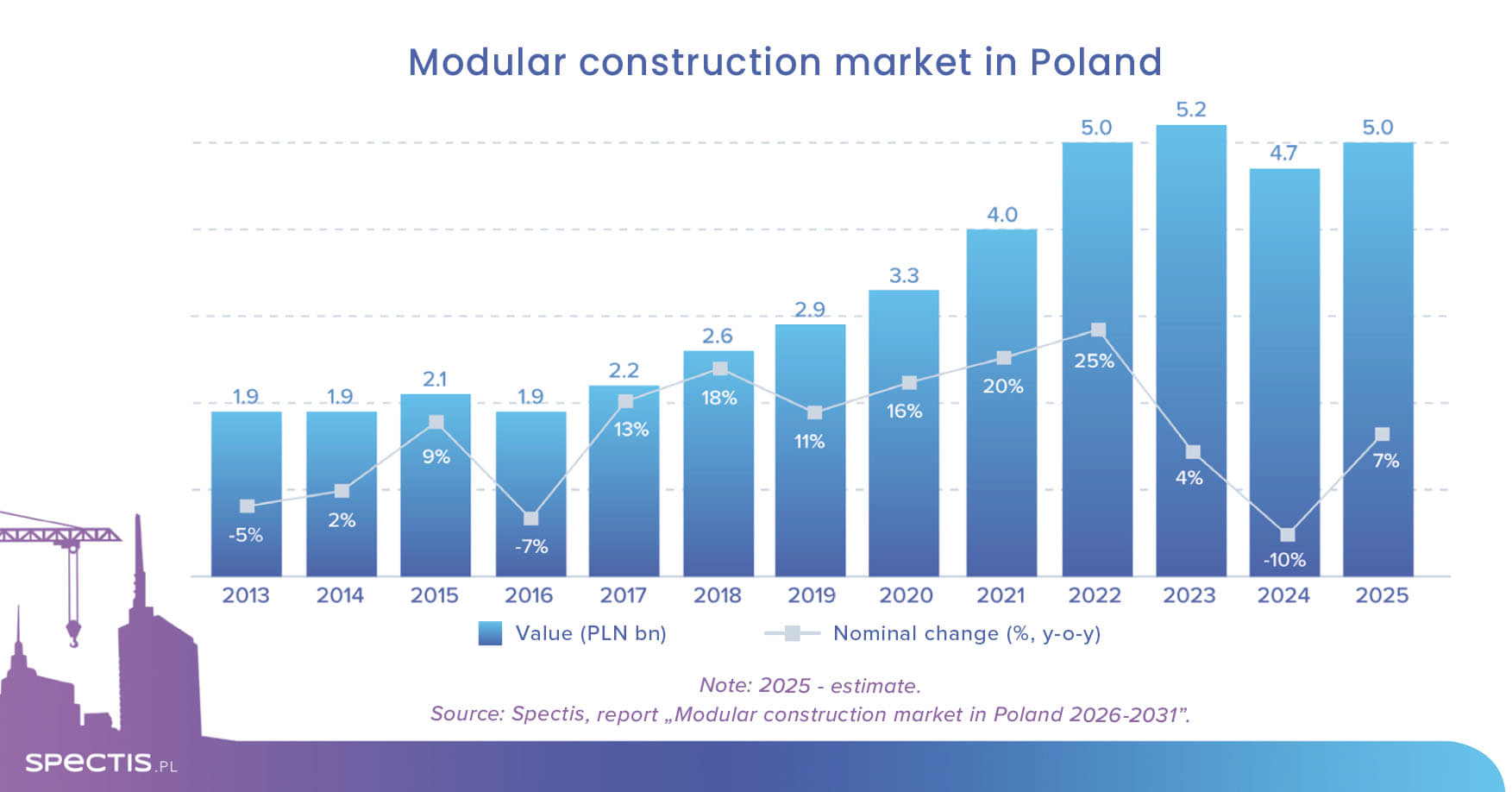

The value of the concrete products market grew by around 14% in nominal terms in 2021, topping the PLN 10.6bn-mark on the back above-average increases in production costs, according to the "Sector of concrete products in Poland 2022-2027" report. The outlook for 2022 is again for a double-digit growth rate in terms of the market’s value.

