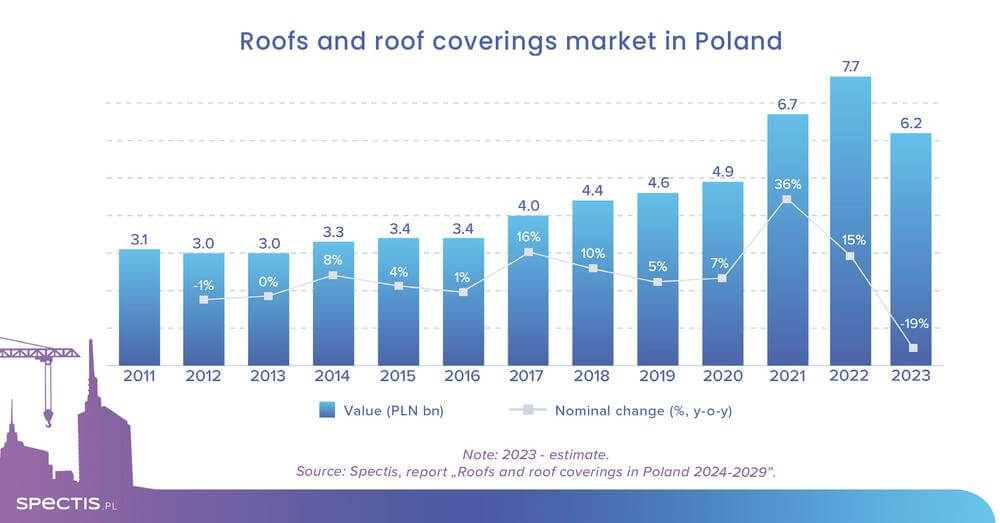

Despite a brief downturn inherent to the post-investment boom phase, the long-term outlook for the Polish roofing market remains highly promising. Key factors supporting the recovery of the roofing market’s potential in the coming years will include strong long-term macroeconomic fundamentals of Poland’s economy, the structural shortage of flats in Poland when compared to the EU average, an upsurge in investment activity in the residential construction sector, a substantial volume of logistics construction projects, and the fact that building repairs and upgrades account for a substantial portion of the market.

Revenue generated by 80 manufacturers of roofing products covered in the report released by Spectis, "Roofs and roof coverings in Poland 2024-2029", totalled PLN 24bn in 2022, with nearly 30% of that figure contributed by roof coverings, according to the findings presented in the report. Factoring in estimated revenue for all companies operating in the sector and taking into consideration other niche types of roof coverings, the market’s value stood at around PLN 7.7bn. Based on preliminary estimates, the market’s output shrank in double digits, dropping to PLN 6.2bn in 2023. The downturn was due to two factors” a limited volume of orders and the decrease in the average price of roof covering products, in particular metal roofing.

Metal roofing materials remain the largest segment of the roofing sector in Poland. 43 companies (out of 80 businesses presented in the report) carry products from this segment, and nine of them generated significant sales (over PLN 100m). At the same time, that segment saw its market share grow exponentially over the past few years, drawing on the popularity in the single-family housing segment. Metal roofing tiles have become the preferable choice of roofing products due to their durability, appearance, and the ease of installation.

Bituminous roofing products are the second-largest segment. Out of 80 companies presented in the study, 21 companies offer products from this segment, with 10 of them generating sales exceeding PLN 50m. Tar paper products, also known as bituminous felts, are commonly used as a flat roof covering material. They are also used on rigid-sheathing pitched roofs, with tar paper installed over boarding.

Ceramic roofing materials are the third-largest segment of the roofing sector in terms of value. This segment is different from other metal or bituminous roofing in terms of production concentration. Only five out of 80 manufacturers presented in the report offer ceramic roofing products. Cement roofing and fibre-cement roofing products represent the fourth-largest market segment. This segment is similar to ceramic roofing in terms of production concentration. Only four out of 80 manufacturers presented in the report offer cement roofing products. Traditional pitched roofs made of roofing tiles are commonly used because of their durability, appearance, and a wide variety of colour and design.

Synthetic membranes are the fifth-largest segment, and they are an alternative solution to roofing felt. And despite a higher price, they have consistently gained an increasing share of the flat roofing market. 12 companies (out of 80 businesses presented in the report) carry products from this segment. Liquid membranes are the smallest market segment presented in the report, and they are mostly used for renovation of flat roofs. Liquid membrane products are offered by eight companies out of the total of 80 companies presented in the report.

Roofing with integrated PV cells have become an increasingly popular trend due to the growing interest in sustainable solutions. Products of that kind are tested by manufacturers of metal roofing and producers of heavy roofing materials alike. Complete solar roofs are also becoming an alternative solution to regular roofing products, fully replacing roofing tiles or any other roofing type.

Green roofs also gain popularity as they are appreciated by investors for their thermal insulation properties, rain water absorption capacity, and ability to reduce urban heat island effects. Solutions of that kind are increasingly applied in commercial buildings and residential buildings.

Request a free sample of the report:

info@spectis.pl

_h.jpg)