News from SPECTIS

News

The value of the construction market in Poland expected to exceed PLN 200bn in 2018 after a record-setting 2017

09 Feb 2018

The ongoing investment upturn, which began several months ago, coupled with excellent performance towards the end of 2017 lifted Polish construction output to new heights. Output generated by Polish construction industry is expected to further climb in 2018. However, its value as a percentage of GDP is still fairly moderate.

The latest report from research firm SPECTIS, “Construction market in Poland 2018-2025”, found that construction output generated by companies operating in Poland climbed to a record high in 2017, slightly surpassing the previous record of 2011.

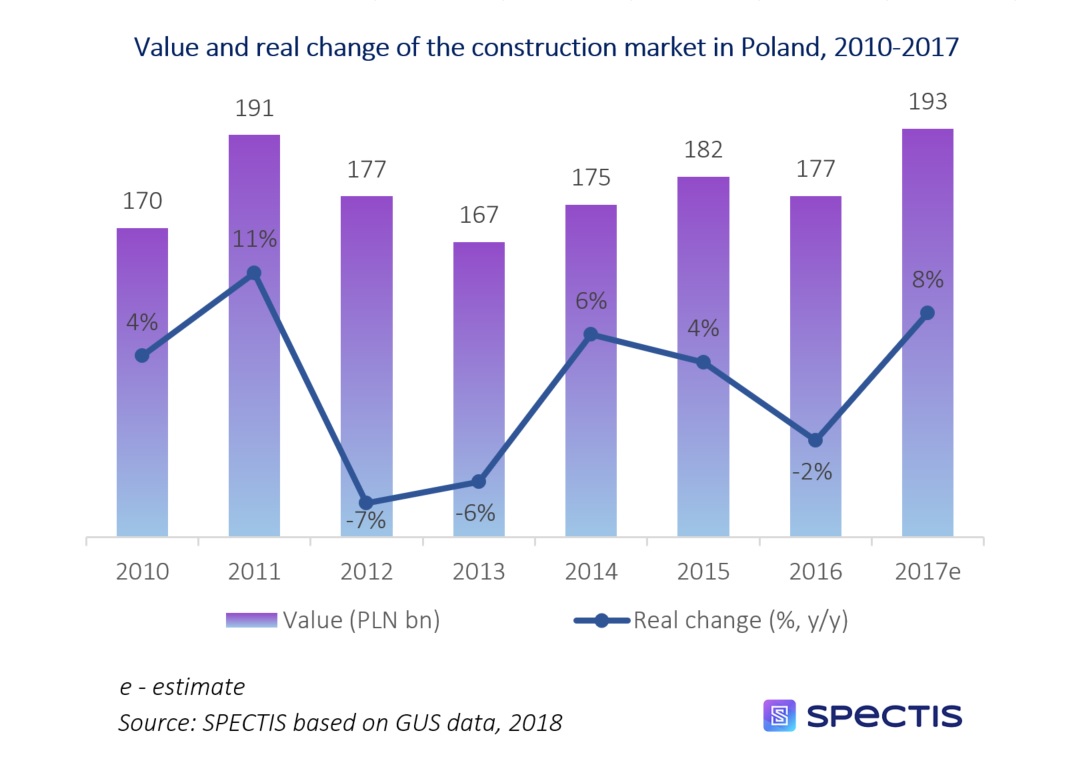

The final data for 2017 will be published only at the end of 2018. However, based on preliminary results released by major construction companies and taking into account trends in single-family construction and non-residential construction, total construction and assembly output generated by construction companies and non-construction enterprises is estimated to have grown by about 8%, in real terms, to PLN 193bn in 2017.

The new all-time high output of the construction sector is not only driven by last year’s impressive results, but it is also due to the upward adjustment of the data for 2016 released by the Central Statistical Office (GUS) – it turned out that a supposedly poor year of 2016 eventually yielded a construction output drop of a scant 2%. This change indicates that the Polish construction sector’s centre of gravity has clearly shifted from large construction groups to small, more specialised firms.

Despite the upward trend, the construction sector’s contribution to the Polish economy is significantly below the level seen when preparations for Euro 2012 were in full swing. While in 2008-2011 the construction industry accounted for about 12% of gross domestic product, its share slid below 10% in both 2016 and 2017. As a result, the Polish economy, which in the past two years has been mainly fuelled by consumption expenditure, has witnessed a huge investment gap estimated at about PLN 40bn a year. Attempts at bridging the gap hastily by resuming previously halted or delayed projects (public or private), combined with the limited capacity of construction companies, result in a build-up of projects and inflates construction costs.

The outlook for 2018 remains highly favourable for the three segments of the construction sector, the latest SPECTIS report suggests. Accordingly, construction output in Poland is bound to exceed the PLN 200bn-mark for the first time on record and account for a little over 10% of GDP. However, due to rising costs of building materials and labour, the real rate of the sector’s growth can be a tad lower compared to 2017.

Bartłomiej Sosna

Construction Market Expert, SPECTIS