The outlook for the thermal insulation materials in Poland market is bright despite a brief, albeit severe, downturn. After double-digit decreases, in real terms, in 2022 and 2023, the thermal insulation materials market steadily recovers, driven mainly by an upturn in residential construction in 2024. The building repair and improvement segment is poised to grow strongly in the long term.

Manufacturers of thermal insulation products book record-high revenue in 2022

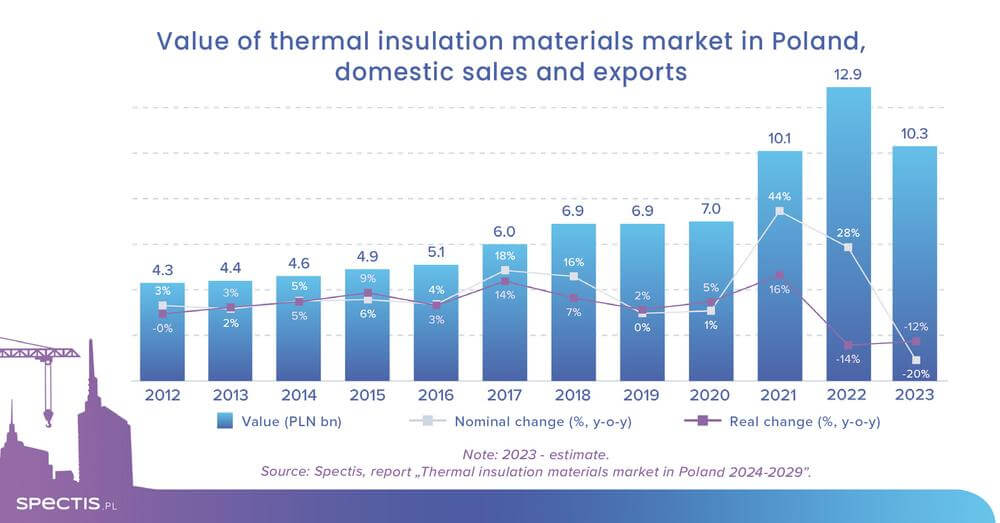

The report "Thermal insulation materials market in Poland 2024-2029" released by Spectis reveals that total revenue generated by 100 manufacturers covered in the study amounted to nearly PLN 40bn in 2022, including PLN 12.1bn contributed by thermal insulation materials. Factoring in the estimated revenue generated by all companies operating in the sector (separately for each of the 11 segments), the value of the thermal insulation materials market was at a record high of PLN 12.9bn in 2022, including PLN 8.9bn generated by domestic sales and PLN 4bn contributed by exports. The thermal insulation materials market increased by 28% in nominal terms in 2022, but due to a nearly 40% hike in the prices, the real growth rates was at -14%.

2023 marked by a severe downturn

Activity in the sector of thermal insulation materials continued to slow throughout 2023. In line with earlier forecasts, the thermal insulation materials market shrank in double digits in 2023, in terms of both volume (-12%) and value (-20%). A downturn in residential construction was the key factor behind the market’s slowdown. The market bottomed out in terms of housing starts in mid-2023, with just under 170,000 units, after it had hit an all-time high of 277,000 in 2021.

Gradual return of optimism in 2024

Following a downturn period, there has been a consistent rise in housing starts in the past 12 months. As a result, the reading of housing starts for the past 12 complete months came out at 226,000 flats and houses started in mid-2024. Improved data from the residential construction market is reflected in production increases recorded in most categories of basic construction materials. Due to the delayed effect, we expect market volume increases also in 2025.

Key factors supporting the recovery of the thermal insulation materials market’s potential in the coming years will include strong long-term macroeconomic foundations of Poland, the continued shortage of flats in Poland compared to the EU average, the requirement to limit emissions in accordance with the objectives of the EU policies, the release of EU’s frozen funds for Poland in the spring of 2024, efforts aimed at reducing smog and support thermal upgrading programmes in the segment of residential buildings and public buildings, the fact that repairs and upgrades account for a substantial portion of the market, plans to introduce even stricter regulations applicable to energy performance of buildings, a strong recovery of demand in residential construction, and restrictions on imports of competitive products from eastern markets to Poland.

Major factors that will have a negative effect on the thermal insulation materials market will include: unfavourable demographic forecasts for Polish economy, a continued high level of interest rates, limited improvement in the single-family construction segment that generates the bulk of demand for thermal insulation materials, slowdown in non-residential construction, high prices of construction materials and services forcing selected investors to scale down, or even suspend, their investment plans, continued low awareness of issues related to thermal insulation of buildings, and the risk that Poland might lose part of funds from the National Recovery Plan, a large portion of which is intended to raise energy performance of existing buildings.

Methodology information about the report:

For the purpose of this report, the market of thermal insulation materials is defined as production (in Poland and abroad) and sales (in Poland and to overseas markets) of basic materials protecting premises, facilities, and equipment against heat loss.

Analysing the number of companies which were not covered in this report that discusses the top 100 manufacturers, and the value of their revenue (these firms were too small or had limited presence in the thermal insulation market), it is estimated that the 100 companies presented in the report account for around 94% of thermal insulation materials produced in Poland. The report also presents the market’s volume and value after factoring in estimated figures for all companies operating in the sector.

Products covered in the report can be divided into eleven main categories: EPS panels, XPS panels, stone wool, glass wool, wood wool, PIR/PUR core for sandwich panels, rigid PIR/PUR foam panels, PIR/PUR spray foam, PIR/PUR sheathing, rubber thermal insulation, and polyethylene thermal insulation.

In most cases (63 out of 100 companies), thermal insulation is the core business of the analysed companies. For companies where thermal insulation is the non-core business, the key areas of operations mostly include roofing materials, construction chemicals, sheet steel, wood products, packaging, and the broadly-defined industrial chemicals.

Request a free sample of the report:

info@spectis.pl

_h.jpg)