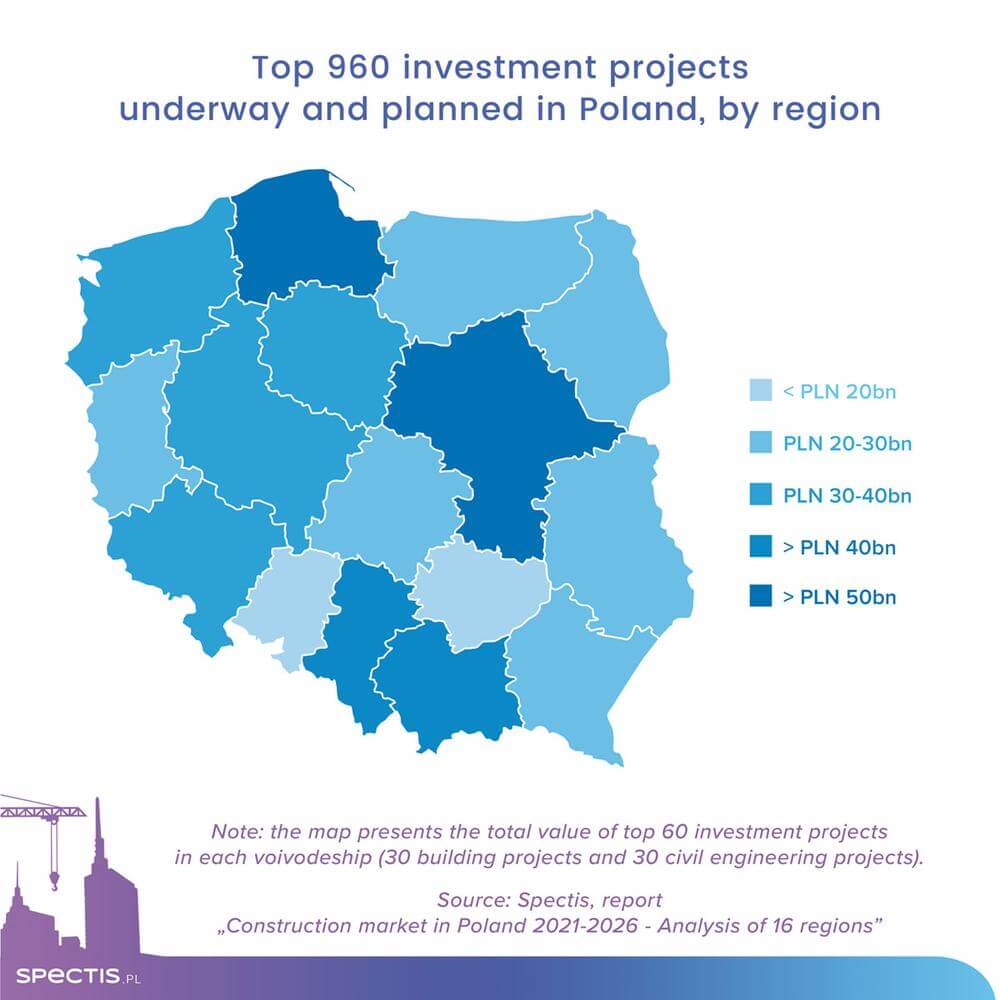

The total value of the 960 largest investment projects underway or planned in Poland is estimated at over €150bn, according to the findings of our latest report "Construction market in Poland 2021-2026 - Analysis of 16 regions".

For the needs of the report, we have reviewed a set of almost 1,000 projects that will make the biggest contribution to the future economic developments in the construction markets locally across the country. The study focused on the top 60 projects in each of the voivodships: 30 building construction projects and 30 civil engineering projects. The total value of the flagship projects underway tops €30bn, whereas projects in the tender or planning stage are valued at nearly €120bn.

The value of projects covered in the report amounts to PLN 710m (€155m) per single project on average: the average figure for building structures stands at PLN 340m (€75m), and it is nearly PLN 1.1bn (€245m) for civil engineering structures. As far as civil engineering projects are concerned, the exponential average value for civil engineering projects has been driven by several mega-projects worth a few dozen billion zlotys. However, projects of that size are typically subject to a serious risk of delay. On top of that, some of the may never be completed at all.

A study of the investment plans indicates that Pomorskie and Mazowieckie regions are in the lead in terms of project value. As far as Mazowieckie is concerned, the largest numbers of projects are planned in the following segments: power construction, airport construction, hydro-technical construction, road construction, office construction, and residential construction. In Pomorskie, the leading segments will include power construction and hydro technical construction. Pomorskie will also be home to some major road and railway projects.

The following positions, in terms of total value of projects, are occupied by Slaskie and Malopolskie (over PLN €10bn each), followed by Dolnoslaskie and Zachodniopomorskie (nearly €9bn each).

Except for Mazowieckie, where a vast portion of the planned projects are non-residential buildings, projects prevailing in the other regions are civil engineering structures, in particular road, railway, and industrial ones.

Besides civil engineering construction, residential construction will remain a major driving engine behind the construction sector’s growth in the regions. A vast majority of the voivodships witnessed positive growth in terms of the number of flats for which construction permits were issued in 2020. Regions with significant increases in this respect included Lubuskie and Kujawsko-Pomorskie (up by 22-25%), as well as Slaskie, Swietokrzyskie and Zachodniopomorskie (12-18%). Single-digit decreases in construction permits were reported by Dolnoslaskie, Lodzkie, Warminsko-Mazurskie, and Mazowieckie. According our forecasts, the average annual number of flats delivered for use will exceed 225,000 in 2021-2026, including 40,000 in Mazowieckie, and 20,000-23,000 in each of Dolnoslaskie, Malopolskie, Pomorskie, and Wielkopolskie.

Ask for free sample of report

info@spectis.pl

_h.jpg)