,

- anticipated interest rate cuts,

- substantial EU funding available for the 2021-2027 period,

- continued implementation of the National Road Construction Programme and local government investments,

- the persistent housing shortage in Poland,

- a moderate rebound in the single-family housing segment,

- increased investment in military construction,

- the established use of reinforced concrete construction methods,

- a strong production base and wide local availability of concrete.

We expect moderately favourable conditions in the ready-mixed concrete market to continue through 2025-2026, supported by the acceleration of large-scale projects co-financed with EU funds. The ongoing National Road Construction Programme and a likely uptick in rail, industrial and energy, and hydrotechnical construction will help rebuild the share of civil engineering in concrete demand in the coming years.

The growing role of megaprojects

From 2027 onward, additional demand for ready-mixed concrete will come from the execution of major megaprojects such as the CPK and its associated high-speed rail network, as well as the initial phases of nuclear power plant construction. Meanwhile, more large-scale hydrotechnical projects are also being planned, though the implementation of some of them remains uncertain.

More details on Poland’s largest ongoing and planned construction projects can be found in the report “Database of the 3,000 largest construction projects”

Upcoming challenges

There are several challenges that could significantly impact the ready-mixed concrete market in the years ahead. These include both macroeconomic pressures and sector-specific issues that could constrain growth and introduce additional risks. Key threats include:

- unfavourable demographic forecasts for the Polish economy,

- the need to cut emissions in line with the EU Green Deal and Fit for 55 package,

- rising raw material costs, including cement, aggregates, and admixtures,

- continued low profitability in concrete production,

- difficulty securing aggregate supplies during peak demand periods,

- complete dependence of the ready-mixed segment on trends in the domestic construction market.

Mergers and acquisitions activity reshaping the market landscape

The ready-mixed concrete market remains highly fragmented, though consolidation is gathering pace. Each year brings major acquisitions. In recent years, the most active player has been Holcim Group (formerly Lafarge), which in 2023 acquired OL-Trans concrete plants and is currently finalising the acquisition of Eurobud Chajewscy’s facilities. In early 2025, TH Beton also acquired three concrete plants in the Lower Silesia region from Jucha Beton Group.

To learn more or download a sample report, visit our store:

Methodological note

For the purpose of the report, the ready-mixed concrete market was defined as the production of concrete at both mobile batching plants (serving large construction projects directly) and stationary batching plants that deliver concrete to construction sites using mixer trucks or dump trucks (in the case of semi-dry concrete). The market definition excludes so-called “ordinary” concrete, which is usually mixed in small quantities on-site using portable mixers, and concrete used in the production of various types of precast concrete products.