The power and industrial construction sector in Poland is undergoing a significant transformation, driven by investments in renewable energy sources and infrastructure modernisation. The report published by Spectis provides an overview of the current market situation and development forecasts through 2031.

Investment value in the power and industrial sector

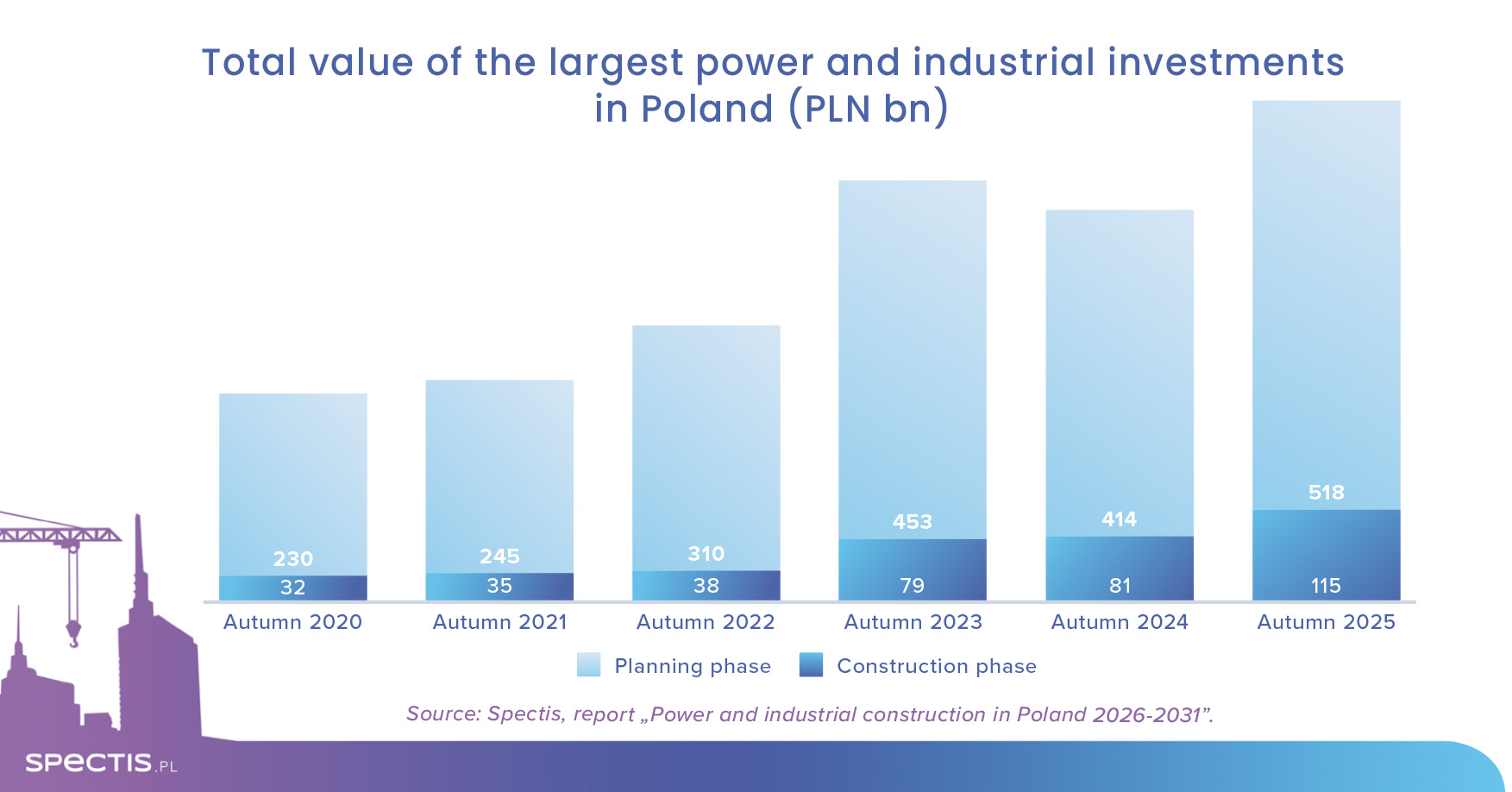

According to our report "Power and industrial construction in Poland 2026-2031", the total value of major investments in the power and industrial sector has reached PLN 633bn. This includes:

- Projects under execution: PLN 115bn

- Planned and conceptual projects: PLN 518bn

Such a vast difference between projects underway and those planned reflects the tremendous growth potential of this construction segment.

Investment trends

As historical trends suggest, further delays in project preparation and shifts toward alternative investment concepts can be expected in the coming years.

It is worth noting that over the past 12 months, the value of investments likely to begin by 2030 has increased by nearly PLN 140bn. This is primarily due to cost updates for nuclear units in Pomerania, emerging plans for the first small modular reactor (SMR) sites, and renewed investment activity in power transmission and energy storage infrastructure.

