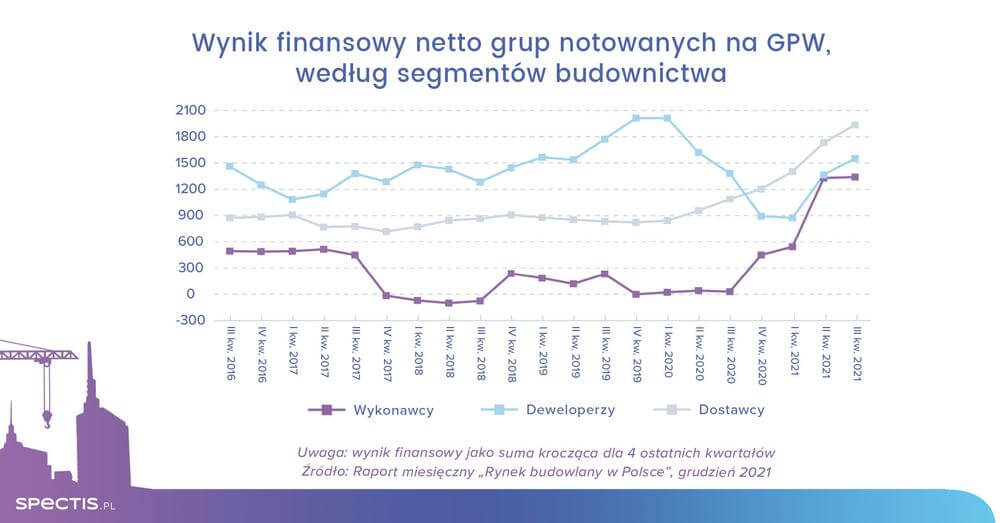

19 construction groups listed on the Warsaw Stock Exchange reported nominal revenue growth of 10% y-o-y over the past four quarters, which was driven by the continued hike in prices of labour and building materials. Also, the aggregate net profit posted by companies in this group improved substantially as it grew by PLN 1.3bn over the year, though it was mostly due to one-off market developments. Notwithstanding that, the profit margin figures reported by the listed construction companies are still worse that results delivered by developers and suppliers of building materials and construction equipment.

The findings of “Construction market in Poland – December 2021”, our latest monthly report, reveal that the aggregate revenue of 19 construction groups whose shares are listed on the Warsaw Stock Exchange totalled PLN 25.9bn in Q4 2020-Q3 2021, compared to the revenue of PLN 23.6bn registered in a year earlier, up by nearly 10% in nominal terms. The aggregate net profit of the analysed companies in the period under review amounted to PLN 1.34bn, as compared to merely PLN 0.03bn a year earlier.

The net financial result generated by the construction companies translated into a net return on sales of 5.2% compared with 0.1% a year earlier and 1% two years previously. Despite marked improvement, construction companies remain the only group reporting earnings below the 6% mark. Profitability of the other two categories of companies, i.e. property developers and suppliers of building materials and construction equipment, was much higher as it stood at 16.8% and 8.7%, respectively. But it should be noted that property developers saw their profit margins shrink dramatically during the pandemic (from the record 29% at the turn of 2019 and 2020), while suppliers managed to improve their profitability (from 6.1% a year earlier).

The net profit improvement registered by construction companies is primarily the result of clear profitability improvement (by a whopping amount of nearly PLN 700m) reported by the Budimex Group, which is the largest construction company in Poland, due to a one-off transaction involving the sale of a property development business unit. Strong improvement was also reported by the groups of Rafako and Trakcja (especially that the most severe financial losses reported by the groups in 2019 and 2020 were over).

From among property developers listed on the WSE, Dom Development, Atal, MLP Group, Echo Investment, and Marvipol posted the highest net profit margins in the past four quarters. In terms of value, the strongest improvement was registered by Atal, and Warimpex.

As far as producers and suppliers of building materials and construction equipment are concerned, in the past four quarters, the groups of Kety and Stalprodukt recorded the highest net financial profits. They accounted for around half of the profits generated by all the suppliers. Robust profit figures in excess of PLN 100m were also delivered by Bowim, Rawlplug, and Ferro.

Ask for free saample of our monthly report.

info@spectis.pl

_h.jpg)