Our latest report "Construction market in Poland 2022-2029", indicates that following a strong start to the year, the outlook for the construction sector over the coming months of 2022 is now less bright. The expected slowdown can be indirectly caused by the ongoing war in Ukraine, which only aggravates the problems the market has been facing previously, such as soaring prices of raw materials, building materials, and energy sources or the shortage of labour.

The latest statistics indicate that the construction sector has made enough of a cushion in Q1 2022, so it should see several-percent growth in terms of the market value in 2022 as a whole, despite the projected slowdown over the coming months. There are more concerns about 2023 and 2024 regarding both the volume of work and contract profitability.

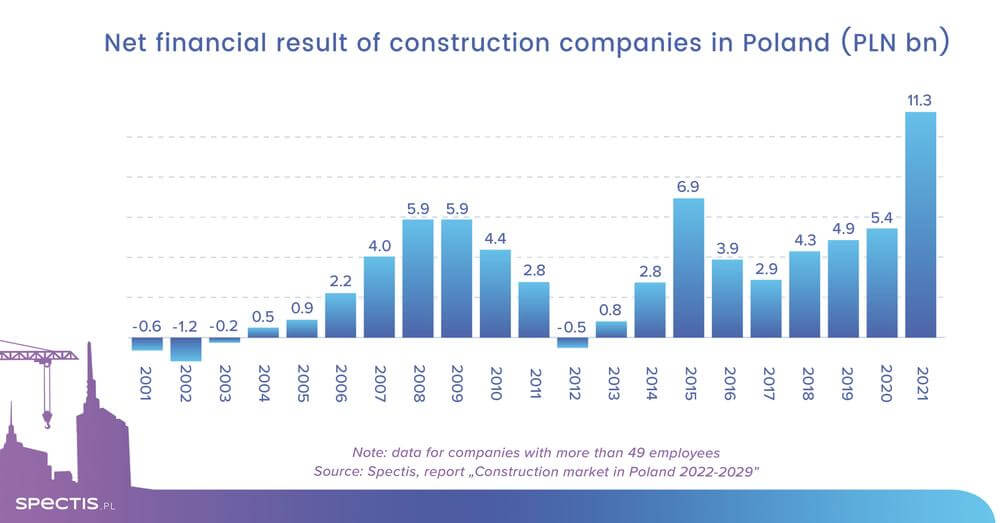

Construction companies have had a successful spell of a few years in terms of profit generation. Accordingly, many of them have built a financial cushion for a rainy day as their profits were hefty last year. The group comprising 1,200 medium-sized and large construction companies generated a combined net profit of PLN nearly 11.3bn in 2021, compared to PLN 5.4bn in the preceding year.

Over half (PLN 5.8bn) of the profit was contributed by companies specialised in building construction projects, which are among the chief beneficiaries of the upturn in the residential construction segment that has lasted for the past few years. Importantly, civil engineering companies also delivered high profits last year as they reported aggregate net profits of over PLN 4bn. Specialist construction enterprises (involved mostly in installation and finishing projects) added PLN 1.4bn in net profit. In terms of the net profit, building construction companies achieved a record 9.7% profit margin, civil engineering construction companies - 6.6% (also the highest ever figure), and specialist construction companies - 5.7% (below the record result of 2016).

Construction companies operating in Poland were severely impacted by skyrocketing prices of building materials and increased labour costs in 2021, but since reasonable pricing policies were put in place, these rising costs were also accompanied by substantial revenue hikes. As a result, the companies were able to reduce the cost-to-revenue ratio to 91%, which resulted in marked improvement in the net sales margin to a record 7.8%.

As the prices of practically all building materials, energy sources, and labour have continued to grow since the start of the year, achieving equally good results in 2022 is rather unlikely. Many contracts priced in 2020 and 2021 will deliver losses. The number of claims regarding contract prices from general contractors against contracting parties is expected to grow massively in 2022. And it will be the outcome of the contract price negotiations that will largely drive the construction industry’s profits this year.

Ask for free sample of the report

info@spectis.pl

_h.jpg)