Contractor market landscape

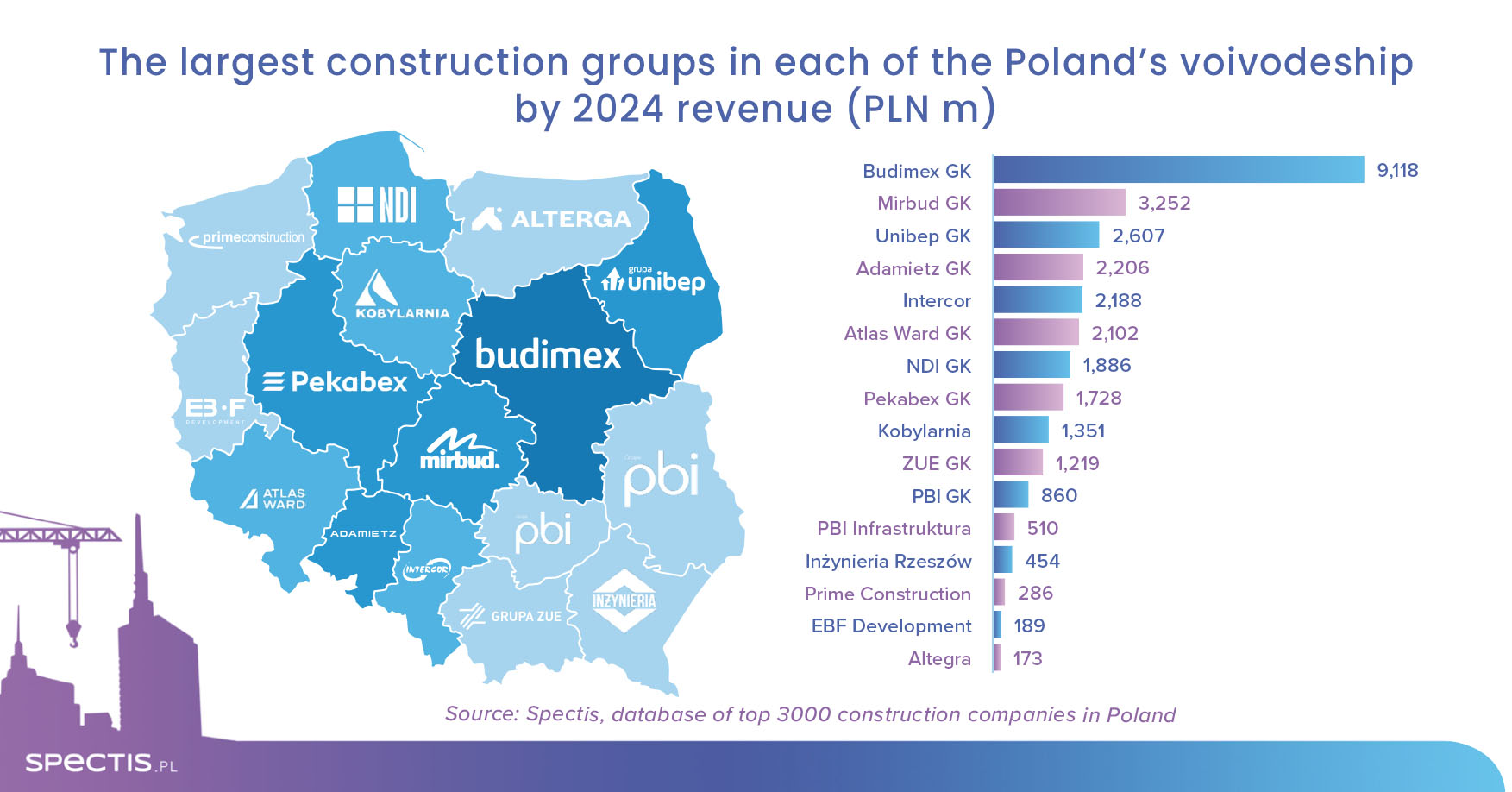

According to Spectis analysis, total annual revenues of the 200 largest power and industrial contractors in Poland decreased by 4% in 2024, reaching PLN 64bn. Of this amount, PLN 43bn relates to broadly defined power and industrial investments, including:

- Power generation units

- Waste-to-energy plants

- CHP plants

- Boiler houses

- Specialised industrial installations

- Renewable energy sources

- Transmission networks

Based on trends from the first three quarters of 2025, the sector’s value could grow by up to 10% in the full year. Continued investment recovery is anticipated in 2026-2027, driven in part by projects co-financed under the National Recovery Plan (both grants and loans).

Contractor market structure

The power and industrial construction market remains moderately concentrated:

- Top 5 contractors: 25% market share

- Top 10 contractors: 36% market share

- Top 20 contractors: nearly 50% market share

Due to the surge in renewable energy investments in recent years, the group of 200 leading contractors increasingly includes renewable energy sources (RES) installation specialists, particularly in photovoltaics. Many of these companies have grown several-fold within a few years, boosting annual revenues from tens to hundreds of millions of PLN.

Outlook for the power and industrial construction sector

In the coming years, renewable energy sources will become an increasingly important part of the energy market.

Planned investments through 2030

According to the updated National Energy and Climate Plan:

- Energy transition (2026-2030): approx. PLN 800bn

- Energy distribution and storage (by 2030): over PLN 450bn

- Next phase (2031-2040): PLN 620bn

Sector development challenges

It is important to highlight that the average annual investment volumes significantly exceed the current capacity of the 200 largest power and industrial contractors in Poland. As a result, it is likely that only a portion of these ambitious plans will be executed, and the overall energy transition of the Polish economy will take much longer than originally anticipated.

Summary

Poland’s power and industrial construction sector is undergoing a profound transformation, with RES and infrastructure modernisation playing key roles.

The scale of planned projects is impressive, but lengthy preparation times and frequent changes in investment concepts may delay tangible effects. The sector’s development pace will largely depend on the actual capacity to deliver such a massive number of projects within a relatively short timeframe.

To learn more or download a sample report, visit our shop: