The combined revenue of Poland's top 120 manufacturers of water and wastewater infrastructure components has reached nearly 20bn PLN, with about 7bn PLN coming from the water and wastewater product segment. Despite challenges from an economic downturn, 2024 brought stable results for most producers. In the coming years, the water construction market is expected to be driven by investments backed by various public funding sources, including the KPO, the FEnIKS program, and NFOŚiGW funds.

Market value and growth prospects

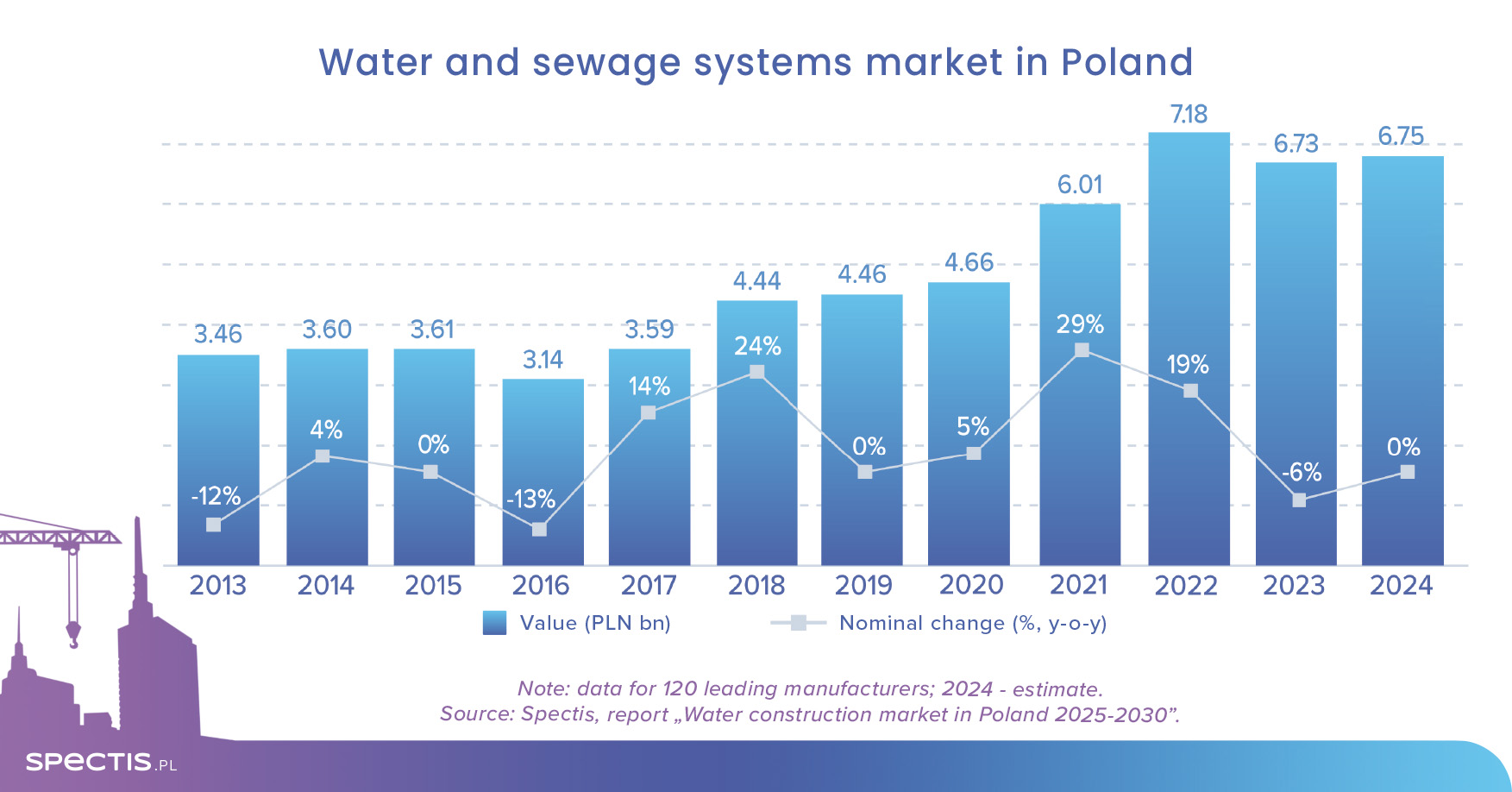

According to the Spectis report “Water construction in Poland,” the combined revenues of the 120 largest manufacturers of water and sewage infrastructure components in Poland reached PLN 19.3bn in 2023. Of this total, just under 35% came from the water and sewage products segment, translating to over PLN 6.7bn in sales.

Based on preliminary data, we estimate that in 2024, the sales value of the 120 manufacturers remained at a level similar to the previous year. The first months of 2025 indicate a moderate recovery, which should bring the market value back to over 7bn PLN. A key driver of the industry's growth this year will be the implementation of investments co-financed by the European Funds for Infrastructure, Climate, and Environment (FEnIKS program), the National Recovery Plan (KPO), and funds from the National Fund for Environmental Protection and Water Management (NFOŚiGW).

Growth drivers

In the coming years, growth in water construction will be supported by:

- Strong long-term macroeconomic fundamentals in Poland

- Climate change and rising environmental awareness among society and businesses

- The EU’s 2021–2027 budget framework, which allocates nearly PLN 30bn for water and sewage investments

- EU directives (notably on wastewater, sludge, and drinking water quality) prompting infrastructure upgrades and expansion

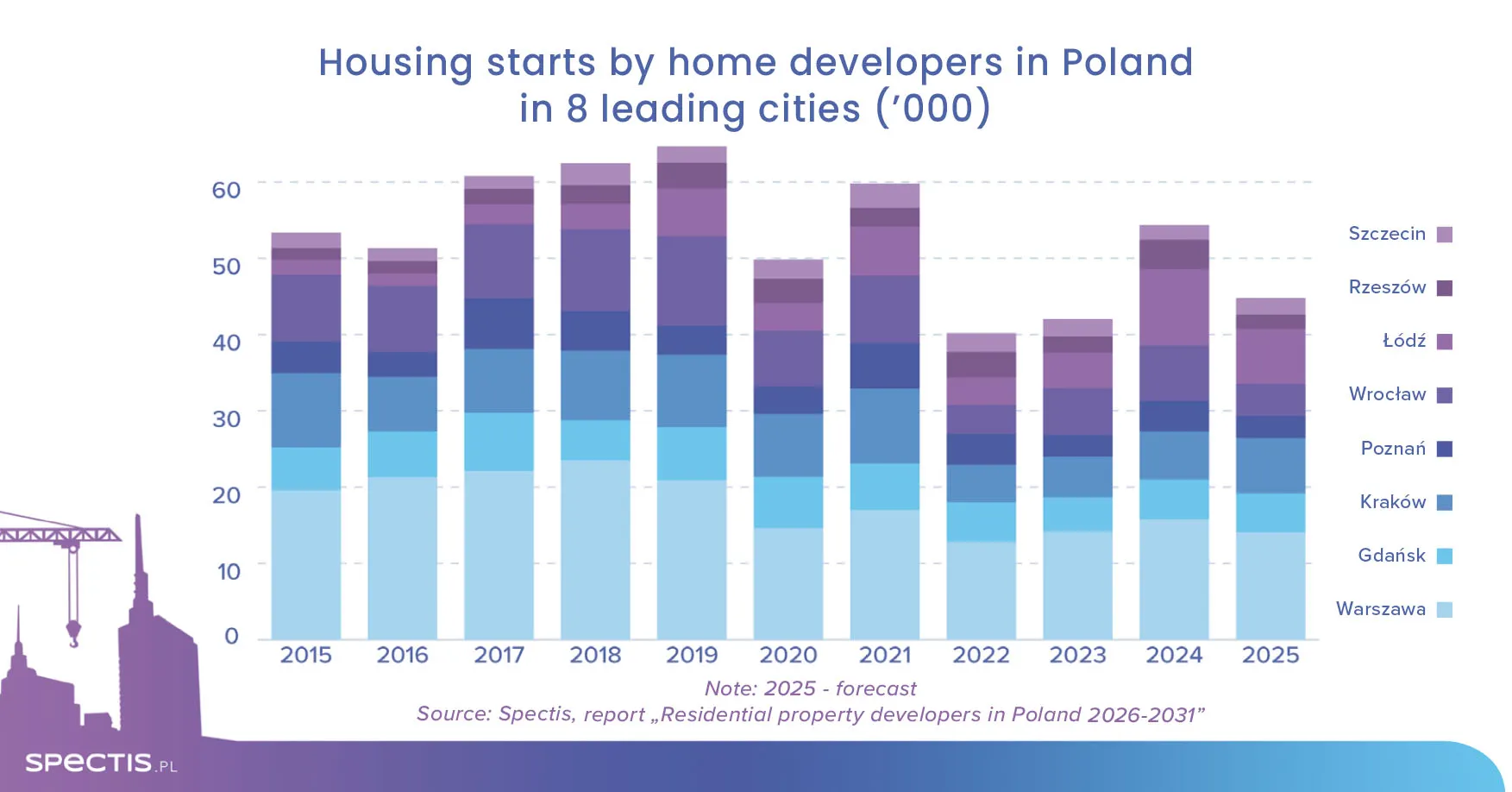

- Ongoing construction sector growth, driving demand for network expansions

- Stable and significant export sales by domestic manufacturers

- Expanded flood protection measures (retention systems and hydrotechnical protection)

Market development challenges

However, the water and sewage construction market faces several challenges:

- Unfavourable demographic trends in Poland

- Absence of a consistent policy framework for sector development

- High municipal debt reducing local governments’ investment capacity

- Rising material and construction costs

- Government focus on road and rail projects over hydraulic engineering

- Prolonged administrative and environmental approval processes delaying projects

- Highly fragmented water and sewage companies

- Potential decrease in EU funding after 2027, impacting large-scale projects

Sector structure and significance

Water and sewage construction is crucial for managing water resources, protecting the environment, and ensuring high living standards in Poland. This sector supports municipal, industrial, and environmental infrastructure and has a significant impact on safety, environmental quality, and economic development.

In the report “Water construction in Poland”, water and sewage systems are divided into four key functional categories:

- Water supply systems

- Sewage systems

- Stormwater drainage systems

- Sanitary water systems

Water supply systems

Water supply systems are the backbone of water infrastructure, responsible for delivering potable water to end users. Their operations include:

- Extracting water from natural sources (e.g., deep wells)

- Treating water at specialized facilities

- Storing water in retention reservoirs

- Distributing water through extensive pipeline networks

These systems ensure dependable water access for households, public institutions, industrial sites, and emergency services (e.g., fire hydrants).

