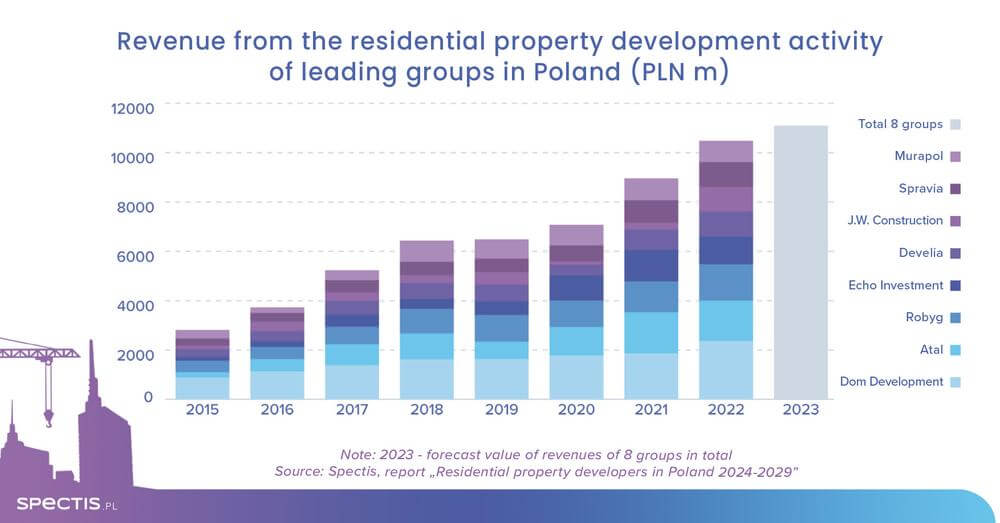

As the residential construction market faced a fast-changing environment in 2023, home developers were eager to respond quickly. However, an analysis of the companies’ strategies performed by Spectis for the needs of the report "Residential property developers in Poland 2024-2029" indicates that they remained cautious in their business decisions despite the upturn and a great scope of opportunities,

Numerous home developers would revise their pricing strategies in the course of 2023, and they made efforts to expedite preparations for new projects. Likewise, companies stepped up competition to secure land in the major cities where they would be able to launch projects immediately. Some home developers ventured to expand into new local markets. Only one company out of the top 30 players in the residential development sector covered in the report decided to pursue a large-scale acquisition.

Consolidation processes slow

There was a series of large-scale mergers and acquisitions as well as a lot of reshuffling in the residential development market in the recent years. In February 2021, Budimex made a decision to conclude a conditional agreement for the sale of its entire interest in Budimex Nieruchomosci. CP Developer acquired the shares – the company was established with a view to concluding the agreement by entities associated with the Cornerstone Partners investment fund of Warsaw, and Crestyl Real Estate of Prague. The final agreement was made in May 2021. It should be noted that the new owners renamed the company Spravia. The acquisition of the remaining 50% interest in Spravia by Crestyl from Cornerstone Partners was completed in November 2023.

In April 2021, Echo Investment signed the agreement for the acquisition of a 66% interest in Archicom, a Wroclaw-based property developer. The company was sold by its founders.

In July 2021, Dom Development acquired a 77% interest in Sento, a home developer based in Krakow whose business is focused on the segment of high-standard apartments. The company further solidified its position in Krakow in 2022, having acquired a 100% interest in housing companies of the Buma Group.

In December 2021, Bricks Acquisitions Limited executed a conditional agreement for the sale of 100% shares in Robyg with TAG Immobilien, a Germany-based investment fund operating in the private rental sector, together with its subsidiary. Previously (2020), TAG Immobilien acquired 100% shares in Vantage Development, a property development company based in Wroclaw. Robyg and Vantage have been building synergies within the TAG Immobilien Group since 2022. The Robyg Group will build and sell flats and handle general contracting for Robyg’s and Vantage’s projects. Vantage will solely focus on the private rental sector.

The Develia Group was the only one to pursue an acquisition in 2023. The company reported that a preliminary agreement for the acquisition of 100% shares in Polish subsidiaries of French-based Nexity, real estate development company, was signed in June 2023. The transaction price was set at €100m. The final agreement was executed in July 2023. Following the acquisition, the number of Develia’s flats under construction was raised to around 1,400, while its land bank was sufficient to build around 2,200 dwellings. The transaction boosted the company’s offering in Warsaw and Krakow, its two key markets, significantly. Moreover, Develia expanded its operations into Poznan, a completely new market for the Group.

Hunt for land continues

The other major developers preferred to pursue organic growth options, i.e. buying land, expanding into markets, and restructuring their organisations. The dislocation of the housing market caused by the government-led Safe 2% Loan scheme combined with the prevailing uncertainty in the sector and the limited availability of land appear to effectively prevent developers from adjusting supply to demand and reduce their willingness to take risk.

Murapol remains the most diversified property developer in terms of geographical location. Murapol Group is present in 19 cities of Poland and has plans for further expansion. The company intends to gain a foothold in Lublin in Q1 2024. It is also engaged in talks regarding acquisition of land in Kielce, Czestochowa, Olsztyn, and Rzeszow.

Atal, a property developer present in many geographical regions, also expands the scope of business activities. In November 2023, the company commenced construction of the Idea housing estate in Swarzedz (Poznan area). It is its first project in that location, and, at the same time, the thirteenth city in Poland for Atal where it has a presence.

Victoria Dom’s strategy also encompasses expansion into new cities and towns. Previously most active in Warsaw and Krakow, the developer intends to get established in other urban agglomerations as well. The company has already acquired land for a housing estate in Gdynia.

YIT, a Finish-based development company, intends to launch its first project in Krakow in 2024. To date, the developer has generally focused on Warsaw and Gdansk.

Echo Investment made efforts towards restructuring the group in 2023: the company concluded agreement with Archicom concerning a contribution in kind to Archicom that comprised a separate residential business of the Echo Investment Group. As a result, the Archicom Group will become a residential pillar, while Echo will focus on developing the segments of commercial properties, rental flats, and creating mixed-use destination projects.

More about developers' strategies and plans we present in the report "Residential property developers in Poland 2024-2029".

Request a free sample of the report:

info@spectis.pl