However, the significant growth of the market’s value is not only due to the market’s volume, but, above all, to rising production costs. As it was the case in 2017 and 2018, manufacturers of concrete products witnessed a sharp surge in the prices of steel in 2021 and 2022 (steel represents 65-75% of material costs in the heavy prefabrication segment). A similar trend was observed with regard to the prices of cement and aggregate material. Likewise, the prices of labour, third-party services, and energy sources also increased. Rising costs were quickly reflected in higher product prices. While in 2015 and 2016 a tonne of concrete products generated sales of around PLN 240, it was almost PLN 290 in 2019 and around PLN 330 in 2021. We expect the product prices to continue to soar also in 2022.

The sector of concrete products – which can be defined as the production of reinforced concrete products, prestressed concrete products, spun concrete products, and vibropressed concrete products – has greatly increased its contribution to the construction industry for the past decade. It was still in 2011 that the value of that market accounted for less than 3% of total construction and assembly output, while in 2021 it vastly exceeded 4%.

In 2022, the value of the concrete products market will stand at around PLN 11.7bn, i.e. over twice as much as it was ten years ago, on the back of the expected nominal growth rate of 11%. In 2023, its value should top PLN 12bn.

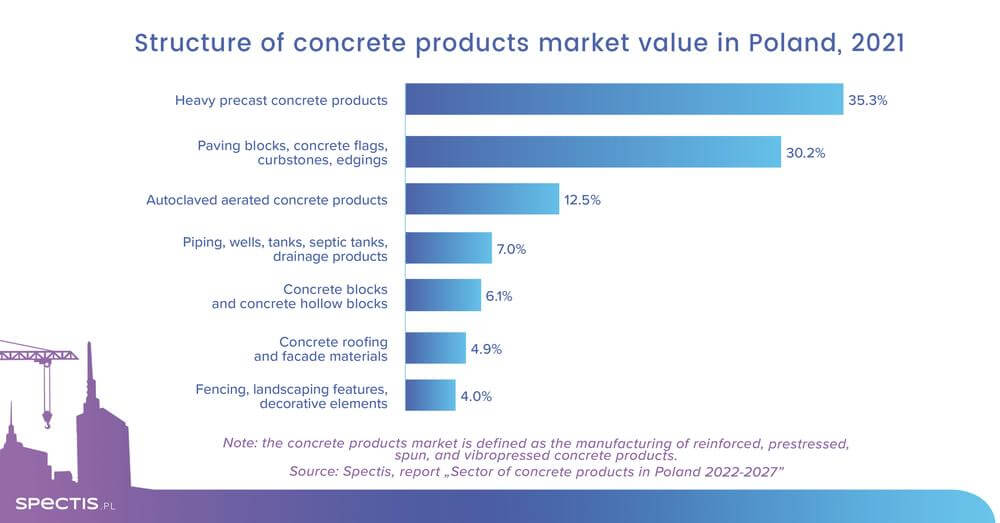

In terms of volume, the segment of paving blocks (including concrete flags, curbstones and edgings) remains the main segment of the concrete products market. Yet, the heavy prefabrication segment is the principal market segment in terms of value. Since steel prices have been on the rise in recent years, the segment has been ahead of the segment of paving blocks in terms of value since 2017. The segment of autoclaved aerated concrete products is the third-largest segment in terms of value. Combined, these three groups account for over 75% of the market’s value. Its remaining sections comprise concrete blocks and hollow blocks, pipes, manholes, tanks, culverts, and other parts of sewage systemsroofing products and facade materials, fencing, architectural ornaments, and decorative concrete elements.

The concrete products market remains fragmented as even the leading manufacturers occupy market shares of 6-7%. The top 15 market players represent nearly 50% of total output produced by the 150 companies covered in the report, according to our calculations. From the viewpoint of individual segments, the autoclaved aerated concrete sector is the most concentrated. On the other hand, the most fragmented segments are those where entry barriers are low, manufacturing technologies are relatively affordable, and transport of products over long distances is economically unfeasible – these segments include paving blocks or concrete hollow blocks (e.g. foundation, wall, floor or chimney blocks).

Ask for free sample of the report

info@spectis.pl

_h.jpg)