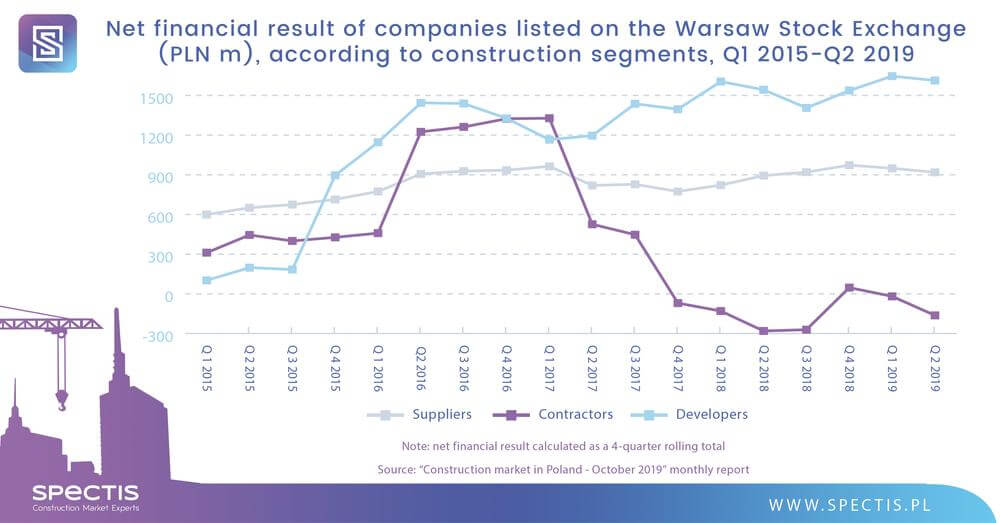

Total revenue reported by more than 20 construction groups listed on the Warsaw Stock Exchange grew by 7.4%, in nominal terms, in Q3 2018-Q2 2019 to almost PLN 25bn (€5.8bn). However, growing revenue figures still do not translate into improved profitability of the construction industry as a whole, which has been in the negative territory for nearly two years. The upturn in the construction sector of the past few years has benefited mostly property developers and, though to a much lesser extent, producers and suppliers of building materials and construction equipment.

The findings of "Construction Market in Poland – October 2019", the latest monthly report from Spectis, reveal that the aggregate net loss of 21 construction groups whose shares are listed on the Warsaw Stock Exchange totalled PLN 243m (€57m) in Q2 2019, compared to a net loss of PLN 99m (€23m) registered in the corresponding period of 2018. The aggregate loss for the past four quarters (Q3 2018-Q2 2019) amounted to PLN 163m (€38m). Thus, construction companies’ overall profitability has been in the red for almost two years.

Contracting companies are the only group within the broadly-defined construction industry to report negative financial results on a regular basis. Profitability of the other two categories of companies, i.e. property developers (24 companies) and suppliers of building materials and construction equipment (26 companies) and has remained stable.

The Q2 downturn in the construction sector’s profitability is mainly due to poor results posted by the PBG and Elektrobudowa groups. Budimex, Dekpol and Erbud maintained decent profit margins. Profitability of other construction groups still hovers around zero.

The net financial result generated by the contracting companies in the past four quarters translates into a net return on sales of -0.7%. Profitability of the other two categories of companies, i.e. property developers and suppliers of building materials and construction equipment, remains stable, at 18% and 4.5%, respectively.

From among property developers listed on the WSE, MLP Group, Capital Park and Warimpex posted the highest net profit margins in the past four quarters. BBI Development, Polnord and Rank Progress had negative profitability.

As far as producers and suppliers of building materials and construction equipment are concerned, the highest profitability ratios were reported by Ulma Construccion, Sniezka, ZM Ropczyce and Ferro. On the other hand, Ceramika Nowa Gala, Libet and Drozapol Profil failed to show profits at all.

Why not have a full read of the monthly report?

Ask for free monthly report

info@spectis.pl