The estimated value of over 200 major railway projects, both ongoing and planned, is almost PLN 120bn, including PLN 35bn (30% of the total amount) represented by ongoing projects, and over PLN 80bn being the value of projects in the tender, planning or initial concept stages, according to the findings presented in our report entitled “Railway construction in Poland 2021-2026”. The vast gap between the value of ongoing projects and projects in the planning stage reveals substantial potential for the growth of this branch of the construction industry.

The aggregate annual revenue earned by top 80 railway construction companies (defined as companies specialised in construction of railways, tramways, electrical traction systems, rail traffic control, and signalling systems) described in the report have already exceeded PLN 30bn, including nearly PLN 12bn (40% of total revenue) contributed by railway projects.

The Polish railway construction sector is moderately concentrated. Out of the top 80 companies covered in the report, the five largest companies account for over 40% of the market. Over the past decade, the Polish railway construction sector has been an unstable market with high volatility in terms of the volume of orders. It is also strongly dependent on investment activity of a single contracting entity.

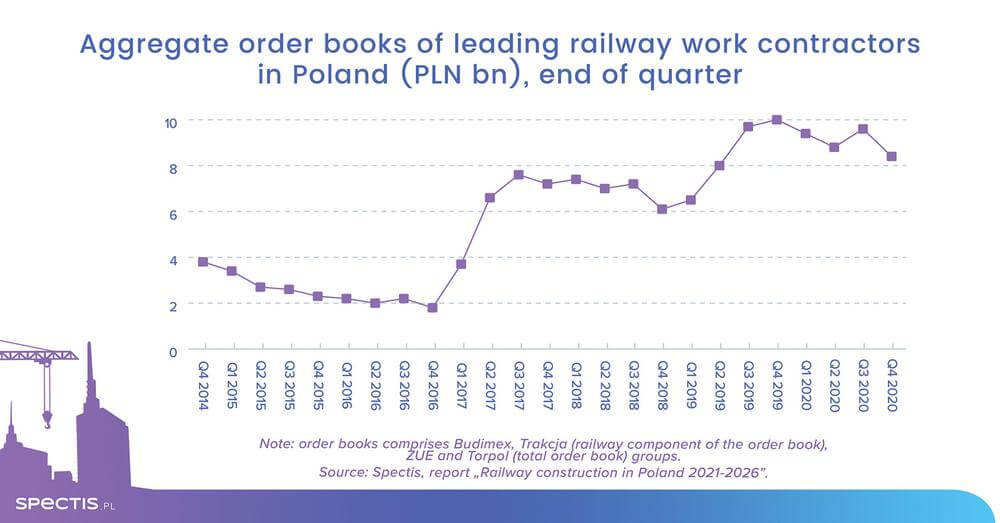

What contractors operating in the railway construction sector are concerned about is a limited number of new tenders – as at the end of 2020, PLN 3.4bn worth of projects were in the tender stage, compared to PLN 10bn-11bn in 2019 and 2018, respectively. A slowdown in PKP PLK’s tendering activity observed in 2020 has started to take a toll on the aggregate backlog of orders held by the top four railway construction companies (Torpol, Budimex, ZUE, and Trakcja), as calculated by Spectis - it was just over PLN 8bn as at the end of 2020, compared to PLN 10bn a year earlier. Despite a temporary slowdown in tendering activity, the long-term outlook for the railway sector is believed to be bright.

In 2017-2019, the average net profit margin for the 80 companies stood at a scant 1.3% as it was adversely affected by financial problems faced by several major market players whose results weighed on the industry’s results as a whole. An analysis of financial results posted by the major companies shows that the industry’s net profit margin improved significantly in 2020, having returned to the 2013-2016 levels (i.e. around 4%).

The long-term outlook for the railway construction industry will be driven by the implementation of the so-called CPK railway component of the potential construction of the Central Communication Port. Projects comprising the airport part are scheduled for completion by the end of 2027. Tasks included in the railway section of the project are planned to be delivered by the end of 2034, with the timeline spanning two consecutive EU financial perspectives. The cost of the railway component is estimated at over PLN 90bn, and over half of that amount is to be spend in 2024-2027.

Ask for free sample of report

info@spectis.pl

_h.jpg)