The main materials used for water supply components are plastics and cast iron.

Typical components include:

- Pipelines and valves

- Pressure and storage tanks

- Pump stations

- Water treatment facilities

External sewage systems

External sewer systems are critical for safeguarding the environment and public health by safely channeling domestic and industrial wastewater from its source to treatment facilities. They function through gravity-driven or pumped transport of pollutants via extensive networks of pipes, collectors, and wastewater pumping stations.

Proper design and maintenance of these systems help minimize the risk of contaminating groundwater and surface water while preventing failures in urban infrastructure.

The primary materials used in manufacturing sewer system components are plastics and concrete products.

Core components include:

- Sewer networks (sanitary and combined)

- Wastewater treatment plants

- Grease and oil separators

- Sludge management facilities

Stormwater drainage systems

Stormwater drainage systems are increasingly vital in urban areas, especially with climate change and more intense rain events. They channel and store rainwater and meltwater to prevent flooding, sewer overloads, and soil erosion.

Their operation involves collecting water from impervious surfaces (roads, sidewalks, roofs), temporarily storing it, filtering it, and, if necessary, treating it before discharging it into natural water bodies.

The majority of products used in stormwater management systems are made from plastics.

Key components include:

- Stormwater sewer networks

- Rainwater harvesting tanks

- Stormwater reuse systems

- Linear drainage channels

Sanitary water systems

These systems are located inside or near buildings - whether residential, public, or industrial. Their purpose is to supply usable water (hot and cold), distribute it to access points, and collect and transfer wastewater to the external sewer network.

This segment is a critical component that directly impacts building usability and residents' quality of life.

The primary materials used in manufacturing components classified as water sanitation systems are plastics and, to a much lesser extent, steel.

Typical installations include:

- Sanitary water supply networks

- Sanitary sewage networks

- Domestic septic tanks and on-site wastewater treatment units

To learn more or download a report sample, visit the store:

Methodological note

For the purposes of the report, the water construction market is defined as activities involving the production of components for water and wastewater systems, including water supply systems, sewer systems, stormwater management systems, and water sanitation systems, as well as services related to the construction of facilities and infrastructure for inland water and water-wastewater systems. Each of these water and wastewater construction market segments is further categorized by the material used, such as plastics, concrete, steel, cast iron, and other materials.