The outbreak of the war in Ukraine and a looming energy crisis caused by the conflict made the Polish government realise that Poland should be vitally interested in driving energy transition and put words into action. There has been a significant rise in both the number and the value of projects planned since the beginning of 2022. As a result, the current value of the top 210 power projects, both underway and planned, already exceeds PLN 530bn. However, noteworthy is the fact that top 80 power and industrial construction companies that operate in Poland have a combined annual production capacity of PLN 30bn. Accordingly, it follows that the energy transition of the Polish economy can be a project spanning over two decades or even longer.

Growing number and value of projects planned

The current value of the top 210 industrial and power construction projects, both ongoing and planned, stands at PLN 532bn, according to the findings presented in "Power and industrial construction in Poland 2024-2029", a report released by Spectis. The combined value of projects under construction is PLN 79bn, while projects in the tender, planning or initial concept stages amount to PLN 453bn. The huge gap between the value of ongoing projects and projects in the planning stage reveals an enormous potential for the growth of this branch of the construction industry.

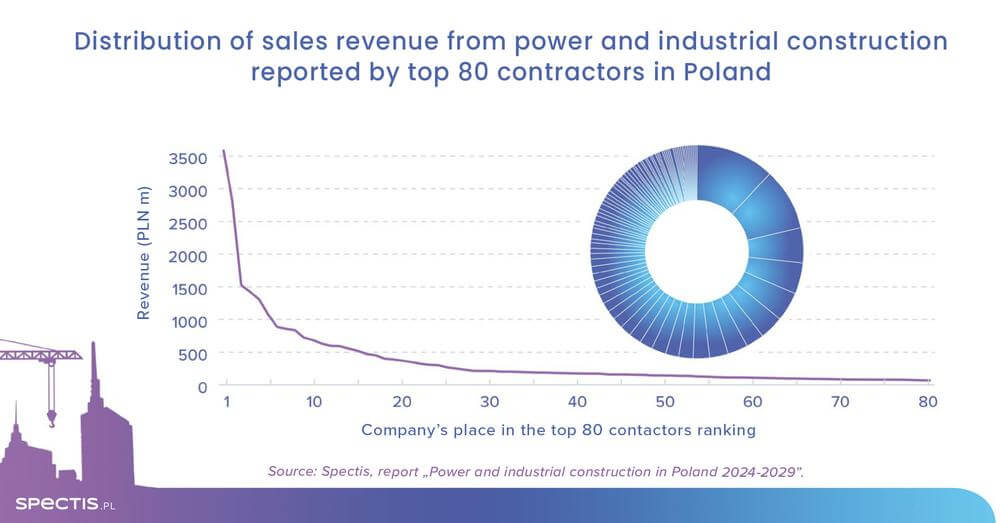

The aggregate annual revenue generated by the top 80 power and industrial construction companies described in the report amounted to PLN 43bn in 2022, including nearly PLN 30bn contributed by the segment of broadly-defined power and industrial projects, such as power-generation units, waste incinerators, CHP plants, boiler rooms, specialist industrial systems, renewable energy sources, and transmission networks.

The power and industrial construction sector remains moderately concentrated. Out of the 80 companies covered in the report, the largest five firms account for a little over 35% of the market, the top 10 enterprises generate 51% of its output, and the top 20 companies have a 68% market share.

Output grows but profitability flat

Taking into consideration the value of projects underway, the power and industrial construction sector in Poland has been in stagnation for a few years, but that trend is starting to change dramatically. The value of power and industrial contracts concluded by the top 80 companies totalled PLN 23bn in 2021 (PLN 20bn in 2019 and 2020). In 2022, it was nearly PLN 30bn. The Q1-Q3 trend indicates that the segment’s value can grow by around 30%, in real terms, in the whole year. In nominal terms, this can amount to a record PLN 43bn.

Low profit margins remain a major issue in this branch of the construction industry. In 2017-2022, the average net profit margin reported by the 80 companies stood at 2%, being adversely affected by financial problems faced a number of major market players.

Low-emission technologies as future for power construction

Renewables will play an increasingly significant role in the power sector in the coming years. The draft document revising the current Poland’s Energy Policy through 2040 indicates that capital expenditure on the development of new capacity planned until 2040 will exceed PLN 700bn, over 80% of which will be spending on zero-emission sources (RES, nuclear power).

The investment upturn in the RES segment observed in the recent years changed the landscape of the market, and there are now more RES installation companies, in particular PV ones, present among the top 80 power construction companies.

On top changes concerning generation capacity, Poland’s National Power System will also be undergoing massive structural changes in the next 20 years. The fact is that the role of coal-fired power generation units will diminish significantly, while renewable energy sources will represent a much larger share in electricity generation. These developments will also require further major investment in power lines.

Request a free sample of the report:

info@spectis.pl

_h.jpg)